2 Sweet Dividend Stocks to Buy to Satisfy Your Craving for Passive Income

Key Points

These companies are leaders in their industries and well-positioned to deliver steady growth over time.

They also offer dividend yields higher than that of the S&P 500.

- 10 stocks we like better than Coca-Cola ›

As an investor, you imagine your portfolio increasing in value as your stocks climb -- and this could happen. But there's an additional way to gain in the stock market, and this particular investing strategy will bring you guaranteed returns year after year. I'm talking about buying dividend stocks.

These companies offer you a payout regardless of what the market -- or even the dividend-paying stock -- is doing, so you can count on them for passive income. This is a way to protect your portfolio during difficult times and supercharge growth in stronger environments. So, by investing in these players, you're setting yourself up for victory during any market phase.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Now, the big question is: How should you choose a dividend stock? After all, some companies may offer a payment this year, but then turn around and suspend their dividend the following year. Of course, no one can guarantee what a company will do, but you can be reasonably optimistic that a certain group of players will continue not only paying but increasing their dividends year after year. These are known as Dividend Kings. Let's check out two of these sweet dividend leaders to buy to satisfy your craving for passive income.

Image source: Getty Images.

1. Coca-Cola

Coca-Cola (NYSE: KO) doesn't need much of an introduction, thanks to its famous drink. But the company's business doesn't stop there. It encompasses a wide variety of products, from water and juices to coffee and tea brands. This entire portfolio, led by its flagship sparkling beverages line, has helped Coca-Cola become a household name and grow steadily over time.

An example of the company's strength: Coca-Cola calls today's environment "challenging" but still managed to increase revenue and earnings per share by 5% and 6%, respectively, in the recent quarter. This is thanks to the company's solid moat, including its franchise business model and brand strength, as well as Coca-Cola's focus on adapting its beverages to local markets.

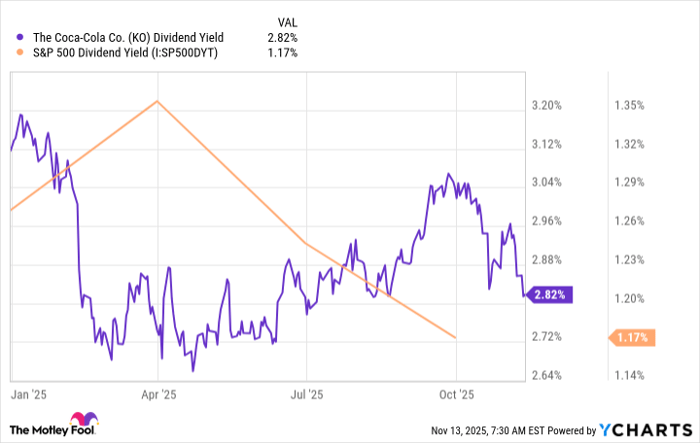

Meanwhile, the company boasts a fantastic record of dividend growth, having increased its payments for 63 consecutive years. This shows a commitment to rewarding shareholders, suggesting the company will continue along this path. Today, Coca-Cola pays a dividend of $2.04, representing a dividend yield of 2.8%, surpassing that of the S&P 500.

KO Dividend Yield data by YCharts.

All this makes Coca-Cola a buy for its great business and for its commitment to sharing the wealth with investors.

2. Abbott Laboratories

I particularly like Abbott Laboratories (NYSE: ABT) for two big reasons: The company is well diversified across the healthcare industry, and it's known for several leading products. We'll talk about diversification first, and this has to do with Abbott's business model. The company has four units: Medical devices, nutrition, diagnostics, and established pharmaceuticals. This scope means that if one unit faces headwinds, another may compensate. That limits risk for the company and for investors.

Second, Abbott is known for some pretty significant products, from the FreeStyle Libre continuous glucose monitoring (CGM) system for diabetes to the MitraClip minimally invasive treatment for heart valve repair. Abbott is also the maker of popular nutrition brands such as Ensure. These are delivering growth -- for example, CGM revenue soared 20% in the recent quarter to $2 billion -- and Abbott's commitment to innovation should keep the momentum growing.

On top of this wonderful healthcare business, Abbott, like Coca-Cola, has made rewarding shareholders part of its strategy. The company has increased its dividend for 53 straight years, and the dividend today has reached the level of $2.36, reflecting a dividend yield of 1.8%. Like Coca-Cola, Abbott offers a higher yield than that of the S&P 500.

All this makes Abbott a great choice for investors craving passive income -- and a company that has what it takes to deliver steady growth over the long term.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool has a disclosure policy.