Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor in the $1 Trillion Club by 2030.

Key Points

Many technology stocks have soared in recent years to market values beyond $1 trillion.

This particular company, which recently approached $1 trillion before retreating, has what it takes to get there within a few years.

- 10 stocks we like better than Oracle ›

In recent years, several technology companies have pushed the general market higher, in part as investors rushed to get in on potential artificial intelligence (AI) winners. Companies from Nvidia to Taiwan Semiconductor play key roles in this high-growth market, and they've seen both revenue and their market value take off.

Why are investors so enthusiastic about AI? Because the technology promises to streamline many tasks, resulting in efficiency, and even lead to game-changing innovation. All this is favorable for corporate earnings, and, therefore, for stock performance. This movement is far from over, with analysts forecasting a trillion-dollar AI market by the start of the next decade.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

That means that Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta Platforms, and Taiwan Semiconductor may welcome a new member to the $1 trillion club. Let's meet the unstoppable player that could join them by 2030.

Image source: Getty Images.

The $1 trillion club

First, a quick note about the "$1 trillion club" -- it isn't an actual club that exists. Instead, it's a way to refer to the companies that have seen their market values soar into trillion-dollar territory. They are all well-established players with track records of earnings growth, and considering current demand for AI and the market forecast I mentioned above, these companies may be heading for more growth as this AI story unfolds.

That means I probably won't surprise you when I say that the stock likely to join this club is yet another company building out a big presence in the AI world. This company is Oracle (NYSE: ORCL). Once known primarily for its database management system, in recent years Oracle has put the focus on building out cloud infrastructure -- and this has been a wise move.

Thanks to this emphasis on cloud, Oracle has seen demand for capacity from AI customers take off, and the company's revenue has followed. The most recent quarter offers us a good example: Cloud infrastructure revenue jumped 55% to more than $3 billion. The company offers strong visibility, predicting that this revenue will reach $18 billion this fiscal year and then progressively climb to $144 billion over the coming four years.

Evidence of explosive growth

The company also reported an explosive increase in remaining performance obligations -- or the value of contracted services that haven't yet been delivered -- with a gain of more than 300% to $455 billion. Following all this news, Oracle shares surged 35% in one trading session, bringing the market value of the company to $933 billion.

In the weeks afterward, however, the stock -- and market value -- slipped as some investors worried about future profitability in certain areas, such as the renting out of AI chips. It's important to remember, though, that Oracle's services are broad, meaning one particular area doesn't define the revenue opportunity. It's also important to note that as the AI story progresses and Oracle ramps up, margins may strengthen across the board.

The path to trillion-dollar market value

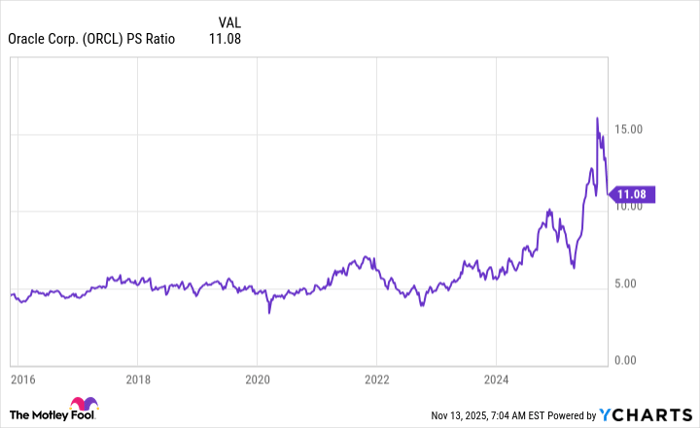

Now, let's consider the path to $1 trillion. Today, Oracle's market value is about $647 billion, and to reach $1 trillion, the stock price would have to gain 60% from its current level. Meanwhile, Oracle has forecasted total revenue of $225 billion in fiscal 2030, which would result in a price-to-sales (P/S) ratio of about 4. This is lower than the current ratio of 11 and actually brings Oracle close to its average P/S ratio over the past several years.

ORCL PS Ratio data by YCharts.

All this suggests that Oracle could climb to $1 trillion by 2030, joining the tech giants I mentioned above.

But what does this mean for you as an investor? While it's positive to see a stock advancing and a company's market value rising, market value itself isn't a reason to buy a particular stock. So, I wouldn't go out and buy Oracle just because it has a particular market cap.

I would buy Oracle shares, though, for the company's long track record of earnings growth, its database management strength, and its potential in the AI market. The good news is that you now can scoop up Oracle on the dip and possibly accompany it along the path to $1 trillion.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Adria Cimino has positions in Amazon and Oracle. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.