"Big Short" Money Manager Michael Burry Just Bet Against Nvidia and Palantir. Is He Calling the Top of the Artificial Intelligence (AI) Boom?

Key Points

Michael Burry famously predicted the mortgage crisis that struck in 2007 and 2008.

Burry has been known to bet against themes in the stock market, and this time, his eye is on artificial intelligence.

Recent regulatory filings indicate that Burry's hedge fund has opened short positions against Nvidia and Palantir.

- 10 stocks we like better than Nvidia ›

Michael Burry is one of the most intriguing characters in modern financial history. His claim to fame is that he was one of the first investors to sound the alarm that the subprime mortgage crisis was coming, prior to its implosion in 2007 and 2008 -- a financial meltdown that ultimately triggered the Great Recession.

Seemingly overnight, Burry and his hedge fund, Scion Asset Management, gained celebrity among the "smart money" on Wall Street. With that in mind, it's not surprising that he still has the influence to move the capital markets.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

According to Scion's latest 13F filing, Burry has found his new big short(s): semiconductor giant Nvidia (NASDAQ: NVDA) and data mining specialist Palantir Technologies (NASDAQ: PLTR). During the third quarter, Burry purchased put options on both -- bets that each stock will decline in value.

Is Burry sending an ominous warning that the artificial intelligence (AI) sector is due for a correction? Let's unpack how history appears to be on Burry's side, and assess whether this case may be different from similar ones in the past.

Why is Burry betting against Palantir?

For the last two years, Palantir has been one of the most impressive gainers in the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC). In just the last 12 months, shares have climbed by a jaw-dropping 224%.

While its momentum appears unstoppable, Burry does have a legitimate case when it comes to his suspicions surrounding the data analytics darling. From a valuation perspective, Palantir stock looks well overbought.

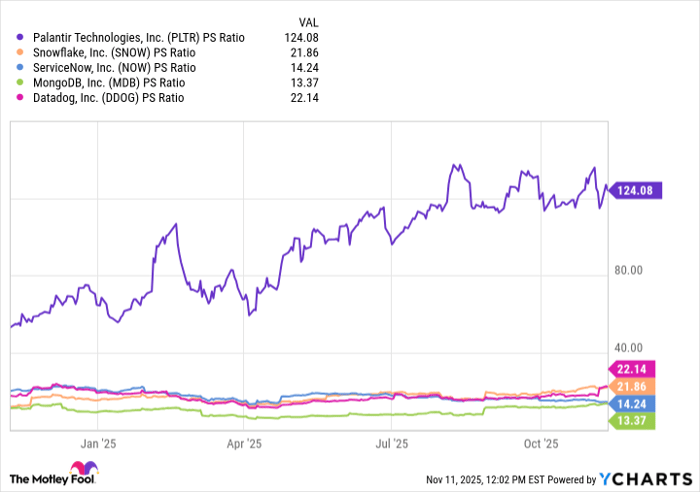

PLTR PS Ratio data by YCharts.

Its price-to-sales (P/S) multiple of 124 is far higher than any of its peers in the software landscape. What's more, Palantir's valuation continues to expand, suggesting that the stock is being fueled by unrelenting positive sentiment and hype.

Given Burry's history with prior stock market crashes, my hunch is that he is drawing parallels between the AI boom and the dot-com era of the late 1990s. For reference, during that period, internet pioneers such as Microsoft, Amazon, and Cisco saw their P/S ratios peak in the ranges of 30 to 50 at the absolute highest.

Considering Palantir's valuation is already in a different league than what investors witnessed during that period of internet euphoria, it's understandable that Burry may believe the stock is on a collision course with history.

Image source: Getty Images.

Why is Burry shorting Nvidia?

For the last three years, Nvidia has been the undisputed leader in the world of high-performance chips. Hyperscalers have boosted their capital expenditures to unprecedented levels to procure vast quantities of Nvidia's graphics processing units (GPUs) in support of their generative AI ambitions.

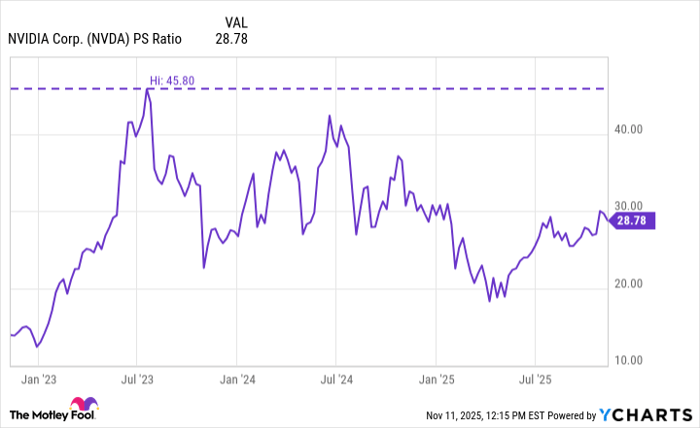

NVDA PS Ratio data by YCharts.

Burry might have some concerns over Nvidia's valuation, too -- despite the chipmaker's record revenue and profit generation throughout the AI revolution.

As of Nov. 11, Nvidia boasted a P/S multiple of 29. That was far below the company's peak ratio, and Nvidia has traded at or above this level on several occasions over the last three years. However, given that it's a level in range of the summit of dot-com-era P/S multiples, it could be argued that Nvidia may be reaching a valuation threshold -- or that its upside is limited from here.

Such a premise could be further supported by the fact that Nvidia's competition is making headway. The rising sales of the GPUs offered by rival Advanced Micro Devices and the custom AI accelerators designed by Broadcom could put a dent in Nvidia's long-term trajectory.

Image source: Nvidia.

History appears to be on Burry's side...

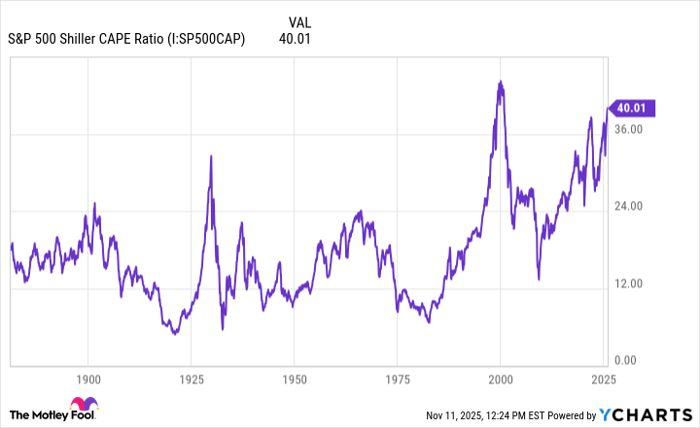

There is no universal barometer that can define when the stock market is overvalued. However, two good indicators to look at are the S&P 500 Shiller CAPE ratio and the Fear & Greed Index.

Right now, the Fear & Greed Index sports a reading of 29, indicating levels of fear are permeating the market. Moreover, the Shiller CAPE ratio currently hovers around 40 -- close to its highest level in two decades.

As the trends below indicate, the stock market has witnessed some sharp corrections in the past -- notably in the late 1990s and 1920s -- after the CAPE ratio climbed to record levels.

S&P 500 Shiller CAPE Ratio data by YCharts.

Given all of this, I feel confident that Burry thinks the AI megatrend has inflated a stock sector bubble. And in fairness, history would suggest that such a conclusion is accurate.

...but I think this time could be different

Only time will tell if Burry's bets against AI leaders like Nvidia and Palantir will prove profitable. In the meantime, I think there is a mountain of evidence supporting the idea that enthusiasm surrounding the AI trend is as strong as ever.

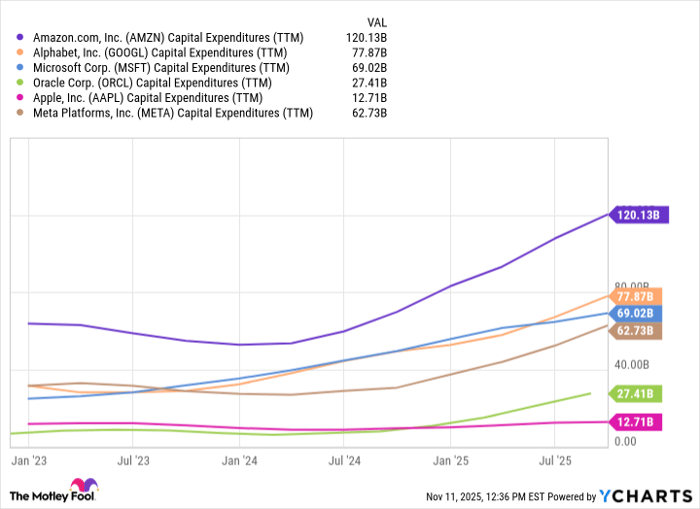

From a macro point of view, hyperscalers are continuing to accelerate their spending on AI infrastructure projects.

AMZN Capital Expenditures (TTM) data by YCharts

In just the last few weeks, investors learned that Meta Platforms plans to double down on its AI investments going into next year.

Moreover, Microsoft has signed two multibillion-dollar deals with infrastructure services companies Nebius and Iren -- both of which will supply the Windows developer with access to servers powered by Nvidia GPUs. Along the same lines, OpenAI also recently committed $38 billion to Amazon to help procure clusters of Nvidia accelerators as well.

In my opinion, Nvidia is well positioned to ride these secular waves as the AI infrastructure era continues to unfold.

On the other side of the equation, I will admit that Palantir stock is due for a pullback in the near term. With that said, I remain bullish on the company's ability to continue winning meaningful business across both the public and private sectors in the long run. While its valuation has gotten frothy, I'm optimistic that Palantir will remain a household name over the course of the coming decades.

For all of these reasons, I think Burry may be viewing AI through a "short"-term lens. While his trades may wind up being profitable, that does not necessarily mean he is right on an overall basis.

In my view, Palantir and Nvidia remain two of the most compelling buy-and-hold opportunities within the AI narrative for investors seeking durable growth and market-beating returns over the long run.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Cisco Systems, Datadog, Meta Platforms, Microsoft, MongoDB, Nvidia, Oracle, Palantir Technologies, ServiceNow, and Snowflake. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.