What's Wrong With Sweetgreen's Stock?

Key Points

Restaurant chain Sweetgreen has been struggling to grow its sales.

Profitability has also been an ongoing problem.

The stock has given back all the gains it amassed last year.

- 10 stocks we like better than Sweetgreen ›

Automation and healthy eating. That combination sounds like it should make for a great investment opportunity. And that's what many Sweetgreen (NYSE: SG) investors were probably thinking when they bought shares of the business in recent years. But despite all the promise surrounding Sweetgreen's business, the results haven't lived up to the potential. This year, the stock has cratered an incredible 80% in value.

To crash so significantly in such a short amount of time raises many questions, including what's behind it, and whether the stock can recover. Here's what you need to know about Sweetgreen stock today, and whether it's worth taking a chance on it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

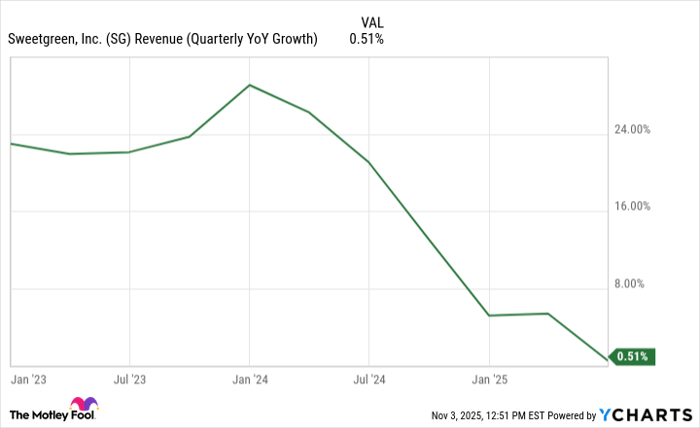

The company's growth rate has been going in the wrong direction

What started out as an exciting growth story for Sweetgreen has turned into a more troubling one, with the company now struggling to stop the slide in its growth rate. During the first half of the year, the company's sales rose by just under 3% year over year, totaling $351.9 million. The growth rate has been on a downward trend for multiple quarters now.

Data by YCharts.

There's no shortage of potential problems to point to. The company has drawn customers' ire for high-priced salads that can cost up to $16. The lack of diversification in its menu and the limited appeal it may offer to the general public may also be a factor, as focusing on salads may prove to be too niche a strategy.

Worrisome economic conditions may also be weighing on the business, because even if people want to eat healthier, they may not feel they can afford to eat at Sweetgreen's stores due to their high prices. After multiple years of higher-than-normal inflation, consumers have been tightening up their budgets and cutting back on discretionary purchases. High-priced salads would almost certainly fall into that category.

Its margins should be much better

Sweetgreen implemented automation in its kitchens to improve the assembly of salads and bowls. It's aiming to keep costs low and raise the experience for customers, as doing so can lead to greater consistency. But despite this combination of automation and high-priced meals, Sweetgreen's business has abysmal margins.

The company still hasn't turned a profit. Although that can be understandable as it is ramping up its growth, what's concerning is that its gross margin may not be high enough for there to even be a path to profitability anytime soon.

Over the first half of the year, the company's total restaurant operating costs (including food, labor, occupancy, and other related expenses) accounted for nearly 82% of its revenue. This is before the company factors in general and admin and other non-direct operating expenses and overhead. Unsurprisingly, during this stretch, the business incurred a net loss of $48.2 million, which was even more than the $40.5 million loss it posted a year earlier.

If the company can't produce high margins while leveraging automation and high prices, it begs the question of whether that is likely to change anytime soon. Based on the stock's performance, investors clearly have their doubts about Sweetgreen's business model these days.

Sweetgreen is still a risky stock to own

In 2024, Sweetgreen's stock soared by 184%, and it looked to be unstoppable. This year, it's been a sharp reversal for the stock, which has coincided with concerns about the economy and consumers scaling back on expenditures. While the stock does look cheap, trading at a price-to-sales ratio of just 1.4, investors shouldn't overlook the risk and uncertainty ahead with the business.

If it's struggling now, things could get a whole lot worse for Sweetgreen if a full-blown recession takes place. Its high prices and lack of diversification would make me wary of holding on to the stock. It may have a hard time winning over new customers in a highly competitive fast food industry, even if economic conditions are good, let alone if they are bad. For now, you may want to consider other growth stocks besides Sweetgreen, as it looks too risky to own right now.

Should you invest $1,000 in Sweetgreen right now?

Before you buy stock in Sweetgreen, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sweetgreen wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Sweetgreen. The Motley Fool has a disclosure policy.