XRP Treasury Companies Have Entered the Chat. Should Investors Hop on Board?

Key Points

Several companies are preparing to buy XRP for their corporate treasuries.

Crypto treasury companies do well in bull markets but have considerable downside risk.

XRP isn't as proven as Bitcoin or Ethereum, which have been the cryptocurrencies of choice for corporations so far.

- 10 stocks we like better than XRP ›

After seeing the success of Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) treasury companies, several corporations have announced plans to take the same approach with XRP (CRYPTO: XRP). The most notable is Evernorth, which aims to raise at least $1 billion to buy XRP and is backed by XRP issuer Ripple.

This type of company will provide an alternative way to invest in XRP. But is it a better option? Let's find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

How the top crypto treasury companies have fared

The leading crypto treasury companies right now are Strategy (NASDAQ: MSTR) for Bitcoin, and Bitmine Immersion Technologies (NYSEMKT: BMNR) for Ethereum.

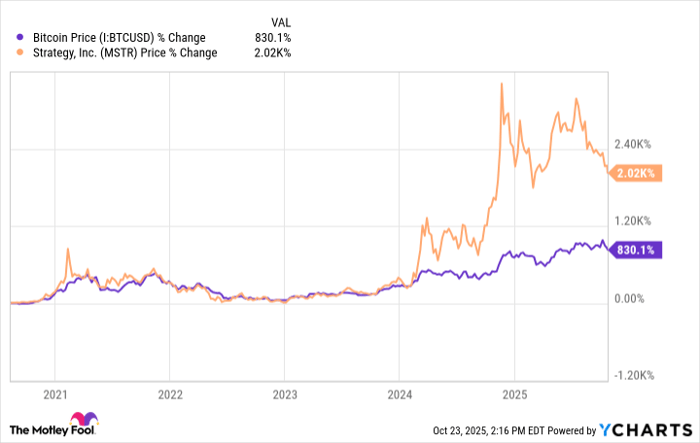

Strategy made its first Bitcoin purchase on Aug. 11, 2020, and it has been wildly successful. Since then, it has delivered much higher returns than the leading cryptocurrency, even though its entire business model now revolves around buying Bitcoin. Here's a look at how their results compare from that date until Oct. 23, 2025.

Bitcoin Price data by YCharts.

Bitmine only announced its Ethereum treasury strategy at the end of June, so that's a fairly new development. The company's share price surged by over 3,000% in a few days afterward, but it then proceeded to lose over 60%. Outside of that initial growth, Bitmine hasn't matched Ethereum's performance.

The dangers of XRP treasury companies

XRP treasury companies present a few serious risks for investors. Any company that makes cryptocurrency a large portion of its balance sheet is betting on a highly volatile asset. That's an issue for any type of crypto treasury company, whether it buys Bitcoin, Ethereum, or XRP. If cryptocurrency has an extended bear market, these companies will likely see their share prices plummet. Companies that use leverage to increase their holdings will be at even greater risk.

Even though XRP is a top-five cryptocurrency, it doesn't have anywhere near the track record of Bitcoin or Ethereum. Bitcoin has always been the largest cryptocurrency by market cap, and Ethereum has been the second-largest since 2016.

They've both established clear uses, as well. Bitcoin is a digital store of value with built-in scarcity due to its maximum supply of 21 million BTC. Ethereum is a smart-contract blockchain that developers can use to run all kinds of decentralized apps (dApps). For example, Ethereum is currently the most popular blockchain for decentralized finance (DeFi) services and stablecoins.

XRP is considerably smaller -- its market cap is less than one-third of Ethereum's. Although it has an interesting use case as a fast, affordable way to make cross-border payments, it hasn't caught on with financial institutions yet. Most banks that partner with Ripple simply use its payment network, but not its XRP cryptocurrency.

Some XRP treasury companies could have short-term success, similar to what we've seen with Strategy and Bitmine, but I question their long-term value. The business model looks like a gimmick, and investors could just buy the cryptocurrency on their own. If you're interested in XRP as an investment, that's likely the better approach.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Lyle Daly has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.