3 Reasons to Buy This Under-the-Radar Quantum Computing Stock Today

Key Points

Alphabet's technology is best-in-class.

Alphabet has massive cash flow to finance its quantum computing investments.

- 10 stocks we like better than Alphabet ›

Quantum computing stocks were all the rage on Wall Street up until a few days ago. Now, quantum computing stocks have sustained heavy losses as investors readjust their expectations of when quantum computing could become a viable alternative.

The most popular quantum computing stocks by far are pure plays like IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), and D-Wave Quantum (NYSE: QBTS). However, these three are long-shot investments that may or may not pay off.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Instead of this trio, I think investors should look at an under-the-radar quantum computing alternative: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). While Alphabet may not be an under-the-radar company in general (it's the fourth-largest company in the world by market cap), it has mostly been forgotten about in the quantum computing realm. I've got three reasons investors should consider Alphabet as a quantum computing investment, and I wouldn't be surprised to see Alphabet outperform some of its quantum computing pure-play competition over the next few years.

Image source: Getty Images.

1. Alphabet is a leader in quantum computing

While many point toward the quantum computing pure plays as being leaders in the quantum computing industry, Alphabet challenged that notion a few days ago when it released some of the latest results of its Willow quantum computing chip.

On Oct. 22, Google announced that its Willow quantum computing chip successfully ran a verifiable algorithm on its quantum computer at a speed 13,000 times faster than a traditional computer. It did this on a 105-qubit system, one of the largest and most powerful currently known. For reference, Rigetti Computing made headlines when two companies purchased its Novera quantum computing system, which has four sets of nine qubits.

Alphabet is clearly a leader in this field, and it has the results to prove it. Alphabet may wipe the floor with its competition, making it the smartest quantum computing company to invest in.

2. Alphabet has plenty of cash to fund its quantum computing investments

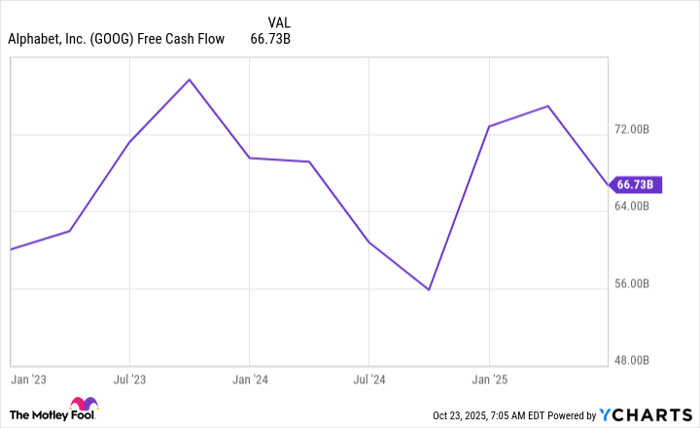

Unlike its quantum computing pure-play competition, Alphabet has nearly unlimited resources to pour into its quantum computing aspirations. This isn't a cheap technology by any means, so having massive cash flow to fund research is critical. Over the past 12 months, Alphabet has generated around $66 billion in free cash flow.

GOOG Free Cash Flow data by YCharts

It's using a huge chunk of that for building out artificial intelligence data centers, but it could also shift those funds to finance its quantum aspirations as well. For reference, IonQ's revenue for Q2 totaled $20.7 million, and it currently has just over half a billion in cash and short-term investments on its balance sheet.

While David and Goliath stories exist for a reason, this seems to be one where David doesn't have enough funding to compete with the Goliath in the industry. I think this gives Alphabet a serious competitive advantage, and it's one that the pure plays may not be able to overcome.

3. Alphabet isn't an all-or-nothing quantum computing play

Lastly, there's no guarantee that quantum computing will work out. Although many companies are starting to prove meaningful applications, it's unknown how large the real-world application truly is for quantum technology. Additionally, these pure-play quantum computing investments are just that, pure plays. It's an all-or-nothing bet that they will achieve quantum computing supremacy. If they don't succeed, there's a significant chance of the investment going to $0.

Alphabet isn't like that. It has a strong advertising business based on its Google family of products, as well as a strong cloud computing offering. If quantum computing doesn't pan out or another competitor beats out Alphabet, it will still be a viable investment. This significantly reduces the risk of the overall investment, making me more confident in backing Alphabet as a quantum computing investment than any other stock in this industry.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.