Is SoFi Technologies Stock a Millionaire Maker?

Key Points

Since its founding in 2011, SoFi Technologies has transformed from a student loan refinancing company into a comprehensive digital financial services platform.

The company is shifting toward capital-light, high-margin, fee-based revenue streams, particularly in its loan platform business.

Analysts project solid earnings growth for SoFi in the coming years.

- These 10 stocks could mint the next wave of millionaires ›

Investing in the stock market is a powerful way to build long-term wealth. Growth stocks can deliver outsize gains, especially when they scale rapidly or capture dominant positions in emerging sectors. Many investors actively hunt for "millionaire maker" stocks. These tend to be fast-growing companies with the potential to multiply many times over on a long time horizon.

SoFi Technologies (NASDAQ: SOFI) is a company that has caught investors' attention. The fintech has experienced stellar growth in recent years and appears poised for solid long-term growth as well. Does it have millionaire-maker potential? Let's dive into the business and find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

SoFi has evolved into a full-service financial company

SoFi Technologies has evolved into a one-stop shop for digital financial services, helping customers with all aspects of finance, including banking, lending, spending, saving, and investing.

The company initially helped customers refinance their student loan debts in 2011. Over the past several years, it has expanded to personal loans and home loans. In its lending segment, the company mainly earns net interest income from retained loans and fee-based revenue from loan origination and sales.

Beyond lending, SoFi has blossomed into a full financial services company, with offerings including SoFi Money (checking and savings accounts), SoFi Invest (an investing platform that offers robo-advisory services), SoFi Credit Card, and SoFi Relay (a personal financial management product).

Image source: Getty Images.

Finally, through its technology segment, SoFi provides essential back-end services, core banking infrastructure, and payment processing functionality for non-bank fintech companies. Expanded through the acquisitions of Galileo and Technisys in recent years, this segment provides recurring revenue that is diversified from its consumer financial products.

How SoFi drives profitable growth

One key pillar of SoFi's growth is what it calls the "Financial Services Productivity Loop." SoFi attracts members with its high-yield accounts and lending products, then encourages them to explore its other offerings. This cross-buying leverages its existing customer base, lowering acquisition costs, improving unit economics, and leading to higher member lifetime values.

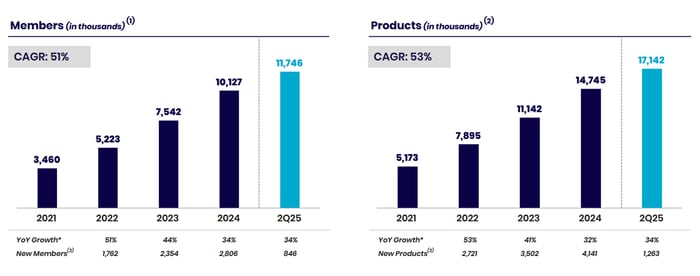

The growth is undeniable. At the end of the second quarter, the company boasted 11.7 million members, representing a 34% growth rate year over year. This figure is up from 3.5 million in 2021. The stellar growth has also led to similar growth in SoFi's total products (the total number of financial products members have with SoFi across all categories).

Image source: SoFi Technologies.

What's next for SoFi

One key component of long-term stability and growth is accelerating the mix toward capital-light, high-margin, fee-based revenue. SoFi has actively driven a shift toward capital-light, fee-based revenue streams, reducing capital requirements and risk. Its loan platform business leverages its origination capabilities to sell loans to third-party partners.

Its loan business platform is scaling quickly and is running at an annualized pace of $9.5 billion in originations and generating over half a billion dollars in high-margin fee-based revenue. Management is optimistic that the platform will become a $1 billion revenue business, allowing SoFi to serve a broader range of members while minimizing capital risk.

It also expects solid growth from its financial services segment. Revenue per product increased by over 50% compared to last year, rising from $64 to $98. Meanwhile, interchange revenue was up 83% on the year, driven by nearly $18 billion in total annualized spend across Money and Credit Card. It anticipates adjusted net revenue growth of 60% to 65% in this segment for 2025.

Is SoFi a millionaire-maker stock?

SoFi is growing quickly, and the investment community sees solid growth continuing. Analysts covering the stock project SoFi will grow earnings per share (EPS) to $0.32 this year, or 165% year over year. Solid growth is expected over the next several years, with 2028 EPS projected at $0.92. This is impressive growth, but unlikely to persist long-term.

If the stock scales with its growth, I think SoFi could experience up to 15% growth on an aggressive assumption, and 8% for more conservative estimates over a longer time horizon. Based on this projected range, a $10,000 investment could be worth $46,600 to $163,600 in 20 years. Of course, a larger investment upfront (or over time with dollar-cost averaging) could grow into a larger sum over a long time horizon.

One thing to keep in mind with these projections is that they are just that. Maintaining its current strong growth over a long period, especially in the financial services industry, where competition is fierce, may prove challenging. That said, SoFi is growing rapidly today, and I believe it offers solid long-term growth prospects for patient investors who buy it today as part of a diversified portfolio approach.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,033%* — a market-crushing outperformance compared to 193% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of October 20, 2025

Courtney Carlsen has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.