$1 Trillion Quantum Leap: 1 Quantum AI Stock Ready to Ride the Wave to 2035

Key Points

Alphabet has long been exploring quantum AI technology.

The company has engineered its own chip, called Willow, which just achieved a major breakthrough.

Quantum computing could be the next big catalyst for Alphabet, a company that already has deep inroads in the AI revolution.

- 10 stocks we like better than Alphabet ›

For the last two decades, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been on the cutting edge of numerous generational technology shifts.

The company made its bones by completely revolutionizing how consumers search for content online when it introduced Google in the late 1990s. Over the last several years, it segued into entertainment via YouTube, electronics through Android, and now has its eyes on technology's grand prize: artificial intelligence (AI).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

While Wall Street continues to fixate on user stats around the company's large language model (LLM), called Gemini, or how its cloud infrastructure stacks up against Amazon Web Services (AWS) and Microsoft Azure, smart investors are looking toward the next frontier: quantum computing.

Let's explore how Alphabet is quietly building a quantum AI empire and assess what this potential trillion-dollar market means for the company's broader AI ambitions.

There is loads of value hidden deep within Alphabet

Alphabet's largest source of revenue and profits stems from advertising. Between Google and YouTube, the company's platforms attract billions of page views on a monthly basis. This huge digital surface area makes it highly valuable to consumer brands looking to capture online engagement.

What most investors may not realize, however, is that over the last two decades, management has deliberately and strategically reinvested its profits into the business. The result is a sprawling ecosystem spanning cloud computing, cybersecurity, custom semiconductors, and autonomous vehicles.

One of the lesser-known subsidiaries is DeepMind, an AI research lab that Google uses to explore new machine learning technologies. Beyond its work in generative AI, DeepMind is playing a role in the company's quantum ambitions, too.

The result so far is yet another potentially revolutionary breakthrough: a processor called Willow.

Image source: Getty Images.

What is Willow and why is it important?

Quantum computing differs from classical systems in many ways. Chief among them is that quantum systems rely on qubits (quantum bits) as opposed to binary bits (0's and 1's).

Qubits can exist in multiple states at once, a property known as superposition. In theory, this structure provides an edge over traditional computing standards because quantum algorithms can evaluate multiple outcomes of the same scenario at once.

While this sounds exciting, developing quantum AI is a monumental undertaking. These systems have so much going on from a processing standpoint that they often become overwhelmed and riddled with errors.

Alphabet's approach has been to design a chip that can self-correct errors as workloads scale up. The chip, known as Willow, previously achieved a breakthrough in which it processed a computation that could take today's most advanced supercomputer 10 septillion years to complete.

Impressive? I'd say so. But practical? Not really.

This brings up an important nuance. Quantum AI promises to upend industries such as energy modeling, financial risk analysis, and drug discovery, but its applications today are quite limited -- essentially nonexistent on commercial scale.

This is where Alphabet's latest milestone comes into play. The company's Quantum Echoes algorithm -- running on Willow -- produced a verifiable advantage. In layman's terms, this means that the results from Willow's latest simulation can be repeated and get the same result.

This is important because it demonstrates that Google has made Willow more practical -- and potentially reliable -- for problem-solving today, and not just relevant for theoretical applications with no real utility. This could pave the way for legitimate, scalable adoption at the enterprise level.

Image source: Getty Images.

How quantum AI could be Alphabet's next billion-dollar business

For now, Alphabet's trajectory in the AI revolution will likely continue to be benchmarked by its progress in fields such as cloud computing and model development.

But what I appreciate about the company is that its leadership is thinking well beyond generative models and niche use cases. Quantum computing may not be moving the financial needle for Alphabet today, but the company appears to be on the precipice of becoming a first mover in AI's next frontier. Such a shift could represent a generational inflection point for the company's existing AI infrastructure.

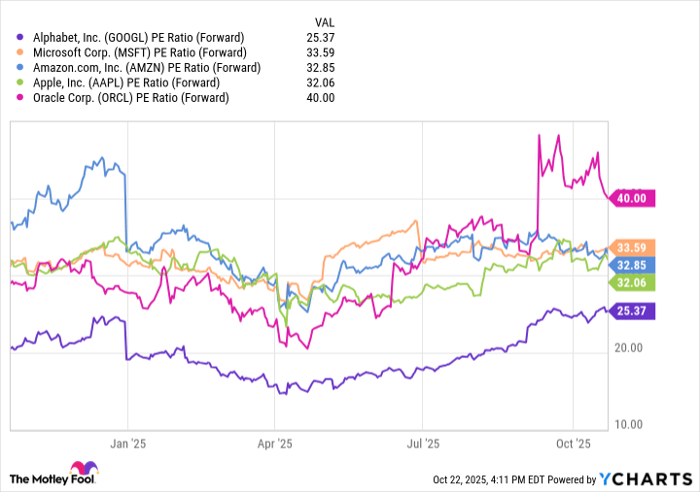

GOOGL PE Ratio (Forward) data by YCharts.

Nevertheless, investors are discounting the company relative to its cohorts in big tech. Its forward price-to-earnings multiple (P/E) of 25 is materially lower than several peers -- potentially suggesting that the markets are overlooking the company's vast, albeit subtle, achievements.

For investors looking for compelling growth and broad exposure to the AI boom, Alphabet represents a unique mix of value and durable economics.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Adam Spatacco has positions in Alphabet, Amazon, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.