3 Millionaire-Maker Technology Stocks

Key Points

Arm Holdings addresses one of artificial intelligence's biggest and most unexpected stumbling blocks.

Building new semiconductor manufacturing factories is complicated as well as expensive. It's best just to let the established and experienced veteran in the business handle it.

Advanced processors launched the AI era, but it's all the other components found within data centers that will usher in its next chapter.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

It's been so true for so long that it's almost become cliché. Nevertheless, it needs to be stated plainly: Technology stocks are still the market's best overall bets for growth. These companies just create too much sociocultural change for this not to be the case. This isn't likely to change in the near or distant future either.

But do any of these companies have enough market-beating longevity to turn their shareholders into millionaires? Actually, a bunch of them do. Three of these prospects stand out among the rest. The common thread among these three names is no coincidence either.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

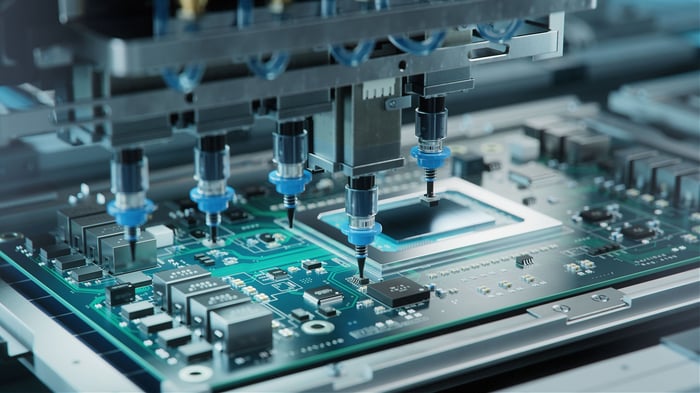

Image source: Getty Images.

1. Arm Holdings

Arm Holdings (NASDAQ: ARM) is often grouped together with semiconductor stocks like Intel (NASDAQ: INTC) and Nvidia (NASDAQ: NVDA). That's not quite what the company does, though. Rather than making its own silicon, Arm designs it and then licenses this know-how to conventional chipmakers. It may not be a big business compared to Nvidia's or Intel's; last fiscal year's total revenue was a mere $4 billion. It's a reliably profitable business model, however, with wide profit margins. Of last year's $4 billion top line, nearly $800 million was turned into net income.

More important to growth-seeking investors, last year's sales growth of 24% is apt to only be a taste of what's to come.

See, Arm Holdings is very, very good at what it does. That's creating chip architecture that's incredibly power-efficient. For perspective, the company reports that Amazon Web Services' cloud customers using Arm-based Graviton processors are seeing a net operating cost that's 20% less than it would be with comparable non-Arm processors. Apple's (NASDAQ: AAPL) newer artificial intelligence (AI)-capable iPhones also utilize silicon designed by Arm since their onboard artificial intelligence features require quite a bit of power from their relatively small mobile batteries.

Given that sheer power consumption has become one of AI's biggest stumbling blocks, look for more and more of its intellectual property to be found wherever AI workloads are being handled, including within data centers and even PCs themselves. Arm is confident of its prominent place in this future anyway. Early this year, the company predicted it would account for half of the world's data center processor (not necessarily AI data centers) market by the end of 2025. There's not been much reason in the meantime to think this won't be close to being the case.

Longer-term, look for Arm Holdings to continue inching its way into the mainstream AI data center business, a hardware market that Global Market Insights expects to grow at an average annual pace of 18% through 2034.

2. Taiwan Semiconductor Manufacturing

To say the aforementioned Nvidia and Intel "make" their own silicon isn't entirely accurate. They design, brand, market, and sell processors. Like most other semiconductor companies, however, they don't actually manufacture their own chips. They instead outsource this work to a third-party contract manufacturer. And in most cases, this contract manufacturer is going to be Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for short. Several credible estimates suggest it alone makes on the order of two-thirds of the world's semiconductors, and roughly 90% of the world's advanced chips.

Yes, this dominance has become a bit of a sore spot, for chipmakers as well as entire nations' governments that are concerned about too much reliance on a single source of foreign supply of something so important. Several semiconductor outfits (particularly since the COVID-19 pandemic shut down supply chains) are now working toward more manufacturing self-sufficiency. Back in 2022, for instance, Intel committed $28 billion to build two new chip foundries in Ohio.

Since then, though, the completion date for these facilities has been pushed back to at least 2030. As it turns out, setting up new factories to manufacture advanced microchips is complicated as well as expensive. Competitors like TSMC are also evolving in the meantime, and can easily afford to upgrade their capabilities because their production facilities are already generating profitable revenue. The more serviceable -- and often cheaper -- model for chip companies is just letting TSMC retain its commanding control of the microchip market and simply working with the manufacturer on its terms.

That's what Apple's doing anyway. Rather than even trying to build its own manufacturing sites, it's working with TSMC to build a major production facility in Arizona. Indeed, TSMC has pledged up to $165 billion worth of investments in production facilities within the United States alone, giving American companies access to the supply they want but punting the cost and risk of this effort to a company that's already proven it knows how to profitably manufacture microchips.

Bottom line? As long as the world needs semiconductors (which it always will), it's going to count on TSMC to provide them one way or another.

3. Broadcom

Finally, add Broadcom (NASDAQ: AVGO) to your list of millionaire-making technology stocks.

To date, the bulk of the AI revolution has centered around Nvidia. And understandably so. After all, it was Nvidia's purpose-built processors that made modern-day AI possible. Processors are only a small piece of the puzzle, though. You still need ways to connect thousands of different processors to one another within a data center to create a true neural network.

That's where Broadcom comes in. It offers these critical solutions. For example, just last week, it unveiled the industry's first-ever 800G AI Ethernet network interface card. That just means this networking technology can handle data at speeds of up to 800 gigabits per second (for perspective, that's about 800 times faster than the typical speed of fiber-based broadband connectivity meant for at-home consumers), capable of connecting hundreds of processors into a platform that can manage trillions of digital data points. The company also recently introduced Wi-Fi 8 technology, offering the wireless connectivity speeds that will be necessary now that mobile devices like the aforementioned iPhone are becoming AI-capable devices themselves. They'll also need to send and receive the massive amount of information now being created by the advent of AI.

This might drive the point home: Even against a wobbly economic backdrop, the company's AI-related revenue grew 63% year over year to $5.2 billion last quarter, and is expected to reach $6.2 billion for the quarter currently underway.

This is still only the beginning, though, if the company's recently established relationship with OpenAI to create custom AI chips is a glimpse of what's to come. As the AI industry evolves, it will need more specific solutions for the entire data center. Broadcom is one of the few players outside of the processor segment of the stack that's in a position to meet these specialized needs.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,380!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.