Prediction: This Under-the-Radar AI Stock Could Deliver the Market's Best Returns

Key Points

SoundHound AI is winning big clients in the financial and healthcare industries.

Management believes it could keep putting up 50% organic revenue growth annually for the foreseeable future.

- 10 stocks we like better than SoundHound AI ›

Finding under-the-radar artificial intelligence (AI) stocks isn't as easy as it once was, as there is a ton of interest in the sector, and interesting new players don't stay obscure for long. Still, there are plenty of stocks out there that could deliver jaw-dropping returns thanks to their various approaches to AI.

One of the ones I'm most excited about is SoundHound AI (NASDAQ: SOUN). It's still a relatively small company, with a market cap of $7.7 billion. If some of management's projections are true, it won't stay this small for long and could deliver some of the best returns in the market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

SoundHound AI is a leader in audio recognition technology

SoundHound AI pairs generative AI with audio recognition. This isn't a new concept; products like Siri and Alexa have been attempting to do this for some time. However, SoundHound AI's technology is a massive leap forward in this arena, and its success is on display in multiple industries.

Two of the most popular deployment areas for SoundHound AI's tech are in restaurant drive-thrus and digital assistants in vehicles. SoundHound AI has captured many clients in the restaurant and automotive sectors, but it has its eyes on larger prizes.

Some of the most promising are industries where there is a heavy customer support presence, like the healthcare and financial industries. If SoundHound AI can create a product that can replace humans in assisting customers with common tasks, the cost savings to such companies could be enormous. SoundHound AI is already seeing strong adoption from companies in these industries; it claims seven of the top 10 global financial institutions as clients, and four of them increased their spending or renewed their contracts with it during Q2.

All of this success resulted in SoundHound AI's strong Q2 growth of 217% to $42.7 million. Few companies are growing at that speed, regardless of whether they're involved in artificial intelligence. However, investors aren't concerned about what SoundHound has delivered in the past. They want to know what's next.

On the latest earnings call, Chief Financial Officer Nitesh Sharan stated that he thinks a goal of annual organic growth of 50% or greater for the "foreseeable future" is likely. While that's slower than its current pace, sustained 50% growth is nothing to be disappointed about, and could deliver massive, market-crushing returns.

However, there's one roadblock in the way.

SoundHound AI's stock carries a premium valuation

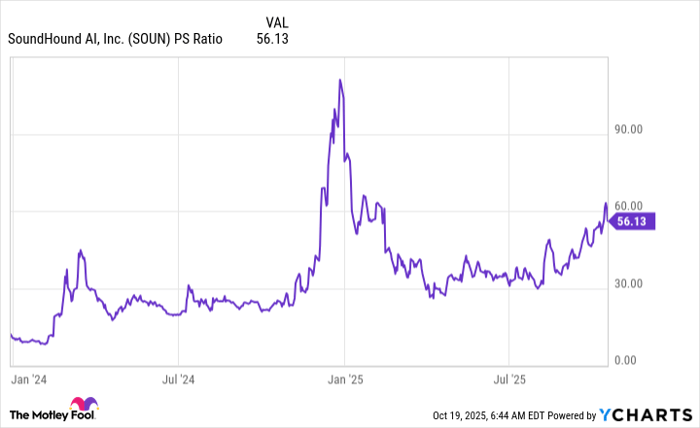

Just because SoundHound AI's stock isn't wildly popular in the stock market doesn't mean that it's an unknown. Quite a few investors have become aware of this booming business, which has caused its valuation to skyrocket over the past few years.

SOUN PS Ratio data by YCharts.

Trading now at 56 times sales, SoundHound AI is valued at some of its most expensive levels since it crashed at the end of 2024 and the beginning of 2025. That valuation is a bit of a red flag for investors: Most software stocks normally trade between 10 and 20 times sales, with the most successful trading at close to 30 times sales. However, most software companies aren't growing at sustained annual rates of 50% or greater, so SoundHound AI gets a bit of a pass here. Even so, it will take a few years' worth of such growth to bring its valuation back to reasonable levels, even if shares trade largely flat in the meantime.

Should SoundHound AI sustain its 50% growth rate for five years, its revenue will total nearly $1.3 billion by the end of 2030. Relative to SoundHound AI's current $7.7 billion valuation, this would only price the stock at 5.9 times 2030 sales. If the market gives it a 20 times sales valuation, that would put SoundHound AI at a market cap of $26 billion.

To hit that result from here would require it to deliver a compound annual growth rate of 28% over a five-year span, which would easily be among the market's higher-performing stocks.

So SoundHound AI stock may be expensive right now, but if it can deliver on the growth it expects, it could still be a phenomenal investment opportunity.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $600,550!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,116,616!*

Now, it’s worth noting Stock Advisor’s total average return is 1,032% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.