Mexican Peso steadies as markets await Powell's tone, tariff signals

- The Mexican Peso holds gains as risk appetite improves due to the announcement of talks between the US and China.

- Focus turns to the Federal Reserve interest-rate decision and Chair Jerome Powell’s words over the possibility of future cuts.

- USD/MXN steadies, with short-term resistance remaining firmly intact.

The Mexican Peso (MXN) extends gains against the US Dollar (USD) on Wednesday, benefiting from renewed hopes of de-escalation in global trade tensions after positive developments between the United States and China. Optimism surrounding the upcoming trade dialogue between senior US and Chinese officials, set to take place in Lucerne, Switzerland, over the weekend, has lifted broader Emerging Market (EM) sentiment. For Mexico, a reduction in global trade frictions supports external demand, reduces risk aversion, and eases pressure on capital flows, contributing to recent Peso stability.

With USD/MXN trading near 19.639, down 0.17% at the time of writing, the currency pair remains tightly aligned with shifts in risk sentiment and monetary policy expectations. While global trade talks and tariff uncertainty continue to influence investor positioning, attention is now focused on the Federal Reserve’s (Fed) interest rate decision, due on Wednesday.

Mexican Peso looks to Powell’s guidance for next policy cue

The Federal Open Market Committee (FOMC) statement, followed by Fed Chair Jerome Powell’s press conference, will be key in shaping the short-term outlook for the US Dollar and, by extension, the Mexican Peso.

Although the CME FedWatch Tool currently indicates a 95.6% probability that the Fed will leave interest rates unchanged within the current 4.25%-4.50% range, Powell’s comments on inflation, growth, and credit conditions will be closely parsed. These remarks carry market-moving potential, particularly if they alter expectations around the anticipated rate cut in July.

Shifts in US Treasury yields and the Dollar’s trajectory will likely spill over into EM currencies like the Peso, which are sensitive to global liquidity and interest rate differentials.

Mexican Peso monitors US-Mexico diplomatic strain

Meanwhile, tensions between Mexico and the United States remain a critical background risk. On Saturday, Mexican President Claudia Sheinbaum publicly rejected a proposal by US President Donald Trump to send American troops into Mexico to combat drug cartels. “We respect bilateral cooperation, but we will not accept troops on our soil,” Sheinbaum said during a speech in Texcoco. Trump later confirmed the offer in comments to reporters aboard Air Force One on Sunday, stating: “We’ve made the offer. The cartels are a threat to both nations. If they want help, we’ll give it.”

On Tuesday, the Mexican Foreign Ministry responded with a formal statement reinforcing Mexico’s sovereign position: “Mexico complies with international agreements, but sovereignty is non-negotiable.” These developments, alongside existing US tariffs on Mexican exports, continue to weigh on bilateral trust and raise uncertainty for regional trade and investment.

Given that approximately 80% of Mexican exports are bound for the United States, any deterioration in US-Mexico relations, whether through increased tariffs, policy divergence, or diplomatic conflict, poses a clear risk to the Peso. At the same time, positive signals from the broader global trade environment, including US-China trade discussions, may help to offset some of that pressure if sentiment continues to improve.

Mexican Peso daily digest: Waiting for Powell’s words

- US President Donald Trump has openly criticised Fed Chair Jerome Powell over high interest rates, claiming the central bank is “hurting American competitiveness.” While the Fed maintains its independence, political rhetoric adds pressure during a sensitive policy phase.

- Security and trade agreements between the US and Mexico have come under renewed pressure following recent remarks by both governments. Disagreement over sovereignty and troop deployments risks complicating broader bilateral coordination, including migration and commerce.

- On Monday, the Mexican government unveiled a fiscal support package aimed at small businesses and infrastructure development in response to slowing growth. The initiative is intended to support domestic demand without undermining fiscal stability.

- The Bank of Mexico is expected to cut its benchmark rate by 50 basis points on May 15, as inflation continues to cool. Gross Domestic Product (GDP) rose by 0.2% in Q1, avoiding a technical recession, but weak investment and external demand continue to weigh on economic momentum.

Mexican Peso technical outlook: Consolidation phase signals indecision

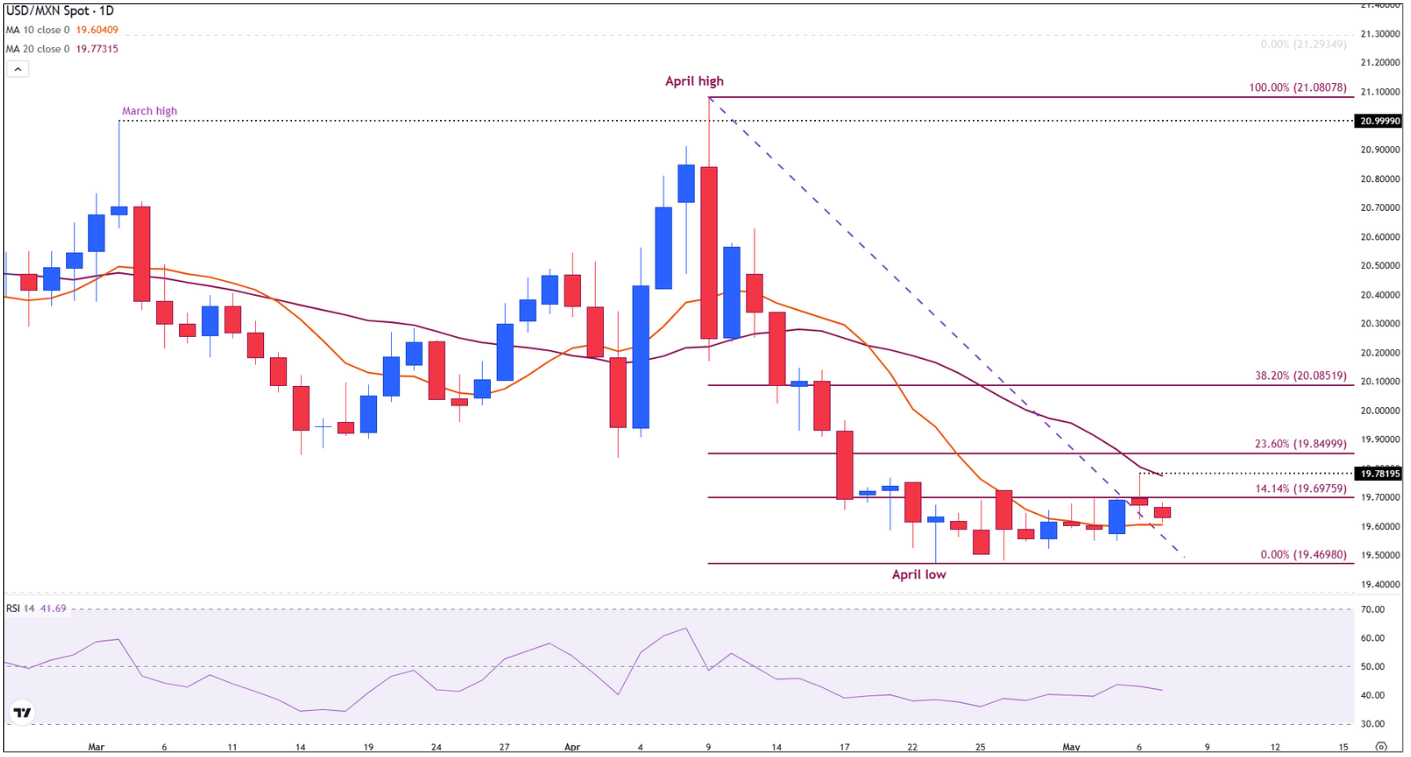

USD/MXN is trading near 19.64, marginally lower at the time of writing on Wednesday, extending the consolidation range between 19.46 and 19.76 since April 18.

Initial support could be found at the 10-day Simple Moving Average (SMA) at 19.60. A break below this level would re-expose the April low at 19.46.

USD/MXN daily chart

Momentum indicators remain subdued. The Relative Strength Index (RSI) flattens near 42.44, below the 50-neutral line, suggesting a lack of strong directional conviction. The overall structure continues to reflect indecision.

To the upside, any bullish confirmation would need to surpass psychological resistance at 19.80. A break above this area could open the door for the 23.6% Fibonacci retracement, drawn from the April 9 high of 21.08 to the April 23 low of 19.46, at 19.85, and toward 20.07 (38.2% Fibonacci retracement). Still, that outcome would likely require a dovish surprise or shift in tone from Fed Chair Jerome Powell during today’s press conference.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed May 07, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve