RBA Interest Rate Decision Commentary: Hitting Pause, But the Easing Cycle Isn't Over – Where Next for the AUD?

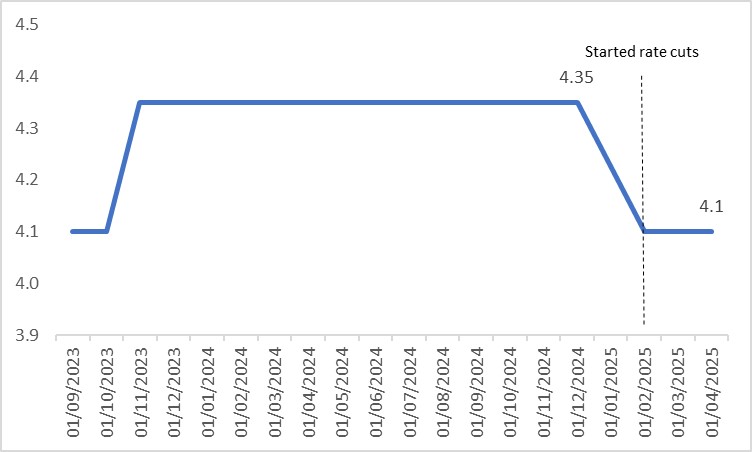

On 1 April 2025, the Reserve Bank of Australia (RBA) announced its latest interest rate decision. In line with widespread market expectations, the central bank kept its policy rate steady at 4.1%. Since November 2023, the RBA had maintained the cash rate at 4.35%, until a 25-basis-point cut in February this year signalled the start of a rate-cutting cycle (Figure 1).

Figure 1: RBA policy rate (%)

Source: Refinitiv, Tradingkey.com

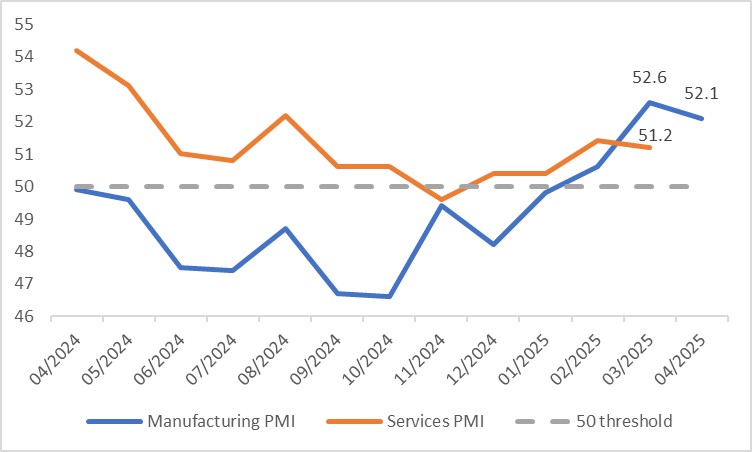

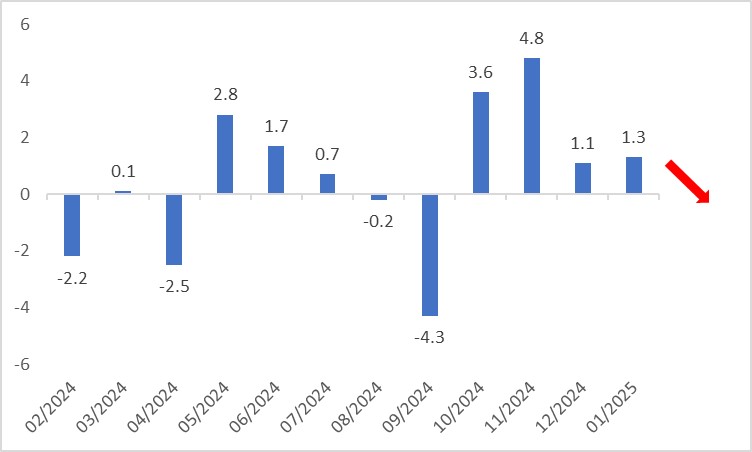

However, both domestic and international uncertainties justified the decision to hold rates steady in April. Domestically, on the consumption side, retail sales have turned positive year-to-date after a decline at the end of last year. The Westpac Consumer Confidence Index surged from 0.1% in February to 4% in March, suggesting that retail sales growth could persist in the near term (Figure 2). On the output side, Manufacturing and Services PMIs climbed above the 50-expansion threshold in February this year and December last year, respectively (Figure 3). These indicators highlight the resilience of the Australian economy, even amid a global slowdown, reducing the urgency for further immediate rate cuts by the RBA.

Figure 2: Retail sales and Westpac consumer confidence

Source: Refinitiv, Tradingkey.com

Figure 3: Manufacturing and Services PMIs

Source: Refinitiv, Tradingkey.com

Internationally, uncertainties loom large, particularly from U.S. President Trump’s foreign policy. The reciprocal tariffs set to take effect on 2 April stand out as the largest headwind for Australia’s economy. On one hand, high tariffs could weaken Australian exports (Figure 4), slowing economic growth and reducing inflationary pressures. On the other hand, if global supply chains are disrupted by a trade war, the rising cost of imported goods—such as consumer products and machinery—could drive Australian inflation higher. This uncertain outlook is the primary reason behind the RBA’s decision to pause rate adjustments this month.

Figure 4: Exports (m-o-m, %)

Source: Refinitiv, Tradingkey.com

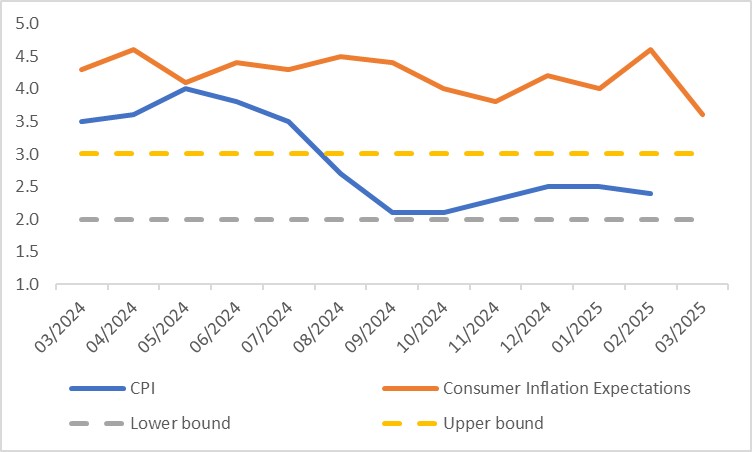

Looking ahead, despite domestic and external headwinds prompting this pause, the broader trend favours continued rate cuts in 2025. Australia’s CPI has been declining from its peak in May last year and has remained within the RBA’s 2%-3% target range since August (Figure 5). This suggests that the RBA is likely to resume its easing cycle later this year.

Figure 5: CPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

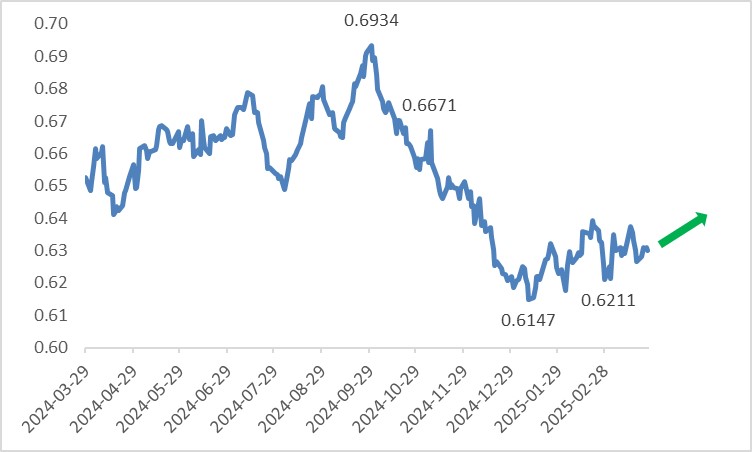

In the foreign exchange market, the Australian dollar (AUD) faces mixed forces. The positive effect of economic resilience is expected to be offset by the negative implications of the rate-cut cycle. Meanwhile, on the U.S. dollar (USD) side, a slowing American economy combined with the Federal Reserve’s renewed rate cuts points to a weakening USD Index. Consequently, in the short term (0-3 months), we are optimistic about the AUD/USD exchange rate (Figure 6).

Figure 6: AUD/USD

Source: Refinitiv, Tradingkey.com