China’s September Core CPI Hits 1% for First Time in 19 Months, PPI Deflation Eases

TradingKey - Although China’s September CPI and PPI remained in negative year-on-year territory, the latest inflation data shows encouraging signs that efforts to combat deflation are gaining traction. Core CPI rose 1.0% YoY — the first time in 19 months it has reached the 1% threshold — while the PPI contraction narrowed further, signaling improving price trends on both the consumer and producer fronts.

According to data released by China’s National Bureau of Statistics on October 15, key highlights include:

- September CPI YoY: -0.3%, an improvement from -0.4% in August

- CPI MoM: +0.1%, turning positive after being flat in August

Most significantly:

- Core CPI (ex-food & energy) YoY: +1.0%, marking the fifth consecutive month of acceleration and the highest level since February 2024 — the first time it has returned to 1% in nearly a year and a half.

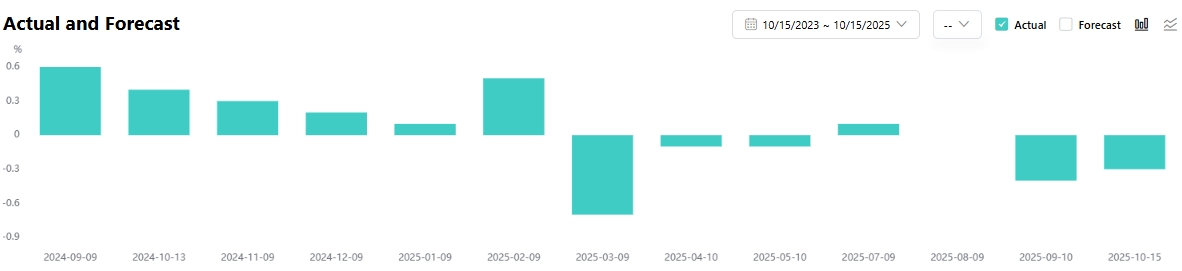

China September CPI Year-on-Year, Source: TradingKey

For producer prices:

- PPI YoY: -2.3%, up from -2.9% in August

- The PPI has now declined year-on-year for 36 consecutive months

- PPI MoM: unchanged for the second straight month

What Drove the Improvement?

The turnaround in CPI momentum was driven by seasonal factors:

- Rising prices for fresh vegetables, eggs, fruits, lamb, and beef

- Gains in non-energy industrial goods and gold jewelry, influenced by strong international gold prices

These were partially offset by lower travel-related costs such as airfares, hotel accommodation, and tourism, due to a timing shift in holiday spending.

The year-on-year decline in headline CPI was largely due to the tail effect, or impact from the higher price level last year.

PPI Shows Stabilizing Producer Prices

The narrowing PPI contraction reflects improving supply-demand dynamics in several industries:

- Coal mining and processing

- Ferrous metal smelting

- Photovoltaic (solar) industry

Authorities noted that ongoing macroeconomic policy support and capacity optimization measures are taking effect. Structural upgrades and rising consumer demand are also contributing to price stabilization and growth in select sectors.

Cautious Optimism: Is Deflation Truly Fading?

While the data offers hope, Zhiwei Zhang, economist at Pinpoint Asset Management, cautioned:

“It is too early to conclude that the deflationary pressure is fading at this stage.”

He explained that although core CPI shows positive momentum, the resurgence of trade tensions and rising uncertainty over growth prospects continue to weigh on domestic demand recovery.