All Eyes on August CPI: The Data That Could Trigger a Jumbo Fed Cut — Or Not

TradingKey - Following the weak August nonfarm payrolls report, the downward revision of prior job data, and a surprise negative print in the PPI, a rate cut by the Federal Reserve in September appears all but certain. The key question now is whether the August CPI report, to be released on September 11, could push the Fed toward a more aggressive 50-basis-point cut — as it did in September 2024.

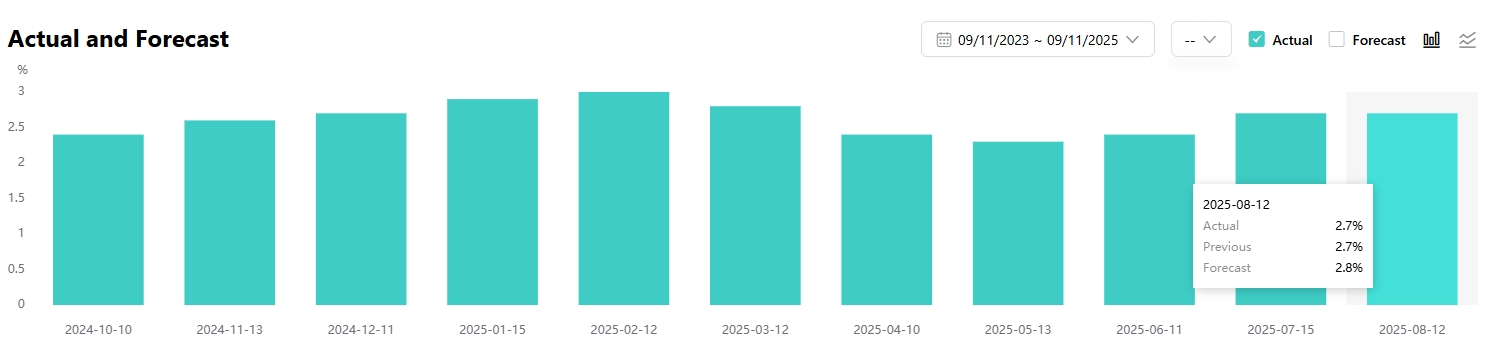

According to consensus estimates from Reuters and TradingKey:

- Headline CPI YoY: +2.9%, up from 2.7%

- MoM: +0.3%, up from 0.2%

- Core CPI (ex-food & energy) YoY: +3.1%, unchanged from previous

- Core CPI MoM: +0.3%, flat month-over-month

U.S. CPI Year-on-Year, Source: TradingKey

Jason Tang, Senior Economist at TradingKey, noted that several factors point to a higher likelihood of rising inflation in August:

- Rising CRB Food Index

- Sharply narrowing year-over-year decline in U.S. gasoline prices

- Increase in used car value index

- High level of average hourly earnings growth

Jason added that shelter inflation may have moderated slightly, as both the S&P CoreLogic Case-Shiller Home Price Index and Zillow Observed Rent Index showed some softening in August.

Are Tariffs Still a Challenge?

As in previous months, the pass-through of tariff effects remains a focal point in the inflation report. While recent CPI prints haven’t shown the sharp rebound many expected, certain categories sensitive to tariffs still suggest businesses are absorbing cost pressures. Economists continue to monitor how these impacts ripple through supply chains and consumer prices.

The PPI report, released a day earlier, brought good news for the “modest inflation” narrative.

- August PPI YoY: +2.6%, well below 3.3% forecast and prior

- PPI MoM: -0.1%, turning negative for the first time in four months

However, according to a new “market-leading indicator” from Morgan Stanley, CPI swap markets are pricing in:

- CPI YoY: 2.91%

- CPI MoM: 0.38%

Both figures are above consensus, suggesting traders expect an upside surprise.

Morgan Stanley noted that while service inflation in areas like airfares and dental care is slowing, tariff impacts may be more pronounced than in recent months, making a higher-than-expected CPI print possible.

Jason believes the base case is sticky but contained inflation. If tariff effects prove stronger than anticipated, CPI could exceed expectations.

Last month, sharp price increases in services stood out in an otherwise moderate inflation report:

- Shelter index: +0.3%

- Healthcare index: +0.7%

- Airfare index: +4.0% after falling 0.1% in June

Wells Fargo said that persistent service price gains and rebounding goods prices have hindered the two-year trend of disinflation, pushing inflation further away from the FOMC’s target.

Meanwhile, Morgan Stanley expects core CPI to post its third consecutive monthly gain, though prices in categories like airfares and healthcare may retreat.

Overall, accelerating goods inflation may be partially offset by softening service prices in the August report.

How Big Should the Rate Cut Be?

Markets widely agree that the Fed has already lowered its threshold for easing, given its dual mandate of maximum employment and price stability. On the labor front:

- Unemployment rate: 4.3%, highest since 2021

- June nonfarm payrolls revised to -13,000, a rare negative print

- Annual benchmark revision: -911,000 jobs

Russell Investments analysts said that to prevent a 25-bp cut, the August CPI would need to show a very large upside surprise.

According to CME FedWatch Tool:

- 90% probability of a 25-bp cut

- 10% chance of a 50-bp cut — up from nearly 0% at the start of the month, driven largely by the weaker-than-expected PPI

After the weak PPI data on September 10, some analysts said it sent a strong signal that CPI could also come in below forecasts, especially given that the MoM PPI drop was the largest in a decade. If CPI also undershoots significantly, the odds of a 50-bp cut could rise further.

However, even if CPI is weak enough to justify a larger cut, Fed officials may still focus on the future path of inflation, potentially limiting the size of this month’s move.

Plante Moran Financial Advisors warned that if overall inflation — especially core services — comes in stronger than expected, investors may need to recalibrate their outlook on how much easing the Fed can deliver beyond September.

Morgan Stanley emphasized that while the level of CPI matters, its composition and context matter more. Growing evidence of tariff pass-through in goods and services could reinforce concerns about persistent inflation.

Will the Stock Market Keep Celebrating?

A surge in Oracle’s stock and the positive PPI report helped both the Nasdaq and S&P 500 hit record highs on Wednesday — the 23rd new high for the S&P 500 this year. President Donald Trump posted on social media:

“Just out: No Inflation!!! “Too Late” must lower the RATE, BIG, right now. ”

MetLife Investment Management noted that fears of stagflation have eased.

State Street strategists said:

“Given that we are building a stronger case for the Fed to restart its cutting cycle while the economy remains on fairly solid footing, this environment serves as a tonic for risk investors.”

Others caution that since tariffs only began taking effect in August, their full impact will likely become clearer over the next few months, which could temper market optimism.

TradingKey maintains a bullish stance over the next 12 months, expecting that supportive policies — rate cuts and tax reductions — will outweigh the headwinds from slowing economic growth.