Ripple Price Prediction: XRP claws back gains, triggering liquidations, as Open Interest slumps

- XRP price retreats over 3% amid a market-wide correction led by Bitcoin.

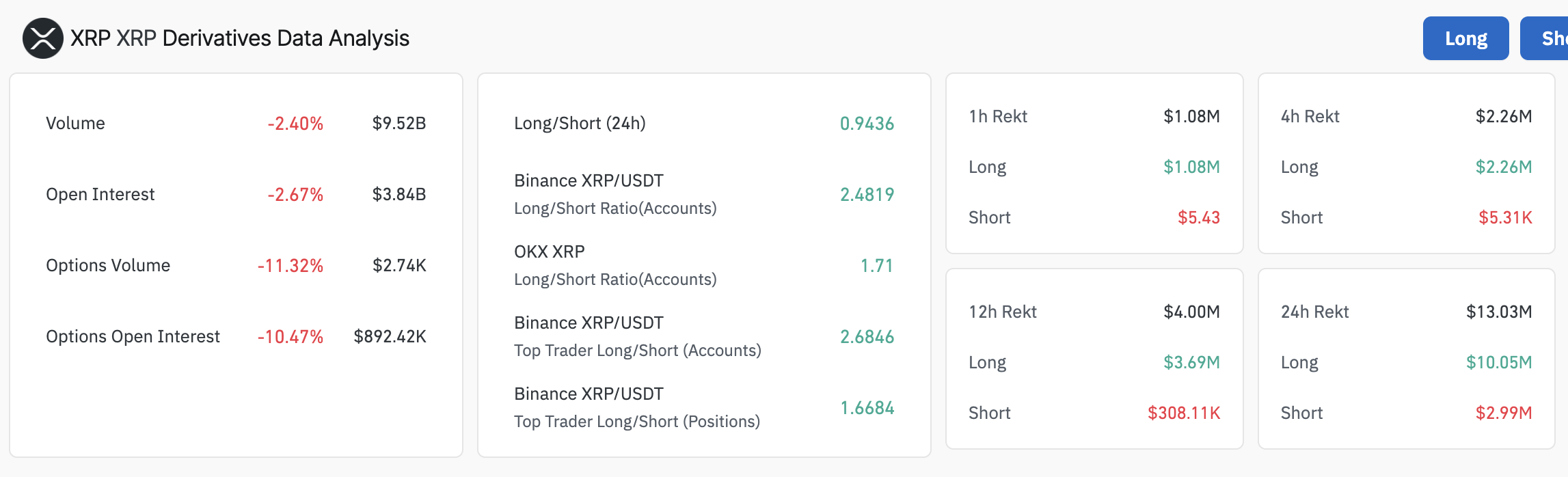

- The drop in the derivatives market’s Open Interest to $3.84 billion signals waning confidence in XRP’s uptrend

- In the last 24 hours, long position liquidations have exceeded $10 million, compared to almost $3 million in short positions.

Ripple (XRP) price is reversing gains at the time of writing on Thursday, following a widespread recovery in the cryptocurrency market on Wednesday. XRP rallied behind Bitcoin (BTC) and reached a previous day's high of $2.30 as global markets digested United States (US) President Donald Trump’s softened tone regarding Federal Reserve (Fed) Chair Jerome Powell and China.

President Trump urged Jerome to be proactive and cut interest rates. The US is optimistic that it will soon resolve the trade and tariff standoff with China, hinting at the potential easing of tariffs ahead of a comprehensive agreement in two years.

XRP price retests short-term support as liquidations surge

XRP price hovers at $2.14 at the time of writing, reflecting bearish sentiment in the wider cryptocurrency market. According to derivatives market data from Coinglass, the XRP Open Interest (OI) has decreased by 2.67% to $3.84 billion over the last 24 hours. This drawback in the price of XRP triggered liquidations on the last day, where long positions valued at $10.05 million were forcibly closed, compared to approximately $3 million in short positions.

The drop in XRP’s derivatives OI reflects a significant decline in trader confidence, which could lead to reduced market participation. In addition to the liquidation of long positions, this mirrors heightened selling pressure, as bullish traders are forcefully ejected from the market.

XRP derivatives data | Source: Coinglass

The 24-hour long/short ratio of 0.9436, combined with a 2.4% drop in trading volume to $9.52 billion, suggests waning market activity. XRP price could face increased downward pressure, potentially breaking below key support areas and accelerating its decline in the near term.

Is the XRP price pullback temporary?

XRP price hovers near the 100 Exponential Moving Average (EMA) at $2.14 after testing the immediate support at $2.11 provided by the 50 EMA on the 8-hour chart below. This follows a reversal from Wednesday’s high of $2.30.

The Relative Strength Index (RSI) indicator’s position at 52.42, as it approaches the midline, reinforces the bearish sentiment. Beyond the 50 EMA support, the next critical level for XRP is $2.00, a significant anchor since March. April’s low, approximately $1.62, is another level to keep in mind in the coming days and weeks.

XRP/USD 8-hour chart

If XRP price navigates the current challenges and reverses the trend upwards, an inverse head and shoulders pattern highlighted on the chart above could return in focus, projecting a 26% increase to $2.74. This target is determined by measuring the distance between the dotted line and the lowest point of the pattern’s head and then extrapolating above the breakout point.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.