Tron DAO announces $70B USDT supply: Here's how TRX price could react

- Justin Sun's TRON network surpasses $70 billion in USDT circulation, reinforcing its stablecoin market dominance.

- TRON now supports over $19 billion in daily USDT transfers, highlighting its institutional-grade scalability.

- TRX price could react to growing adoption as technical indicators show an imminent bullish Golden Cross setup.

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout.

Tron Network surpasses $70 billion in USDT supply amid crypto market recovery

On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion. This further re-emphasizes TRON’s position as the leading network for stablecoin settlements.

The announcement highlights strong institutional and retail demand for scalable, low-fee stablecoin payments infrastructure, particularly in regions where local currencies are volatile, and traditional financial access remains limited.

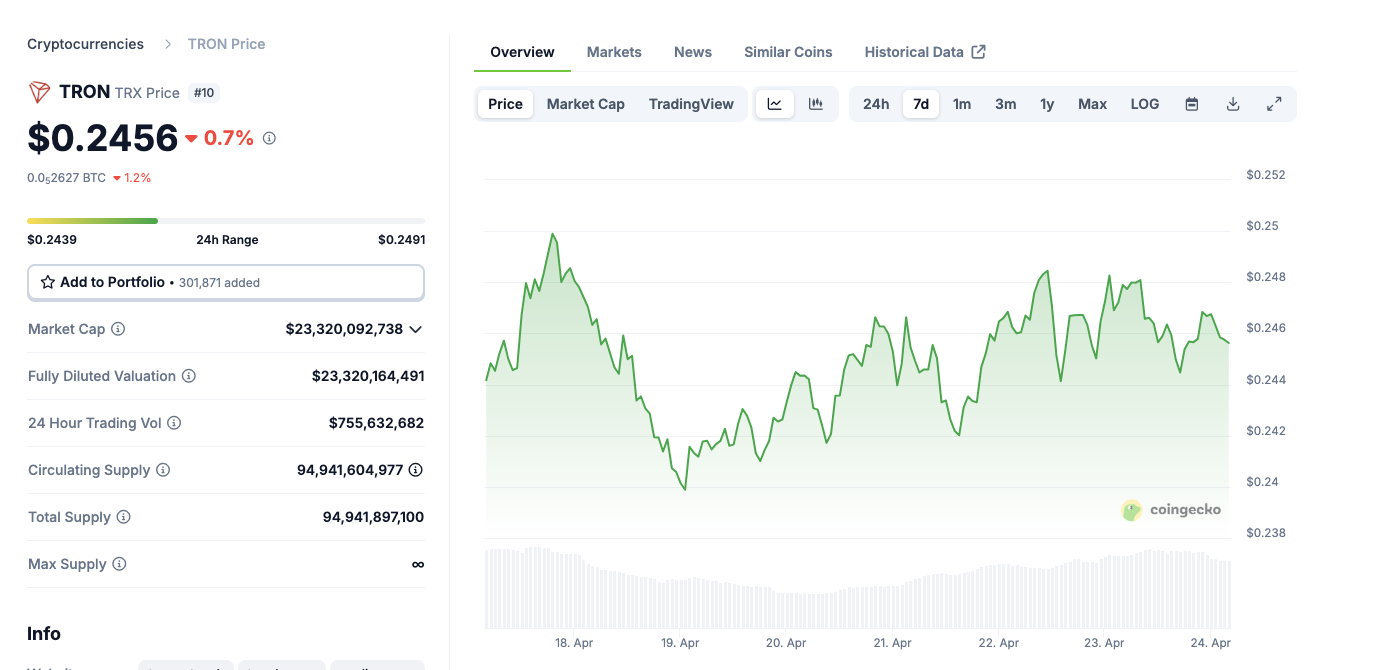

Tron price action | April 24

With over 302 million user accounts and 10 billion transactions processed, TRON now handles $19 billion in daily USDT transfers, according to TRONSCAN.

“USDT on TRON surpassing $70 billion in circulating supply is a powerful reflection of the global community’s trust and support. This progress reflects the commitment of our ecosystem to real-world utility and stability.”

TRON founder Justin Sun, April 2025

The network’s $20 billion in total value locked (TVL) reinforces TRON’s role as a foundational layer in decentralized finance. Tron price is lingering below the $0.25 level at press time, however, rising trading volumes suggest an imminent upward move.

TRON’s milestone in USDT circulation signals expanding market footprint

The latest USDT supply milestone arrives as TRON continues to gain traction for its performance-driven architecture that makes it ideal for stablecoin transfers at scale.

In the official statement released, TRON DAO emphasized that this momentum aligns with broader adoption trends in the stablecoin economy, where users are turning to decentralized networks amid currency devaluation and banking constraints.

As part of its compliance efforts, TRON partnered with Tether and TRM Labs to launch the T3 Financial Crime Unit (T3 FCU). The initiative has already aided in freezing over $150 million in illicit funds, supporting regulatory enforcement while maintaining user autonomy.

TRON’s growing transaction volumes, alongside its active collaboration with global law enforcement, indicate a dual focus on scalability and security. Market observers suggest the network’s expanding role in USDT transfers could enhance TRX token utility, especially if stablecoin legislation advances in the United States and Asia in 2025.

TRON Price Forecast: TRX eyes $0.26 as bulls anticipate a Golden Cross to materialize

TRON (TRX) price is consolidating just below $0.25, showing signs of strength as price action holds above key moving averages. Currently trading at $0.2456, TRX maintains support above the 50- and 100-day simple moving averages (SMA), located at $0.2361 and $0.2377, respectively.

The current TRX price trend suggests a bullish continuation, with the 50-day SMA nearing a crossover above the 200-day SMA at $0.2271—setting the stage for a golden cross.

TRON Price Forecast

Moreover, the recent TRX price action has been defined by higher lows and steady closes above both short- and medium-term averages, indicating healthy buyer interest on dips. Similarly, the tightening range between $0.2370 and $0.2500 sees momentum building for a potential breakout. The Bull-Bear Power (BBP) also leans positive at 0.0021, signaling underlying buying pressure.

In this scenario, a decisive move above $0.25 could open the door to retesting the April high near $0.26. If rejected, downside support rests at $0.2370, with deeper losses likely limited to the rising 200-day SMA at $0.2271.