Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

- Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400.

- The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

- The long-term RSI downtrend underscores bearish sentiment, signaling Chainlink may retest the $10 support level.

- If validated, a falling wedge pattern in the daily timeframe could reverse the bearish trend.

Chainlink (LINK) has seen a lackluster downward trend in its performance since reaching a peak of $30.86 in December. Despite targeted attempts from bulls to change course, recovery for the Oracle network token remains elusive, with LINK sliding by 0.74% on the day to trade at $12.15 at the time of writing on Wednesday. These rampant downside risks can be attributed to weak fundamentals observed from several metrics, including network and whale activity.

Chainlink active address on a free fall

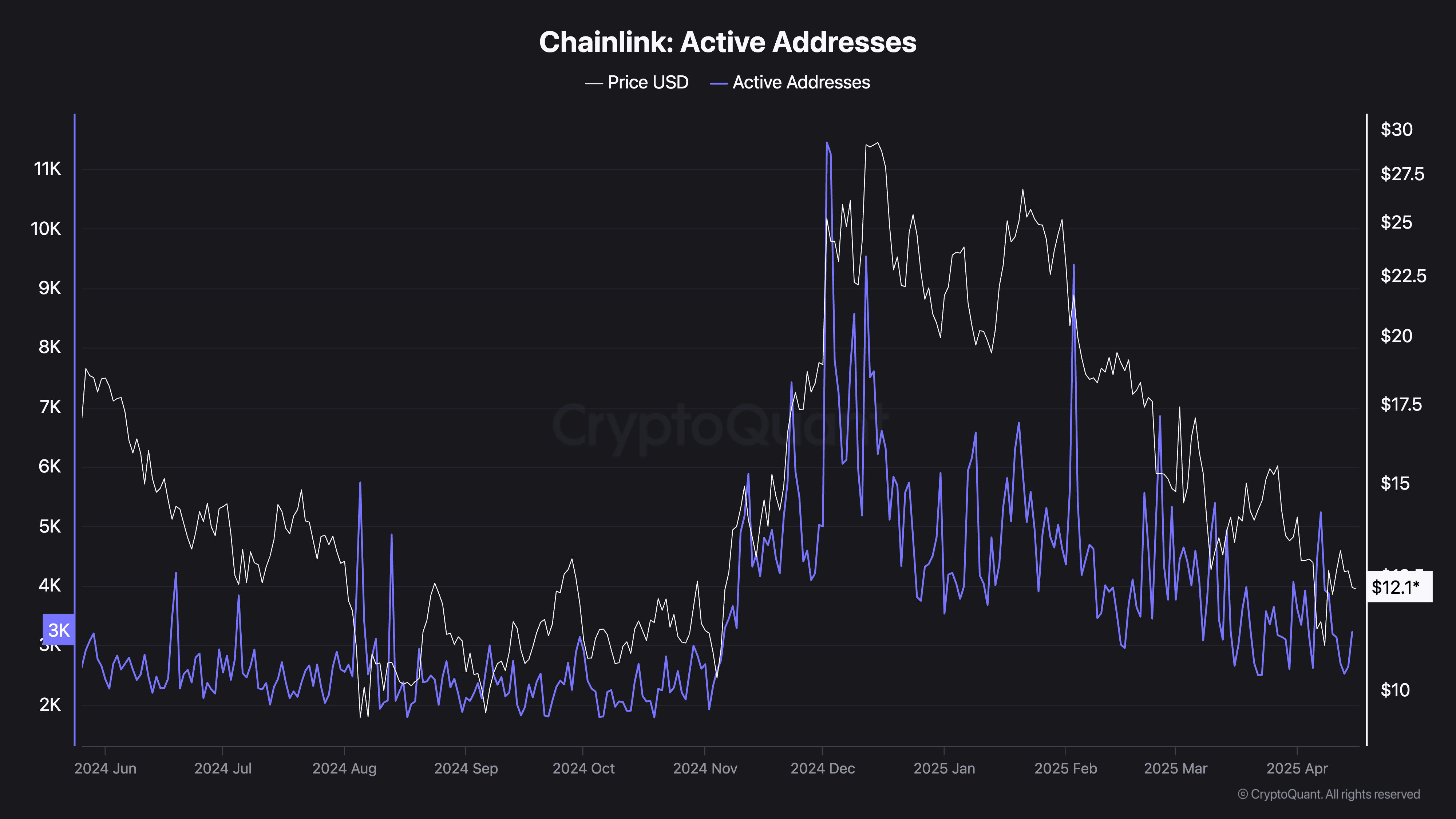

According to CryptoQuant data, the Active Addresses on-chain metric continues to sustain an overall downward trend from its peak of approximately 9,400 addresses in February to roughly 3,200 addresses as of Tuesday. This marks a 66% decline in two and a half months and a 72% drop from the metric’s December peak of approximately 11,400 addresses.

Chainlink Active Addresses metric | Source: CryptoQuant

The chart above shows a close positive correlation between Chainlink’s price and the Active Address metric, which measures the number of unique addresses interacting with the Oracle network by sending or receiving LINK. A sustained decline in this metric suggests low network activity, which may reflect waning user engagement and low confidence in the ecosystem.

At the same time, a noticeable spike in whale selling pressure affirms the concerns about declining user engagement and low confidence among traders. Santiment’s data reveals that between February and mid-April, addresses with between 10 million and 100 million LINK tokens reduced their holdings by 1.88%. This whale cluster currently holds 46.04% of Chainlink’s total supply.

[12-1744804980795.35.13, 16 Apr, 2025].png)

Chainlink Supply Distribution | Source: Santiment

The spike in whale selling activity alongside the slump in active addresses greatly undermines Chainlink’s competitiveness, potentially driving the price down. Therefore, these metrics are worth paying attention to amid the prevailing uncertainty and as LINK closes in on the key support area around $10.00.

Can Chainlink defy weak fundamentals for a quick reversal?

A falling wedge pattern in the daily timeframe signals a potential rebound if validated in the short term. This bullish pattern is formed by drawing two downward-sloping trendlines connecting a series of lower highs and lows, as shown in the daily chart below.

Bulls must break the upper trendline resistance amid increasing trading volume to validate the wedge pattern. LINK could then rise 24% to $15.17, a distance equal to the wedge’s widest points extrapolated above the breakout point.

LINK/USD daily chart

However, the downtrend in the Relative Strength (RSI) indicator shows that bears have the upper hand and may continue to drive the LINK price down.

Support at $10.00 could be retested if the RSI indicator drops further from its current position at 43.00. Traders cannot rule out extended declines below this level, as a spike in selling pressure might accelerate the fall to $8.10, the lowest level since August 5, 2024.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.