Shiba Inu Price Analysis: Bearish trend persists as sentiment remains mixed

- Shiba Inu price steadies on Wednesday, facing resistance at the previously broken weekly level at $0.0000068.

- On-chain data shows mixed sentiment, with increased large orders offset by overheating conditions and growing sell-side dominance.

- Traders should be cautious, as any short-term relief rally appears fragile, as the primary trend remains bearish.

Shiba Inu (SHIB) price stabilizes at $0.0000067 at the time of writing on Wednesday, facing rejection around a key resistance zone. On-chain and derivatives data indicate mixed sentiment among traders, further limiting the chances of a price recovery.

Mixed sentiment among traders caps SHIB’s recovery

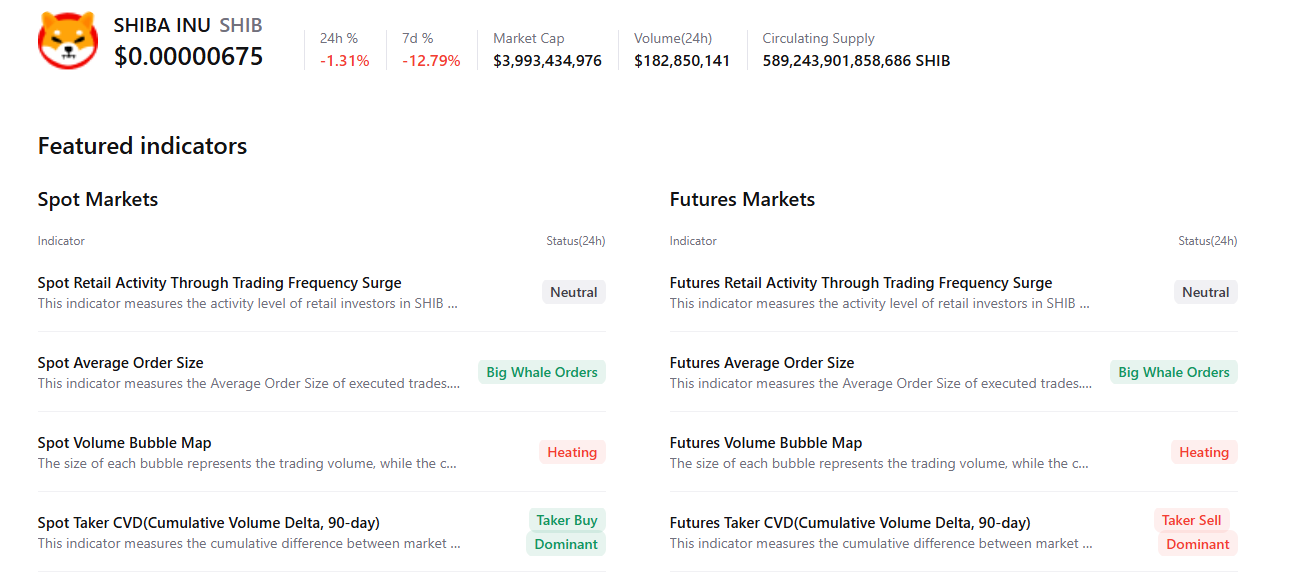

CryptoQuant’s summary data suggests that the dog-themed meme coin sentiment among traders is mixed. While there are large whale orders in both the spot and futures markets, suggesting bullish interest, overheating conditions and rising sell-side dominance indicate that selling pressure remains elevated. This combination suggests indecision among meme coin investors and limits the chances of a sustained recovery.

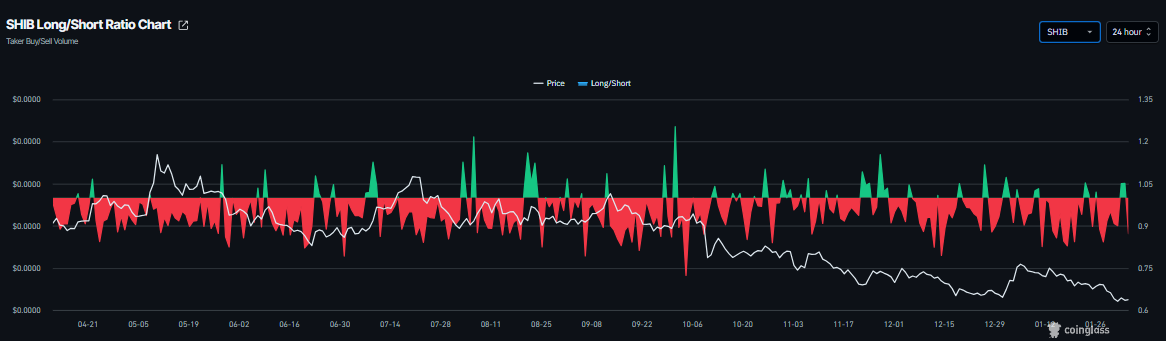

Similarly, the derivatives market is cautious. CoinGlass data shows SHIB’s funding rate flipped positive on Wednesday, currently at 0.0088%, indicating that long positions are paying shorts and hinting at bullish sentiment. However, the long-to-short ratio has slipped to 0.87 on the same period, signaling a rise in short bets. This divergence highlights growing uncertainty in the derivatives market and weakens bullish conviction.

Shiba Inu Price Forecast: SHIB extends losses below October 10 flash-crash low

Shiba Inu price corrected over 11% last week, slipping below the October 10 flash-crash low of $0.0000067 and reaching a level not seen since mid-June 2023. SHIB also closed below the weekly resistance at $0.0000068 and has faced resistance around this level. As of writing on Wednesday, the meme coin is trading at $0.0000067.

If SHIB continues its downward trend, it could extend the correction toward Saturday’s low of $0.0000061. A close below this level could extend the further losses toward the June 10, 2023, low of $0.0000054.

The Relative Strength Index (RSI) is at 35 on the daily chart, recovering slightly above oversold levels, hinting at a potential short-term bounce, though downside risks remain. The Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on January 17, which remains intact and thus further supports the negative outlook.

Traders should remain cautious as the primary trend for SHIB remains bearish, so any short-term recovery has a high probability of a dead-cat bounce — a brief price increase within a broader downtrend.

If SHIB recovers, it could extend the advance toward the 50-day Exponential Moving Average (EMA) at $0.0000078.