Dow Jones Industrial Average brushes off fears as government funding deal inches forward

- The Dow Jones found room on the high side on Tuesday, climbing back above 47,500.

- Equities are grappling with a continued softening in the AI bull trade, but the Dow is soldiering higher.

- Expectations for an end to the ongoing government shutdown are bolstering investor confidence.

The Dow Jones Industrial Average (DJIA) found some room to move higher on Tuesday, despite a general malaise setting into other major stock indexes as the AI tech rally continues to sputter. The Dow has launched itself back toward the 48,000 region as investors bank on a resolution to temporarily fund the US government and resume the flow of critical labor and inflation data.

Investor hope for a government closure solution remains high

The US government has pivoted to finding the necessary votes to pass a temporary funding bill that will see federal services resume operations, at least through the end of January before the cycle of political standoffs and government services hostage-taking can begin again.

A near-term reopening of the federal government following what has become the longest US government shutdown in American history will bring a deluge of official labor and inflation figures, which are necessary datapoints for the Federal Reserve (Fed) to continue delivering the market’s much-desired interest rate cuts.

AI operational costs likely to run much higher than everyone thinks

Renowned bear speculator Michael Burry noted on X-nee-Twitter earlier this week that most of the growth expectations surrounding the ongoing AI tech rally may be built on faulty accounting. According to the legendary investor, AI “hyperscalers”, or companies that provide compute power and rent data access to AI projects, are intentionally understating the depreciation costs of constantly upcycling data warehouse infrastructure to meet ever-growing data-crunching demand. According to Burry, the bulk of the investment cash being sunk into the AI space will continue to be burned at a faster-than-expected rate as AI demand chews through data infrastructure, and tech providers are overstating their future income expectations by drastically understating their equipment replacement costs.

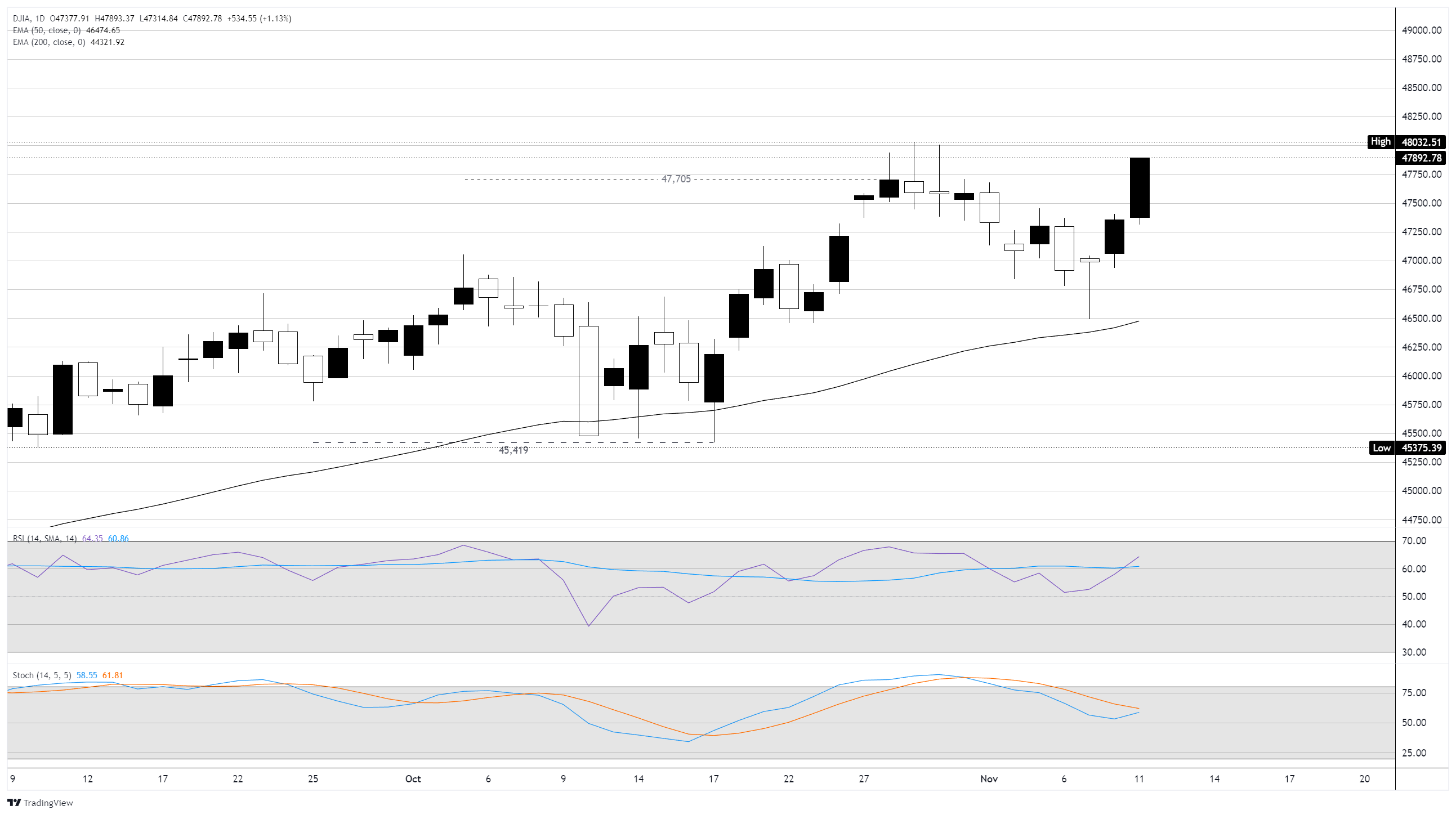

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.