Crypto market cap flirts with new ATH as Bitcoin dominance declines, altcoin season heats up

- Crypto market capitalization reached a record high of $3.80 trillion on Monday.

- The Bitcoin dominance falls below 63% while Ethereum’s crosses above 11%.

- Peter Brandt, a veteran analyst, says it's an altseason with a cup-and-handle pattern in sight.

The total cryptocurrency market capitalization has appreciated by over 15% so far in July, reaching a record high of $3.80 trillion this week on Monday. Bitcoin’s (BTC) rally to a new all-time high at $123,218 catalyzed the broader market recovery amid the regulatory push and political gridlock in the US.

Furthermore, Ethereum’s (ETH) rising dominance gradually erodes Bitcoin’s market share, indicating a growing risk appetite among investors. Peter Brandt, a veteran analyst, points to a cup-and-handle pattern in the total crypto market capitalization, excluding Bitcoin, that could signal the start of the next altcoin season.

Bitcoin dominance takes a hit as Ethereum and other altcoins rise

Bitcoin dominance (BTC.D) refers to the percentage value of Bitcoin market capitalization compared to the total cryptocurrency market. During the 2018 and 2022 altcoin seasons, the capital rotation from Bitcoin to altcoins triggered a massive decline in BTC.D.

At the time of writing, BTC.D holds the lion's share, at 62.89%, down from 66% on June 27. A weekly close below the 63.15% support level marked by the May 11 close, BTC.D could extend the declining trend to the 50-week Exponential Moving Average (EMA) at 60.90%.

BTC Dominance weekly chart.

On the other hand, Ethereum dominance (ETH.D) has surged to 11.02%, up from 9.04% on June 27, indicating an increase in ETH's strength relative to BTC. Adding credence to this, the ETH/BTC chart displays Ether appreciating 16% so far this week against Bitcoin.

ETH/BTC weekly chart.

The loading altcoin season forms a bullish setup

The total market capitalization reached a new all-time high of $3.80 trillion on Monday, as market sentiment improved. The CMC Fear and Greed Index, a sentiment gauge, reads 70, indicating a risk-on sentiment in the market.

CoinMarketCap Fear and Greed Index.

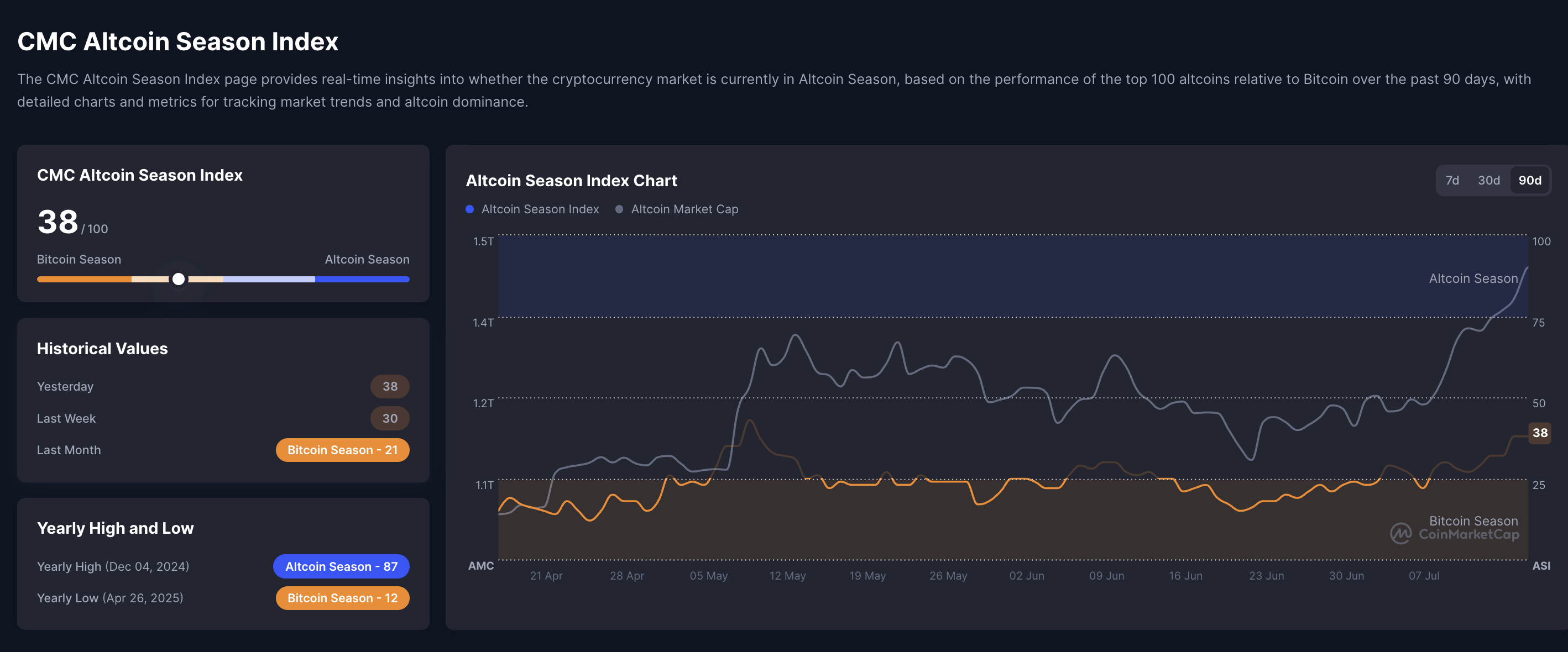

Alongside this, the CMC Altcoin Season Index stands at 38, compared to 23 on July 1, indicating a shift in capital from Bitcoin to altcoins. Typically, a value above 75 highlights an altcoin season.

CoinMarketCap Altcoin Season Index.

The capital rotation pumps have driven the total crypto market capitalization, excluding Bitcoin (TOTAL 2), by over 8% so far this week, to reach $1.41 trillion. Peter Brandt points to a cup-and-handle pattern rising in the TOTAL 2 weekly chart.

The analyst highlights the neckline at $1.70 trillion, which is close to the all-time high of $1.71 trillion reached during the 2021 altcoin season. A weekly close above this level could mark the beginning of a new altseason cycle.

In such a case, the market capitalization of altcoins could cross the $2 trillion milestone, driving the total market valuation beyond $4 trillion.