Strategy Grabs Another $472M In Bitcoin—Even With Price At ATH

Bitcoin has been exploring new all-time highs (ATHs) recently, but Strategy still seems to be in accumulation mode as it has announced another large purchase.

Strategy Has Bought 4,225 Bitcoin In Latest Acquisition

As announced by Strategy Chairman Michael Saylor in an X post, the company has made a fresh Bitcoin acquisition, continuing its chain of 2025 buys. With the latest purchase, the firm has added 4,225 BTC to its holdings.

According to the US Securities and Exchange Commission (SEC) filing, the buy occurred between July 7th and July 13th, and involved an average BTC cost basis of $111,827. This means the 4,225 tokens were acquired for about $472.5 million.

In the same period as the acquisition, BTC witnessed a breakout to new ATHs. If the purchase is to go by, it seems Strategy is still interested in buying even at these high prices. “Short Bitcoin if you hate money,” said Saylor in an earlier X post.

After the latest buy, the total holding of the firm has hit 601,550 BTC. The company spent around $42.87 billion to assemble this stack and today, its value stands at $72.25 billion, implying a significant profit of 68.5%.

Earlier in the day, another Bitcoin treasury company added to its holdings: Metaplanet. According to the X post by CEO Simon Gerovich, the company has added 797 BTC to its reserve, taking the total to 16,352 BTC. Unlike Strategy, though, the firm’s average coin cost basis is on the higher side, standing at $100,191 right now.

In some other news, while the big players in the market have been buying BTC for a while now, data from the on-chain analytics firm Glassnode suggests retail investors have finally joined in.

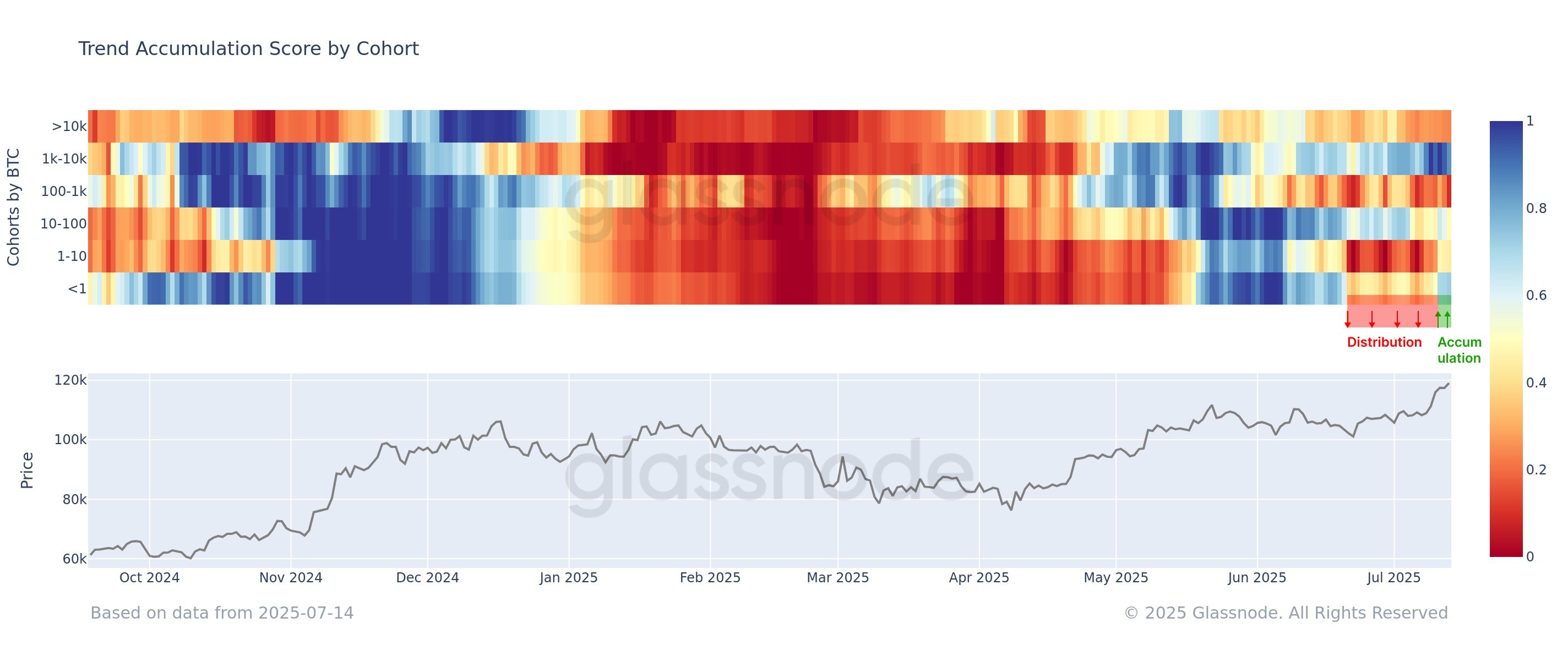

In the chart, the data of the Accumulation Trend Score is shown for the different segments of the Bitcoin userbase. The “Accumulation Trend Score” is an indicator that tells us about whether the BTC investors are accumulating or distributing.

From the graph, it’s visible that the score has recently been pretty close to 1 for the 1,000 to 10,000 BTC cohort. This means that these large hands, popularly known as the whales, have been showing a near-perfect accumulation trend. The latest rally in the cryptocurrency may be a product of this conviction.

While the whales have been buying, the rest of the Bitcoin market has been showing behavior that tends more toward distribution. The mega whales, carrying more than 10,000 BTC, have remained in selling mode with an Accumulation Trend Score around 0.3.

Until recently, the hands with less than 1 BTC, the retail, were in a phase of distribution, but it seems the latest rally has caused them to change their tune, as they have started buying.

BTC Price

Bitcoin went up to $123,000 earlier, but it seems the asset has since seen a setback as its price is down to $119,900.