3 US Crypto Stocks to Watch Today

Crypto US stocks are showing renewed strength, with Circle (CRCL), Coinbase (COIN), and Robinhood (HOOD) all posting notable developments. CRCL is up over 18% today and 404% since its IPO, fueled by surging USDC adoption and cross-chain growth.

COIN is gaining momentum after new product launches and regulatory progress in Europe, while HOOD continues to trend near all-time highs with a 102% gain year-to-date. With each company approaching key technical levels, investors are closely watching to see if bullish momentum can hold.

Circle Internet Group (CRCL)

Circle continues expanding its stablecoin dominance on two key fronts: network integration and cross-chain growth. The company recently launched native USDC support on the XRP Ledger (XRPL), eliminating the need for bridges and allowing developers and institutions to leverage fast directly, low-cost USDC transactions on XRPL.

At the same time, Circle’s Cross-Chain Transfer Protocol (CCTP) hit a record $7.7 billion in stablecoin bridging volume in May—an 83% surge from April.

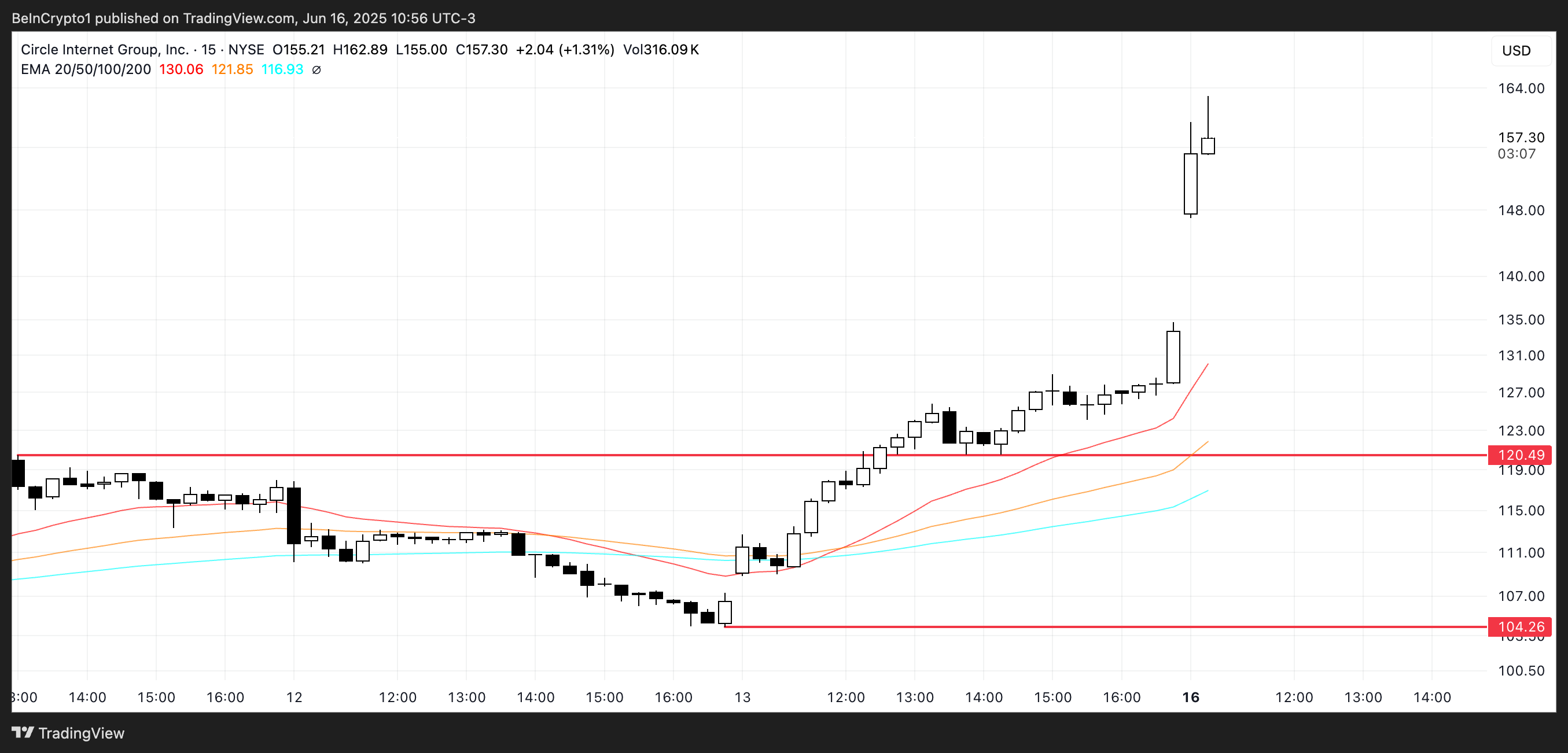

CRCL Price Analysis. Source: TradingView.

CRCL Price Analysis. Source: TradingView.

These developments come amid booming performance from Circle’s newly listed stock, CRCL, which opened today up more than 18%, pushing its post-IPO gains to an eye-catching 404%.

The company’s refusal of Ripple’s $5 billion acquisition offer, combined with its expanding institutional partnerships, has fueled bullish sentiment.

Currently trading around $158, some analysts have set a target price as high as $300, citing the firm’s strong positioning in the stablecoin space. However, if momentum stalls, CRCL’s nearest strong technical support lies near $120.

Coinbase Global (COIN)

Coinbase (COIN) is gaining renewed attention as it continues to strengthen both its product offerings and global regulatory presence.

In a major development, Coinbase partnered with Shopify and Stripe to enable USDC stablecoin payments on Shopify’s Base-integrated checkout system. This feature allows merchants to accept crypto payments without needing new infrastructure, offering settlement in either USDC or local fiat currencies.

At the same time, Coinbase is reportedly nearing approval for a full EU crypto license through Luxembourg—an important milestone under the MiCA framework—which would grant the exchange regulatory access across the European Union. T

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

COIN shares are up 2.7% at the time of writing, reflecting growing investor optimism. Following a 76% year-over-year revenue surge and recent product announcements during its State of Crypto Summit, analysts like Rosenblatt Securities continue to rate the stock a “Buy,” with a $300 target.

If Coinbase regains the bullish momentum seen earlier in May, it could soon challenge the $265 resistance level, with $277 as the next key upside target. However, momentum will need to hold, especially as trading volumes remain soft in the near term—something analysts see as a potential buying opportunity rather than a red flag.

Robinhood Markets (HOOD)

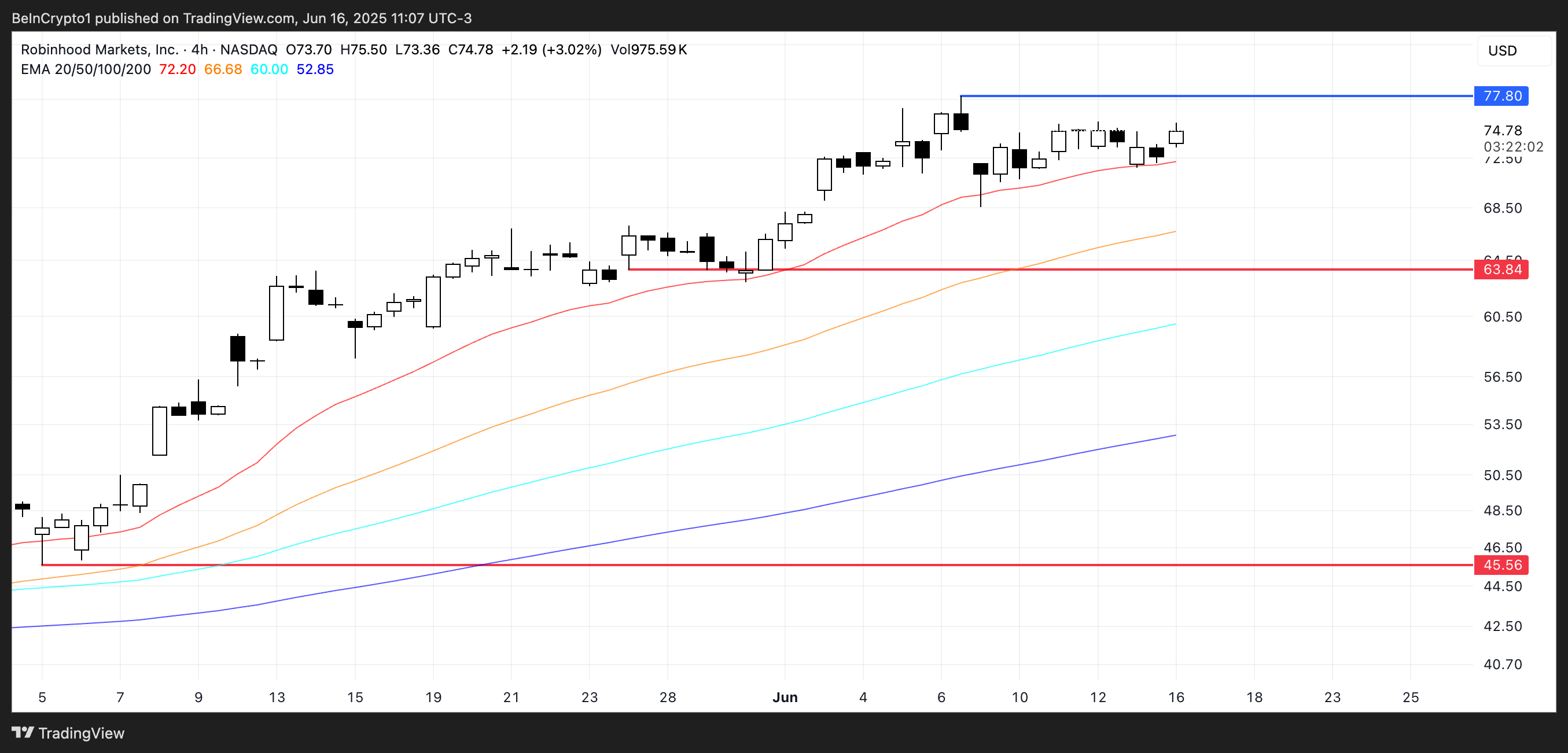

Robinhood (HOOD) continues to trade near its all-time high, with the stock up nearly 102% year-to-date—a standout performance in the fintech sector.

Its Exponential Moving Averages (EMAs) remain firmly bullish, with short-term averages well above the long-term ones, signaling strong underlying momentum.

If this trend holds, HOOD could soon test the resistance at $77.8, and a breakout above that level may open the path toward $80, marking a new all-time high and further validating the stock’s upward trajectory.

HOOD Price Analysis. Source: TradingView.

HOOD Price Analysis. Source: TradingView.

However, despite the bullish structure, investors should monitor key support levels closely.

The $63.84 support zone is critical—if broken, it would likely signal a loss of momentum and a potential trend reversal.

In that case, HOOD could decline sharply, with $45.56 as the next significant downside target.