Aptos trading volume hit 30-day peak after $65 million token unlock: How will APT price react?

- Aptos price recovers after plunging below $6 on Tuesday as markets reacted to a scheduled 65 million APT token unlock.

- APT trading volume rose to 30-day peaks above $374 million, signalling imminent volatility.

- Aptos funding interest remains at elevated positive values, despite the supply surge.

APT token faced high-volume volatility on Tuesday after a $65 million unlock, but derivatives traders remain net long despite losses.

Aptos markets hold steady amid $65M token unlock

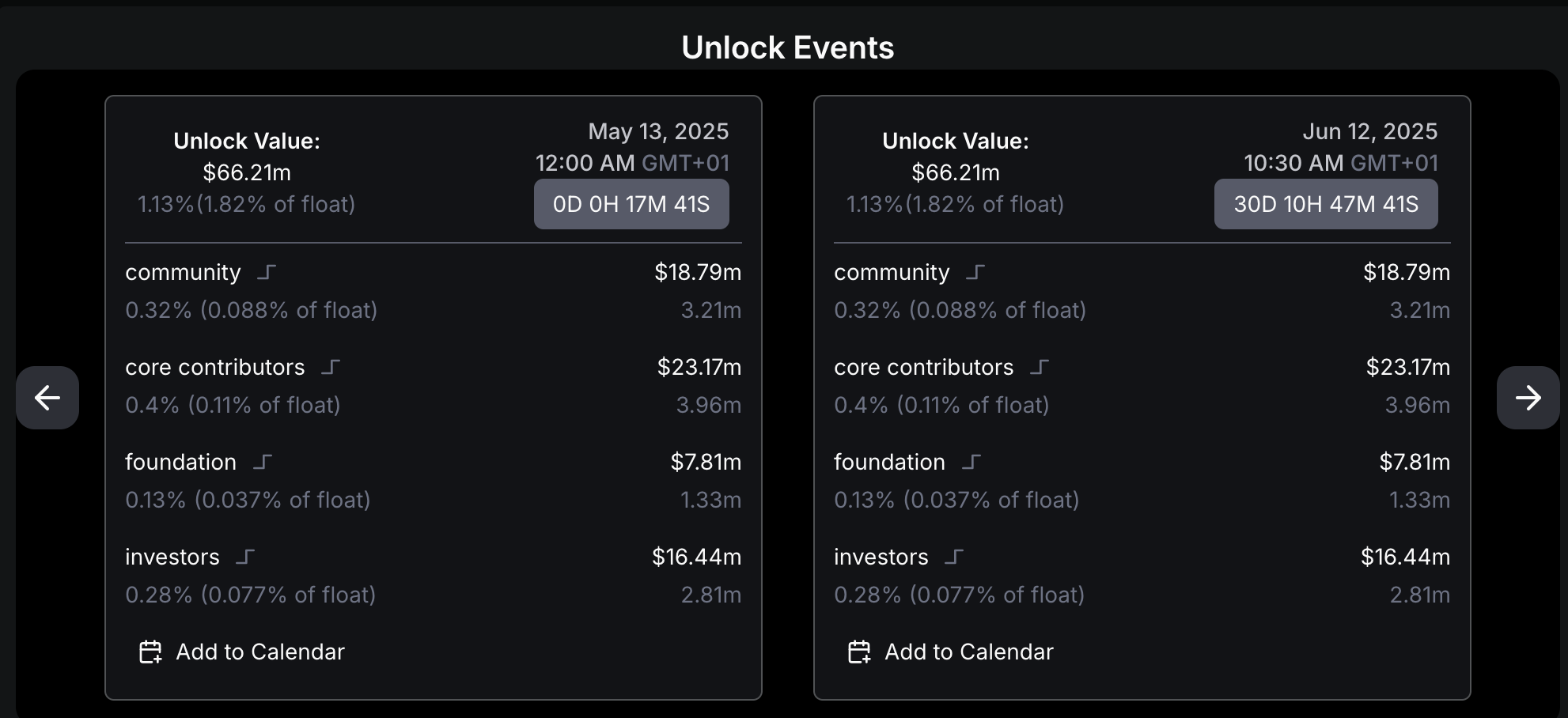

On Tuesday, Aptos executed a scheduled token unlock worth $64.97 million, releasing over 11 million APT into circulation. The breakdown shows distribution to four primary categories: community, core contributors, foundation, and investors.

- Community: 3.21 million APT ($18.44M)

- Core Contributors: 3.96 million APT ($22.74M)

- Foundation: 1.33 million APT ($7.66M)

- Investors: 2.81 million APT ($16.13M)

The release accounted for 1.13% of Aptos' total supply and 1.79% of its circulating float.

Aptos token unlock detail, May 12 2025 | Source: DeFiLlama

Historically, rising trading volume following token unlocks is a classic signal of rapid sell pressure from early holders seizing liquidity opportunities. That pattern appeared to hold, as APT briefly fell below the $6 support level.

Aptos price action, May 13, 2025 | APTUSDT (Binance)

The chart above shows that APT price initially plunged by 10%, trading as low as $5.5 during the hours that followed the $65 million unlock event. Still, markets didn’t entirely capitulate. Bitcoin’s continued rally appears to be anchoring broader sentiment, helping Aptos avoid deeper sell-offs. Notably, APT price has now rebounded above $6, erasing the initial retracement.

Derivatives market shows resilient bullish positioning

Despite the sharp increase in circulating supply and 10.5% dip in Aptos price post-unlock, derivatives markets tell a different story.

Data from Coinglass confirms that APT funding rates were firmly positive at +0.0076 on Tuesday.

This marks a significant reversal from the recent negative low of -0.0122 recorded on May 7.

-1747157950154.png)

Aptos (APT) Trading volume and Funding rate data, May 13, 2025 | Coinglass

The persistent positive funding rate means that traders holding long positions continue to pay a premium, signaling that speculative bullish sentiment remains strong. It suggests that rather than an outright exit, many participants are repositioning for a possible price recovery. This may explain why APT price has rebounded above the $6 mark at press time.

More so, the chart above shows the APT trading volume has hit 30-day peaks above $374 million on Tuesday, confirming that Aptos continues to attract buying pressure in the last 24 hours, neutralizing sell-side pressure from the token unlock event.

This bullish sentiment is likely being buoyed by macro tailwinds from positive US CPI data released on Tuesday. With Bitcoin’s steady consolidation above $100,000 serving as a stabilizing force for altcoins like Aptos, the price could be setting up for an early rebound.

What’s next for APT price?

APT price is consolidating near the $6 level as the market absorbs the newly unlocked supply. If funding rates hold and macro sentiment remains favorable, Aptos may avoid a deeper correction. However, a BTC price breakdown below $100,000 could undermine Aptos price recovery prospects.

Aptos technical analysis: APT eyes $6.50 rally if bulls can hold Mid-Keltner band

Aptos has returned to a positive trajectory following several red candles that aligned with its recent $65 million token unlock. The 12-hour chart reveals a compelling technical recovery.

After bottoming near the lower Keltner Channel boundary at $4.96, APT staged a swift rebound that now finds price consolidating above the midline of the channel, currently at $5.61.

This midline is acting as critical short-term support, and Aptos’ ability to hold above it could validate near-term bullish dominance seen in the derivatives markets.

Aptos technical analysis

Aptos price prediction now leans toward a retest of the upper Keltner band at $6.26, which aligns with prior candle wicks suggesting thin resistance above.

More so, theMoving Average Convergence Divergence (MACD) histogram prints a second consecutive green bar above the zero line, suggesting that bullish momentum is rebuilding.

The MACD line itself is now above the signal line, albeit modestly, which technically confirms a crossover and signals a resumption of uptrend pressure.

However, the forecast remains contingent on holding above the $5.61 mid-Keltner zone. Multi-day closes below this level would invalidate short-term bullish projections and expose Aptos to a retest of the lower band near $5.00.