Retail Investors Choose XRP Over Bitcoin, Glassnode Data Reveals Major Shift

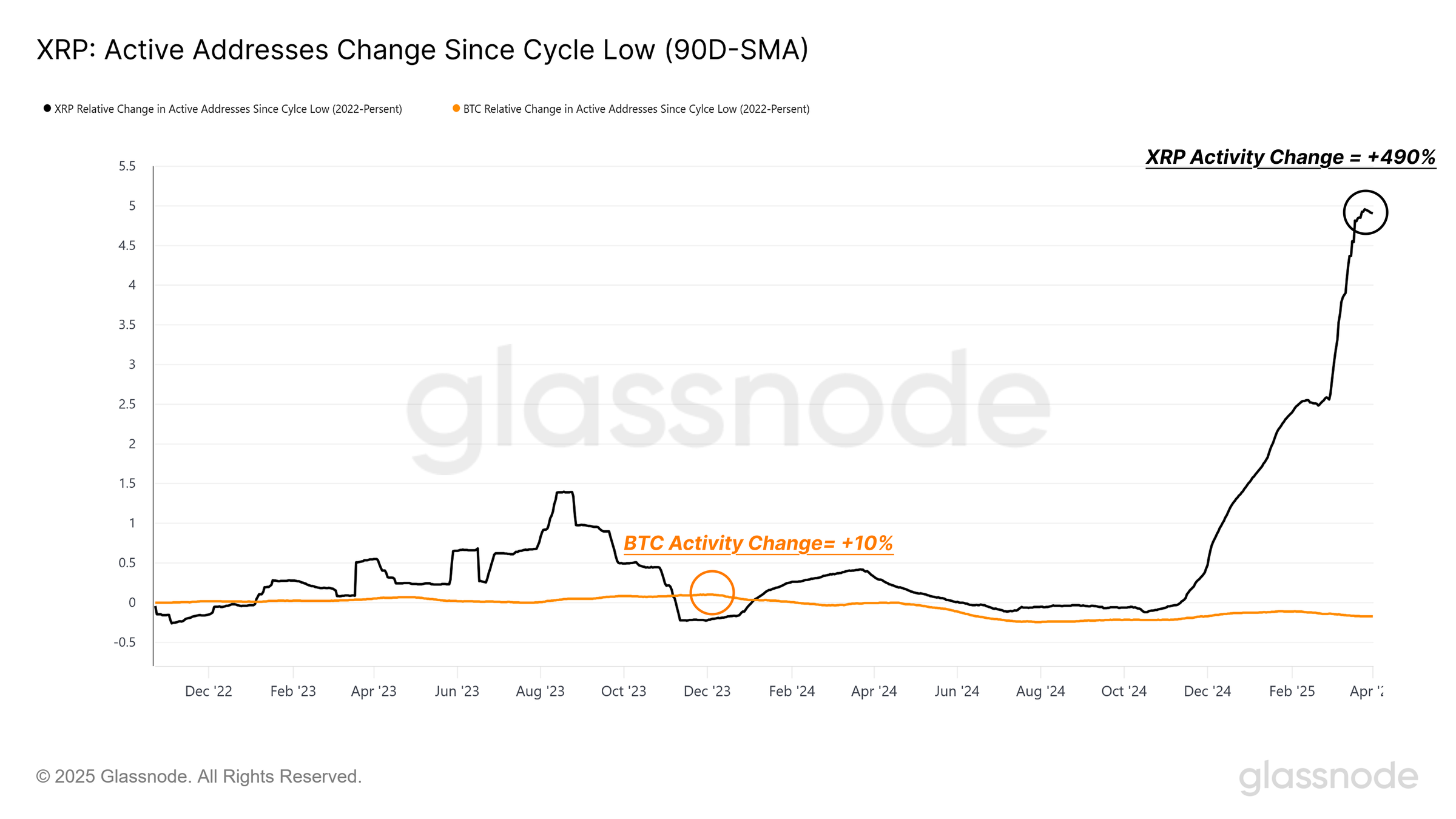

Retail investors are showing a growing preference for XRP (XRP) over Bitcoin (BTC), according to recent on-chain data from Glassnode. The data highlights a dramatic 490% surge in XRP’s quarterly average of daily active addresses. In comparison, Bitcoin only saw a modest 10% increase since the 2022 cycle low.

This sharp contrast suggests that speculative retail demand is fueling XRP’s resurgence. Meanwhile, Bitcoin’s rally remains predominantly institutional-led.

How Are Retail Investors Impacting XRP’s Growth Compared to Bitcoin?

In their latest newsletter, Glassnode highlighted the differing paths of these two major cryptocurrencies. Despite both assets achieving similar price gains—roughly 5x to 6x from their 2022 cycle lows—their trajectories reveal distinct investor behaviors.

“Since the 2022 cycle low, the quarterly average of daily active addresses for XRP has jumped by +490%, compared to just 10% for Bitcoin. This stark contrast suggests that retail enthusiasm has been attracted by XRP, thus providing a mirror for speculative appetite in the crypto space,” the newsletter read.

XRP vs. Bitcoin Active Addresses Growth. Source: Glassnode

XRP vs. Bitcoin Active Addresses Growth. Source: Glassnode

According to Glassnode, Bitcoin’s growth has been steady. Meanwhile, the launch of spot ETFs or the US elections triggered a period of significant upward movement. In fact, Bitcoin hit an all-time high (ATH) just before President Trump’s inauguration.

Contrarily, Glassnode noted that XRP’s rally has been characterized by a sudden breakout from December 2024, driven by retail speculation.

“During this recent surge, XRP’s realized cap nearly doubled from $30.1 billion to $64.2 billion, reflecting a substantial inflow of capital,” Glassnode added.

Nevertheless, the surge also raises some cautionary signals, as it appears to be driven more by recent investments than by long-term, sustained demand. Glassnode observed a rapid concentration of wealth among new investors, with those entering the market in the past six months accounting for nearly half—around $30 billion—of this surge.

XRP Realized Cap Dominated by Newer Addresses. Source: Glassnode

XRP Realized Cap Dominated by Newer Addresses. Source: Glassnode

Moreover, the share of XRP’s realized cap held by addresses younger than six months rose from 23% to 62.8% in a short period. Further insights from Google Trends data revealed that interest in XRP is predominantly concentrated in Europe and the United States, with significantly less search activity in Asia and Africa.

This geographic disparity suggested that XRP’s retail-driven surge may be tied to specific market dynamics in Western regions, potentially influenced by regulatory clarity or community-driven hype.

“When viewed together with the heavy retail participation, this sharp uplift in new holders raises caution signs, where many investors are likely to be vulnerable to downside volatility, given their now elevated cost basis,” Glassnode remarked.

While XRP’s retail appeal is evident, the sustainability of its rally remains uncertain. Glassnode’s report indicates that the capital inflow has slowed since late February 2025, hinting at a cooling of retail speculation.

Moreover, the Realized Loss/Profit Ratio has been steadily decreasing since January 2025. This suggested that investors are seeing fewer profits and facing larger losses.

“Given the retail-dominated inflows and largely concentrated wealth in relatively new hands, this alludes to a condition where retail investor confidence in XRP may be slipping, and this may also be extended across the broader market,” the newsletter highlighted.

Therefore, Glassnode cautioned that the XRP demand may have already peaked. The firm recommended exercising caution until more definitive signs of recovery appear.