Dogecoin (DOGE) Down 12% In One Week as Indicators Show Potential Recovery

Dogecoin (DOGE) continues to face significant selling pressure, with the popular meme coin shedding more than 12% of its value over the past seven days.

Technical indicators paint a complex picture as the Ichimoku Cloud shows early signs of a potential momentum shift despite bearish EMA alignments. The BBTrend indicator’s recovery from extreme negative values suggests the downward move may be approaching exhaustion even as price action remains vulnerable.

Dogecoin Ichimoku Cloud Shows A Potential Shift In Momentum

The Dogecoin chart displays an Ichimoku Cloud setup that reflects recent volatility and shifting momentum.

The price action initially shows a pronounced downtrend from late March, as indicated by the price bars trading well below the cloud. The blue line (Conversion Line) crosses below the red line (Base Line), signaling bearish momentum.

The cloud itself transitions from thick to thin before appearing to shift color, indicating a changing market structure.

DOGE Ichimoku Cloud. Source: TradingView.

DOGE Ichimoku Cloud. Source: TradingView.

More recently, there appears to be a potential reversal forming as the price action begins testing the lower boundary of the cloud while the Conversion Line has started curving upward toward the Base Line.

This suggests increasing buying pressure, though the price remains in a contested zone. The green line (Leading Span A) and red shaded areas show that market sentiment remains cautious, with the cloud formation ahead suggesting continued uncertainty in the immediate future.

Traders might watch for the blue line to cross above the red line and for price to penetrate and maintain position above the cloud as potential confirmation of a more sustainable bullish shift.

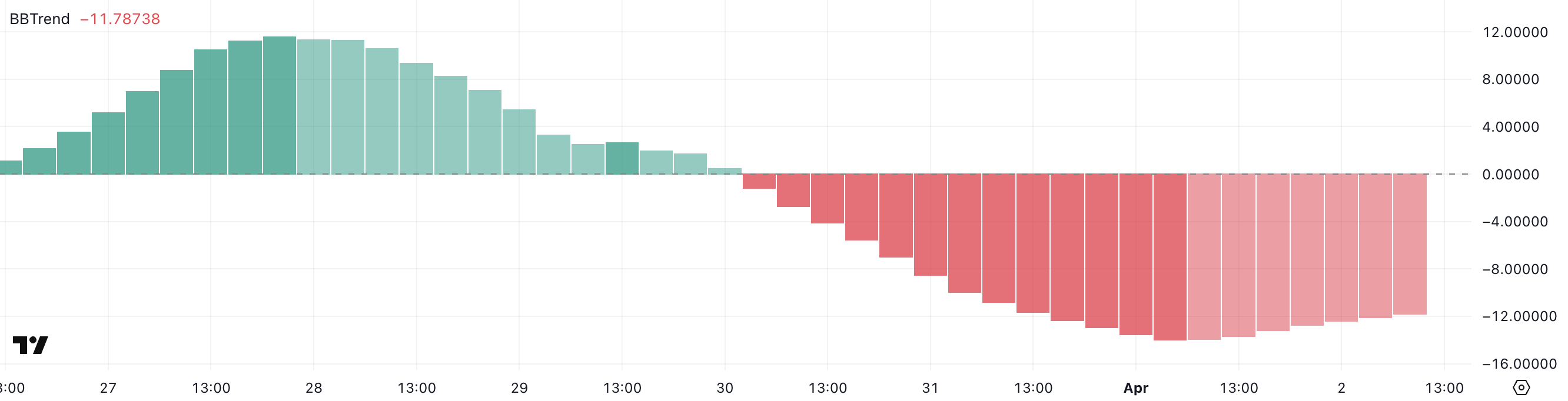

DOGE BBTrend Is Still Very Negative, But Recovering

The BBTrend indicator for Dogecoin currently sits at -11.78, improving from yesterday’s more extreme reading of -13.96 yet remaining firmly bearish.

This three-day negative streak with slight recovery suggests selling pressure may be easing, though the market maintains its downward bias as readings below -10 typically indicate strong bearish momentum.

DOGE BBTrend. Source: TradingView.

DOGE BBTrend. Source: TradingView.

With the indicator still below the significant -10 threshold but moving upward, Dogecoin likely faces continued downward pressure while potentially approaching oversold conditions.

This combination suggests DOGE might soon enter a technical bounce or consolidation phase, though traders would need to see the BBTrend rise decisively toward the neutral zone before considering the current bearish trend exhausted.

Will Dogecoin Rise To $0.20 Next?

Dogecoin’s EMA configuration remains bearish, with short-term exponential moving averages positioned below their long-term counterparts, indicating sustained downward momentum.

However, if this trend reverses and the shorter EMAs cross above the longer ones, Dogecoin price could challenge immediate resistance at $0.179, potentially opening pathways to higher targets should this level be breached.

DOGE Price Analysis. Source: TradingView.

DOGE Price Analysis. Source: TradingView.

Conversely, if bearish pressure persists, Dogecoin risks retesting the critical support level at $0.16, which has previously held firm.

A breakdown below this support would be technically significant and could accelerate selling pressure, potentially driving DOGE toward deeper support at $0.14, representing a substantial decline from current levels.