Mario Nawfal Accused of $7 Million Meme Coin Rug Pull with ROSS Token

Crypto entrepreneur Mario Nawfal faces allegations of orchestrating a meme coin rug pull involving the prominent streamer Adin Ross.

The controversy erupted after Nawfal’s X account, @RoundtableSpace, posted about a supposed partnership with Ross to launch a Solana-based token, ROSS. The post was swiftly deleted, raising suspicions of fraudulent activity.

Mario Nawfal Faces Allegations of Orchestrating $7 Million Rug Pull

On Tuesday, @RoundtableSpace announced the launch of ROSS, claiming that Adin Ross was backing the project. The tweet contained a contract address, seemingly legitimizing the meme coin. However, within 20 minutes, the post was deleted, triggering immediate skepticism within the crypto community.

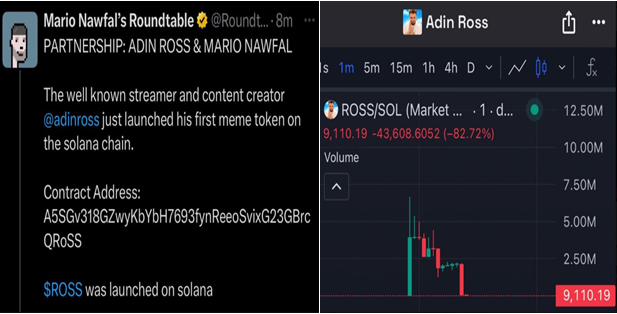

X (Twitter) user @cryptolyxe flagged the incident. The user accused Nawfal of faking a partnership with Ross to drive up the token’s value. Cryptolyxe provided screenshots showing the original tweet and a price chart depicting an 82.72% price crash, indicating a rug pull.

Nawfal and Adin Ross Rug Pull. Source: cryptolyxe on X

Nawfal and Adin Ross Rug Pull. Source: cryptolyxe on X

A rug pull is when early promoters artificially pump a token’s value before abandoning it, leaving investors with worthless assets. According to cryptolyxe, the token’s market cap soared to $7 million before plummeting to zero.

“So Mario Nawfal just posted a fake “partnership” with Adin Ross for a memecoin, then rugs the coin from $7m to 0, and deletes all the tweets… bruh,” cryptolyxe remarked.

In the aftermath, @RoundtableSpace issued a series of statements denying any wrongdoing. They claimed that an unauthorized individual from their team, @hardsnipe, was responsible for posting about the token without approval.

Nawfal’s team maintained that they acted quickly to delete the post and clarified that no official partnership with Adin Ross existed. Nawfal later alleged that his account had been compromised.

“Someone got access to both this account and Crypto Town Hall and posted a fake CA yesterday and today,” Nawfal indicated.

He further clarified that once the breach was discovered, delegate access was revoked. Reportedly, they also changed passwords to prevent further unauthorized posts.

Growing Concerns Over Meme Coin Rug Pulls

Despite Nawfal’s explanations, many in the crypto community remain unconvinced. Several users, including @nftkeano, pointed to Nawfal’s history of promoting dubious crypto projects, fueling doubts about whether this was an accident or a deliberate scam.

“This is literally your 3rd rug this month…,” Keano noted.

Adding to the controversy, Adin Ross’ team denied involvement with the token. Chat logs suggest internal confusion regarding Ross’ participation, reinforcing the claim that the partnership was never real.

While Nawfal’s team insists the ROSS meme coin post was a mistake caused by an unauthorized team member, the crypto community remains deeply skeptical. The quick deletion of the tweet and the sudden collapse of the token’s value raise questions. Nawfal’s history of controversies also does not bode well for his case, leaving many questioning the true nature of this event.

Whether this was a genuine mistake or an intentional scam, the incident reflects the ongoing risks in the crypto arena.

Three weeks ago, rumors circulated about the alleged sale of Kanye West’s X account. The supposed new owners used it to promote the Barkmeta meme coin, sparking fears of a meme coin rug pull.

The incident raised questions about celebrity involvement in crypto scams. Meanwhile, Barstool Sports founder Dave Portnoy faced backlash over accusations that he orchestrated a GREED rug pull.

After promoting the coin, Portnoy allegedly sold off a large portion of his holdings, leading to a price collapse that left investors at a loss.

Additionally, reports indicate that insiders behind the LIBRA meme coin have been linked to other controversial projects, including the MELANIA coin, which also faced rug pull allegations.

The growing trend of rug pulls highlights the risks investors face when buying tokens associated with high-profile figures or influencers.

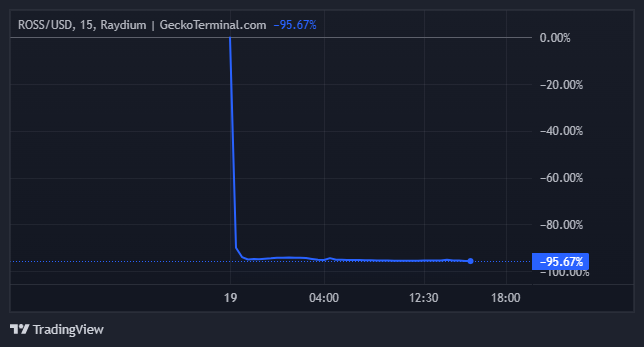

ROSS Price Performance. Source: GeckoTerminal

ROSS Price Performance. Source: GeckoTerminal

Data on GeckoTerminal shows that ROSS has been down by over 95% in the last 24 hours and is trading around its floor price.