Crypto Today: Bitcoin, Ethereum, XRP tick up despite macro uncertainty, retail exodus

- Bitcoin rises above $76,000 following an extended decline to $72,946 the previous day as Fed-related headlines keep investors on edge.

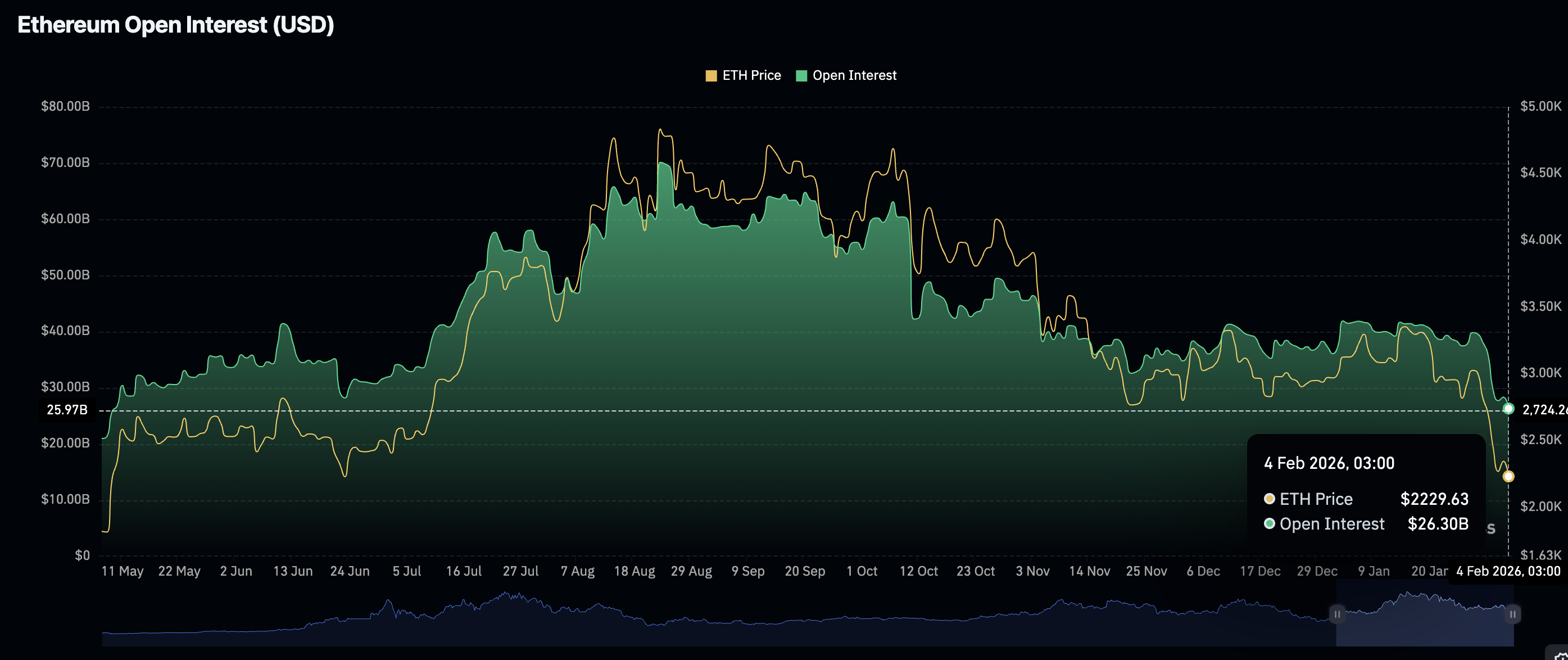

- Ethereum advances toward the $2,300 hurdle amid low retail interest, with futures Open Interest falling to $26.3 billion.

- XRP edges up above $1.60 as the RSI lifts within oversold territory, hinting at bearish exhaustion.

Bitcoin (BTC) is advancing above $76,000 at the time of writing on Wednesday, following a sharp correction to $72,946 the previous day, amid macro uncertainty across the crypto market.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are also posting subtle gains after extending their downtrend on Tuesday as retail investors retreated into the sidelines. Heightened volatility saw futures Open Interest (OI) drop further, adding to the selling pressure.

Fed reforms trigger macro uncertainty as crypto prices wobble

Global markets continue to face macroeconomic uncertainty amid Federal Reserve (Fed) reforms. Right after the United States (US) central bank maintained its target interest rate in the 3.50%-3.75% range on January 28, president Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the next Fed Chair.

Market participants are reassessing Warsh’s previous hawkish stance as Fed governor, which is resulting in instability and a sharp sell-off across precious metals such as Gold and Silver, as well as digital assets.

Kaiko Research stated amid recovery in Gold and Silver prices that “The reversal came as markets reassessed the Warsh nomination. While initial reactions focused on hawkish policy, Warsh's reputation as a defender of Fed independence gradually reassured investors.”

Although Bitcoin shows short-term signals of a trend reversal above $76,000 and toward the $80,000 pivotal level, a K33 Research report suggests the crypto market could be mimicking the price action seen in the 2028 and 2022 selloffs.

“Despite stronger institutional and regulatory tailwinds, including $55 billion in inflows into regulated products, expanding advisor access, and banks launching crypto services amid an easing rate backdrop, market psychology and profit-taking have reinforced steady selling pressure,” K33 Research stated in the report released on Tuesday.

Meanwhile, Bitcoin faces an extended drawdown in the derivatives market. The futures Open Interest (OI) has, for the first time since April, fallen to $50.5 billion on Wednesday, confirming the lack of retail confidence in Bitcoin’s ability to sustain an uptrend in the short to medium term. The OI averaged at $52.4 billion on Tuesday, significantly below the record $94.1 billion on October 7.

Ethereum is also facing an exodus of retail investors, who continue to reduce their risk exposure amid growing uncertainty. The drop in futures OI to $26.3 billion on Wednesday, from $28.3 billion the previous day, undermines Ethereum’s ability to advance from its recent low at $2,110. The OI hit a record $70.1 billion in August, reinforcing the need for steady retail demand to support the next recovery leg.

Similarly, XRP remains on the back foot as derivatives demand slows further to $2.6 billion on Wednesday, from $2.9 billion the previous day. The futures OI has not exceeded $5 billion since the October 10 crash, and remains significantly below the $10.9 billion record high reached on July 22.

Chart of the day: Bitcoin holds above support

Bitcoin is delicately holding short-term support at $76,000 as the Relative Strength Index (RSI) rises to 27 within oversold territory on the daily chart, indicating that while selling pressure is apparent, bears are overextended.

A daily close above the immediate support ($76,000) will likely strengthen a potential bullish outlook toward the $80,000 level. However, the Moving Average Convergence Divergence (MACD) indicator is extending below its signal line on the same chart, suggesting bearish momentum is increasing. Trading below $76,000 may accelerate the downtrend by 4% to Tuesday’s low of $72,946.

Altcoins technical outlook: Ethereum, XRP eye short-term rebound

Ethereum is advancing toward the $2,300 resistance at the time of writing on Wednesday, after testing support at $2,110 on Tuesday. A slight increase in the RSI to 27, within oversold territory on the daily chart, suggests a potential decrease in bearish momentum. Traders will watch for the RSI to rise toward the midline to confirm a steady price recovery targeting the next key hurdle at $2,400.

Meanwhile, the MACD indicator remains below the signal line on the same chart, as investors reconsider their risk positions. The red histogram bars appear to be fading, which may signal a bullish return in the near term.

As for XRP, bulls are holding onto support at $1.60 following a sharp correction to $1.53 on Tuesday. A reversal of the RSI above oversold territory at 30 on the daily chart indicates that bearish pressure may be slowly easing.

Holding support at $1.60 could signal stability and encourage investors to lean into risk, increasing the odds of a rebound to Monday’s high at $1.66.

Conversely, since the MACD indicator is below the signal line on the same chart, the path of least resistance may remain downward, increasing the odds of an extended correction to $1.50 – a support tested on Saturday.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.