Aster Price Forecast: ASTER extends recovery on Stage 6 buyback program

- Aster extends recovery on Wednesday, bringing its gains to over 5% so far this week.

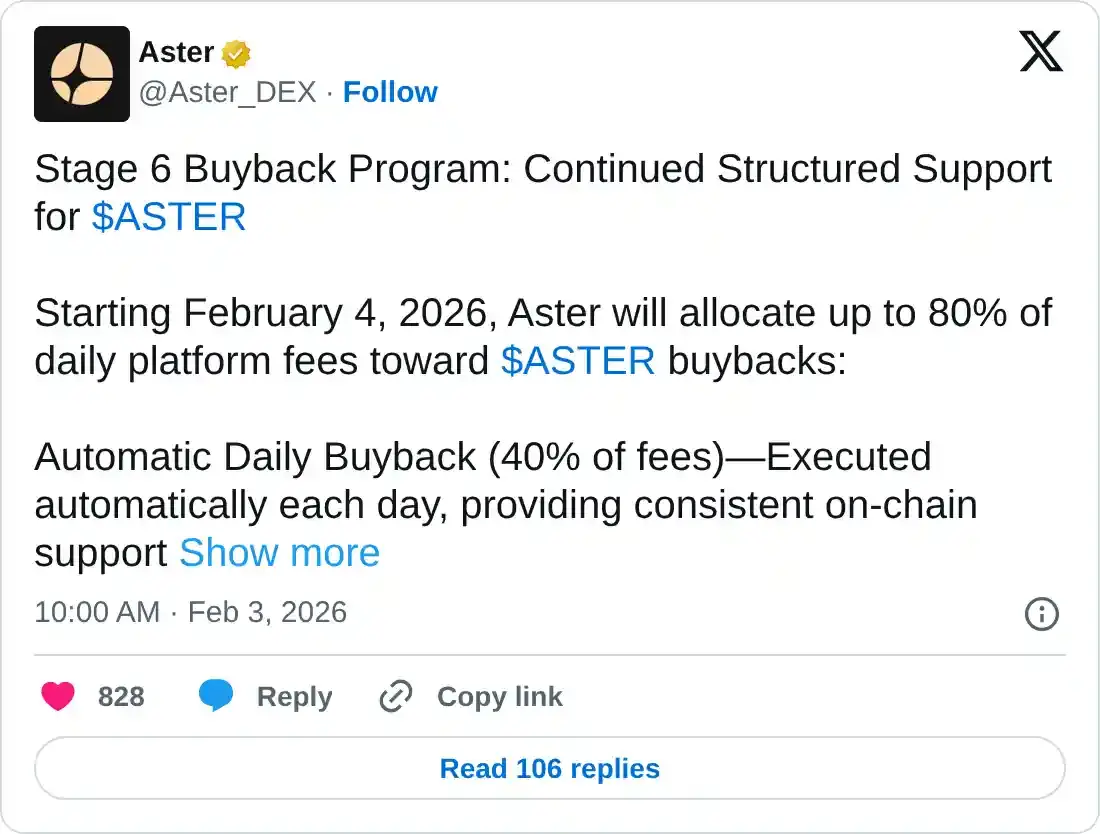

- Aster launches its Stage 6 buyback program, allocating up to 80% of daily fees.

- Derivatives data show a large capital outflow from ASTER futures Open Interest amid reduced bullish interest.

Aster (ASTER) trades in the green so far this week after bouncing off the $0.50 psychological level on Saturday. The decentralized exchange (DEX) specializing in perpetual and spot trading, backed by strategic investors like YZi Labs and connected to the BNB Chain ecosystem, launched its Stage 6 buyback program on Wednesday to reduce supply pressure. However, retail interest in Aster continues to decline, as evidenced by a reduction in Open Interest and a lower funding rate. Technically, ASTER’s outlook remains mixed as the short-term recovery builds on thin ice.

Retail demand weakens despite its new buyback program

Aster struggles to sustain retail interest amid growing competition from Hyperliquid, which recently expanded into the commodities market with HIP-3 and plans to enter the prediction market under the HIP-4 proposal. As a short-term measure to ease selling pressure, Aster launched the Stage 6 buyback program on Wednesday, the final trading airdrop, which allocates up to 80% of daily fees to the buyback, including the automatic daily buyback of 40% from daily fees.

Meanwhile, Leonard, the anonymous CEO of Aster, announced that the monthly 1% unlock will be paused until staking goes live, addressing community concerns about unlock pressure.

On the derivatives side, CoinGlass data show that ASTER futures Open Interest (OI) is down 5.21% over the last 24 hours to $280.55 million, indicating a lower outstanding contracts value. At the same time, the OI-weighted funding rate stands at 0.0026%, down from 0.0046% at its peak the previous day, suggesting that bullish interest has declined significantly.

Aster recovery at risk as momentum remains uncertain

Aster trades below the 50-period Exponential Moving Average (EMA) at $0.66 on the 4-hour price chart, suggesting a broader bearish bias. In the short term, ASTER forms an ascending expanding channel after the bearish breakout of a similar but larger pattern on the same chart.

The Moving Average Convergence Divergence (MACD) and signal line draw closer after an uptrend on the 4-hour chart, while the positive histogram contracts, suggesting an easing of short-term bullish momentum.

At the same time, the Relative Strength Index (RSI) at 48 approaches the neutral, midline, implying a consolidative tone to the minor recovery.

If ASTER breaks the support trendline connecting the Saturday and Sunday lows near $0.55, it could extend a lower leg to the S1 Pivot Point at $0.45.

On the upside, the short-term ascending trendline near $0.60, followed by the 200-period EMA at $0.66, coinciding with the R1 Pivot Point, could cap the recovery.