Axie Infinity Price Forecast: AXS rallies as bAXS token reveal boosts retail demand

- Axie Infinity rises 3% on Tuesday after Monday’s 21% rebound, setting a potential bullish tone for the week.

- The announcement of an app token version of AXS called bAXS for ecosystem and gameplay rewards renewed demand for Axie Infinity.

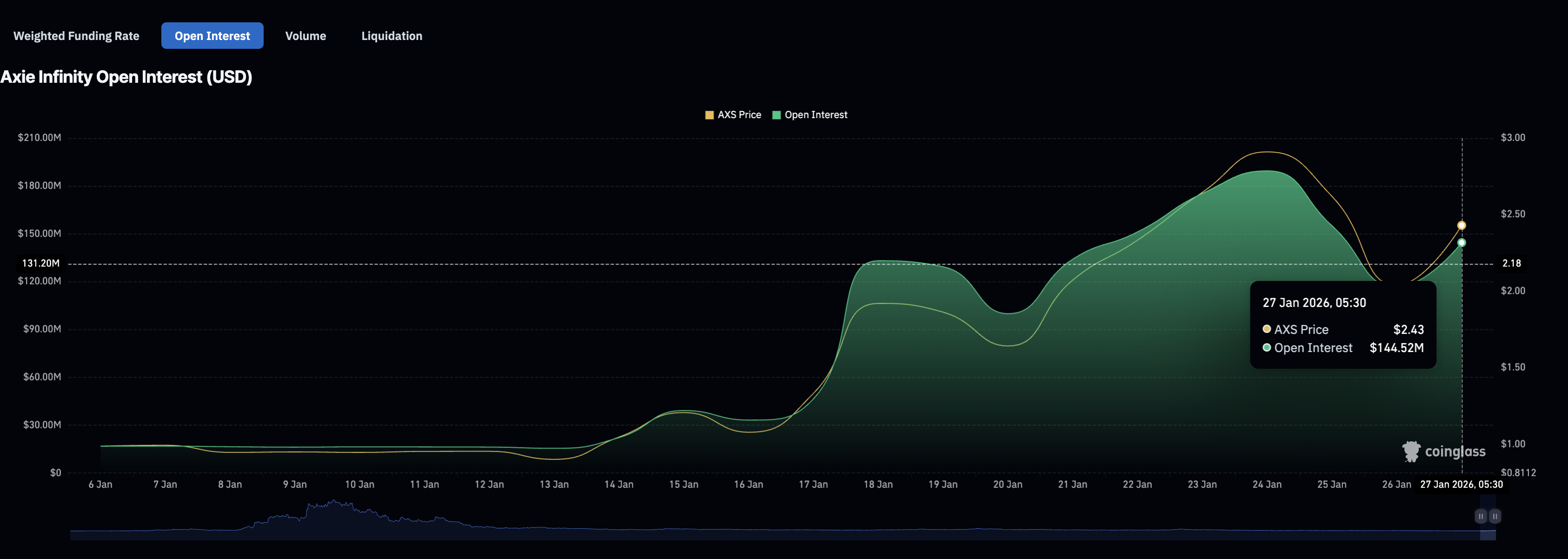

- Axie Infinity regains retail strength as futures Open Interest surges to $144 million from under $14 million on January 1.

Axie Infinity is up 3% at press time on Tuesday, extending the 21% gains from Monday and a bullish start to the week. The gaming token regains retail demand following the announcement of its app token, bAXS, to replace the AXS token across the ecosystem and gameplay rewards. This surge in retail demand pumps the AXS futures Open Interest to a three-year high.

Axie Infinity’s bAXS token reveal renews retail demand

Axie Infinity’s founder, Jeffrey Zirlin, announced the transition of its ecosystem and gameplay rewards to an app token version of AXS, called bAXS. The new bAXS token will carry similar mechanics to AXS, with an introduced variable fee, paid to the treasury and charged to the seller of the token. These fees will be reduced for those with higher Axie scores and will help address in-game economic issues.

On the derivatives side, the launch of the new bAXS token renewed capital inflows into AXS futures, driving Open Interest to a peak of $189.52 million on Saturday, up from less than $14 million on January 1. At the time of writing, AXS OI stands at $144.52 million, holding levels last seen in May 2022. This surge in the notional value of outstanding AXS contracts reflects increased investor confidence in the gaming token.

Technical outlook: Will AXS rally cross above $3?

Axie Infinity holds above the 200-day Exponential Moving Average (EMA), which is sloping higher, while the 50-day EMA exceeds the 100-day, signaling an improving short-term bias.

AXS should clear the 78.6% Fibonacci level at $2.640, measured from the May 14 high of $3.707 to the December 17 low of $0.759, to put $3.707 back on the map.

Technical indicators on the daily chart corroborate a buy-side bias after the recent rally. The Moving Average Convergence Divergence (MACD) line is above the signal line and above zero, with a modestly positive histogram that suggests buyers retain momentum. The Relative Strength Index (RSI) at 65 is bullish and is shy of overbought territory.

In case of pullbacks, initial support aligns at the 200-day EMA at $1.807, with the 100-day at $1.468 and the 50-day at $1.501 underpinning the broader base.

(The technical analysis of this story was written with the help of an AI tool.)