Bitcoin Price Forecast: BTC steadies above $96,000 as ETF inflow surges, derivatives suggest further rally

- Bitcoin price holds above $96,000 on Thursday after hitting a nearly two-month high at $97,800 the previous day.

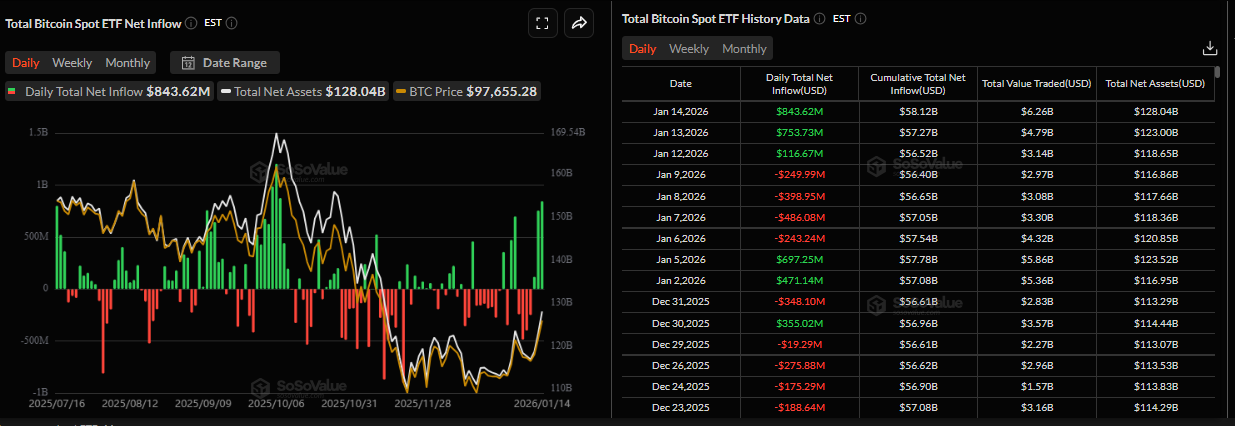

- US-listed spot ETFs recorded an inflow of $843.62 million on Wednesday, marking the third consecutive day of positive flows.

- Options market positioning suggests confidence, with traders expecting BTC above the $100K psychological level.

Bitcoin (BTC) price holds above $96,000 on Thursday after hitting a nearly two-month high at $97,800 the previous day. The bullish price action in BTC is further supported by rising institutional demand, as evidenced by three consecutive days of inflows into spot Exchange-Traded Funds (ETFs) this week. In addition, the options market signals confidence among traders, which could push the Crypto King toward the $100,000 psychological level.

Institutional demand rises

Institutional demand has continued to strengthen so far this week. SoSoValue data show that Bitcoin spot ETFs recorded $843.62 million in inflows on Wednesday, the highest single-day inflow since October 6, marking the third consecutive day of positive flows. If this inflow continues, BTC could extend its ongoing rally.

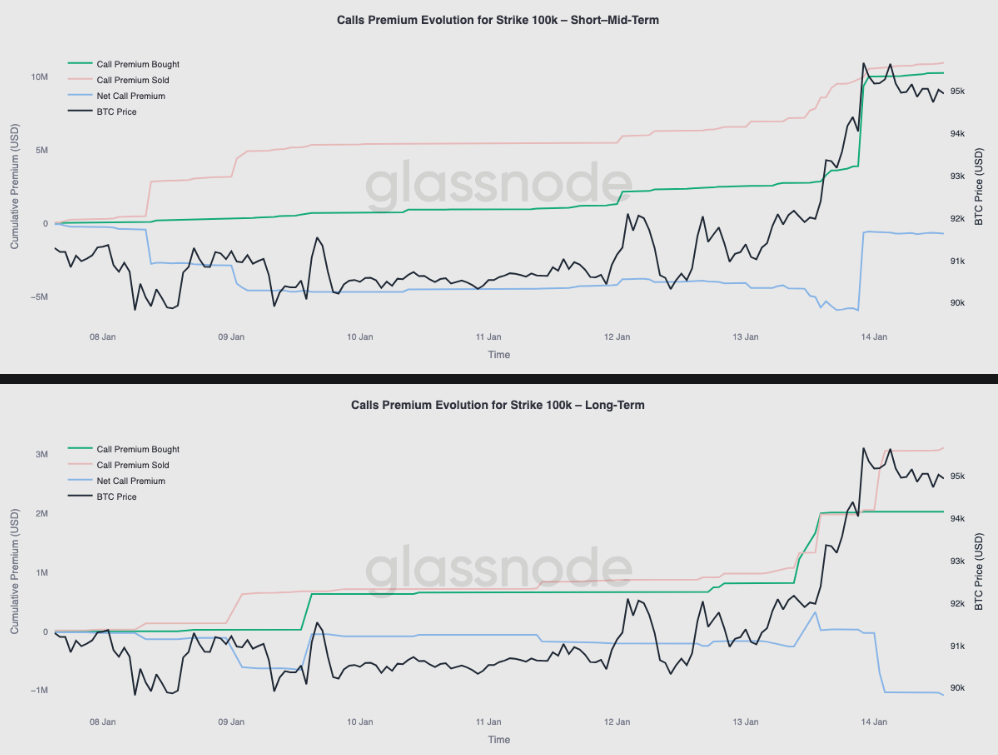

Option market suggests a bullish bias

The Glassnode chart below shows that option flows around the $100K strike, indicating that traders are buying more call options than they are selling. This pushes call premiums higher, showing strong demand for near-term upside exposure.

However, for longer maturities, it shows the opposite behavior. As spot rallied, richer call premiums further out the curve were used as opportunities to sell upside.

This split suggests the market is positioning for a potential retest of the 100K area, while simultaneously expressing hesitation about sustained acceptance above that level over longer horizons.

Bitcoin Price Forecast: Bulls target $100,000 mark

Bitcoin price found support around a previously broken upper consolidation zone at $90,000 on January 8 and recovered slightly through Monday. On Tuesday, BTC rose more than 4% and closed above the 61.8% Fibonacci retracement level (from the April low of $74,508 to October’s all-time high of $126,199) at $94,253. BTC continued its surge the next day, hitting a nearly two-month high at the $97,800. As of Thursday, BTC is trading at around $96,800.

If BTC continues its rally, it could extend the surge toward the key psychological $100,000 level.

The Relative Strength Index (RSI) on the daily chart is 69, nearing the overbought level of 70, indicating strong bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover that remains intact, with rising green histogram bars above the neutral level, further supporting the positive outlook.

On the other hand, if BTC faces a correction, it could extend the decline toward the key support at $94,253.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.