Privacy tokens Monero and Dash surge as XMR hits all-time high

- Monero extended its gains to 7% over the past 24 hours, climbing into the top 20 among the largest cryptos by market cap.

- Increased FOMO could prove risky as XMR sees a rejection near $700.

- DASH skyrocketed by more than 30% but faces resistance near $70.

Monero (XMR) continued its bullish run on Tuesday as it surged to a new all-time high of $692. The token is up nearly 10% over the past 24 hours, stretching its weekly gains above 50%.

Monero has now climbed into the top 20 cryptocurrencies category, ranking at #15, with a market capitalization of $12.2 billion at publication time.

Following the privacy token's surge over the past week, crypto analytics platform Santiment warned that the rising FOMO surrounding Monero could be risky. The platform noted that XMR's social dominance peaked on Sunday, while development activity has declined.

"If you are looking for an entry point, consider doing so after social hype and FOMO wears off slightly," wrote Santiment in an X post on Monday.

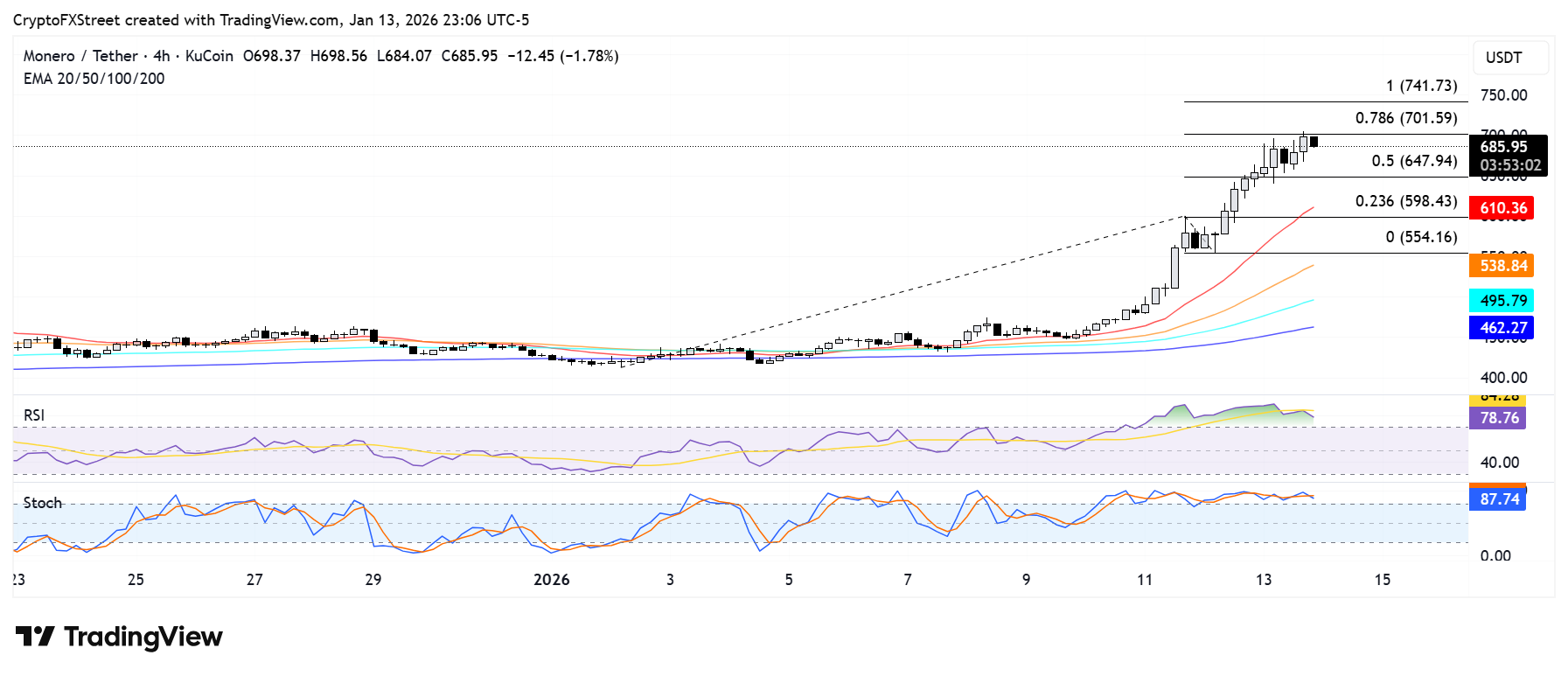

XMR saw a rejection near the 78.6% Fibonacci extension level at $701. A rise above $701 could push the privacy token toward the 100% Fib level at $741.

On the downside, XMR could find support at the 23.6% Fib level near $600.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in overbought territory, signaling heightened bullish momentum. Overbought conditions in the RSI and Stoch often lead to a short-term correction, as evidenced by XMR's recent moves.

DASH jumps 30%, faces resistance near $70

The rise isn't limited to XMR as several other privacy tokens also saw an uptrend.

DASH is up about 30% over the past 24 hours, leaping out of a downtrend that began on November 5. Social mentions around the token have risen by over 30%, according to LunarCrush data. The token faces resistance near $70 after flipping its Exponential Moving Averages (EMAs).

On the downside, DASH could find support around $55.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are approaching their overbought levels, indicating strong bullish momentum.