Bitcoin Price Forecast: BTC struggles amid ETF outflows, bearish futures data

- Bitcoin struggles to clear the 50-day EMA, dropping below $91,000 from a high of $92,519 earlier on Monday.

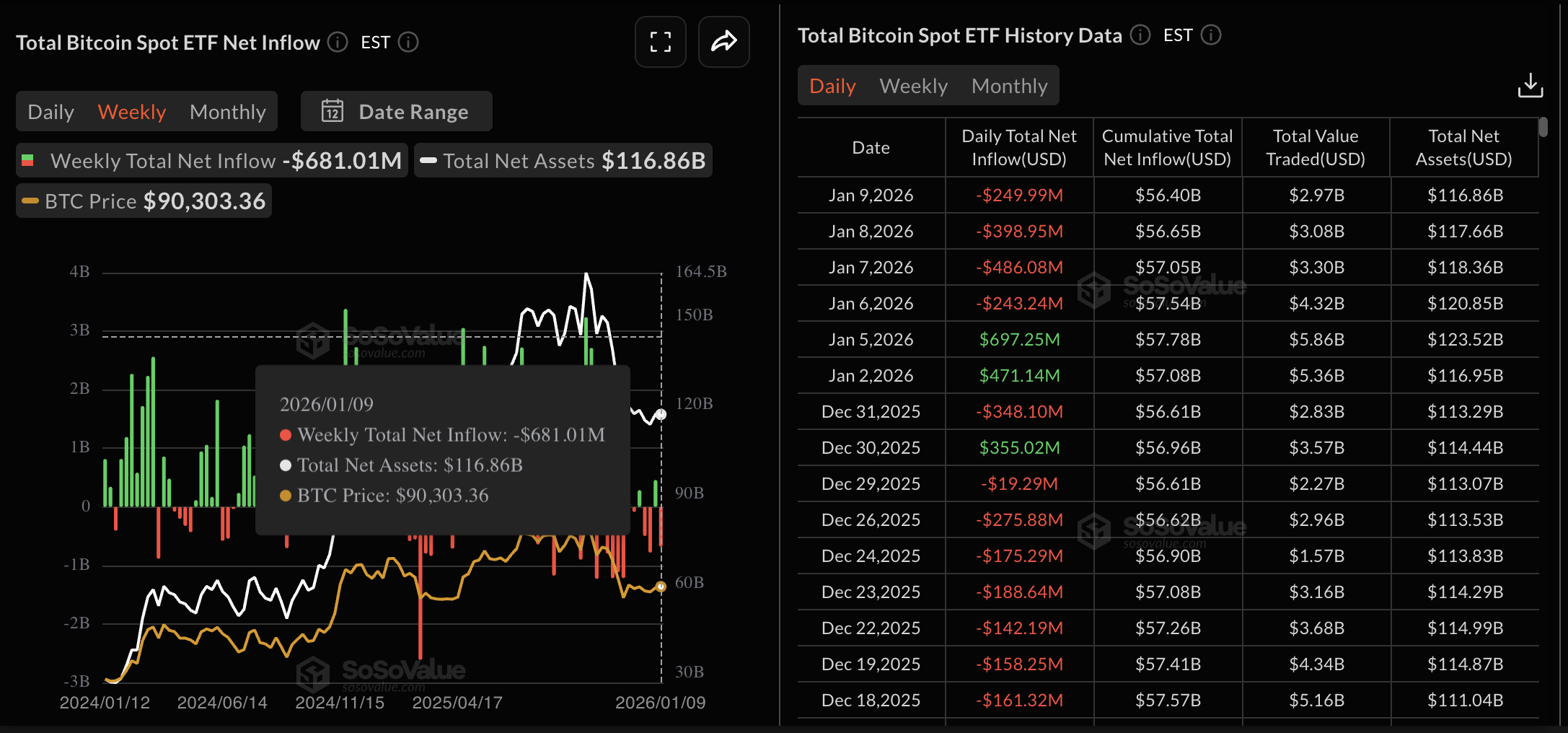

- The US spot Bitcoin ETFs are facing outflows, recording roughly $680 million in withdrawals last week.

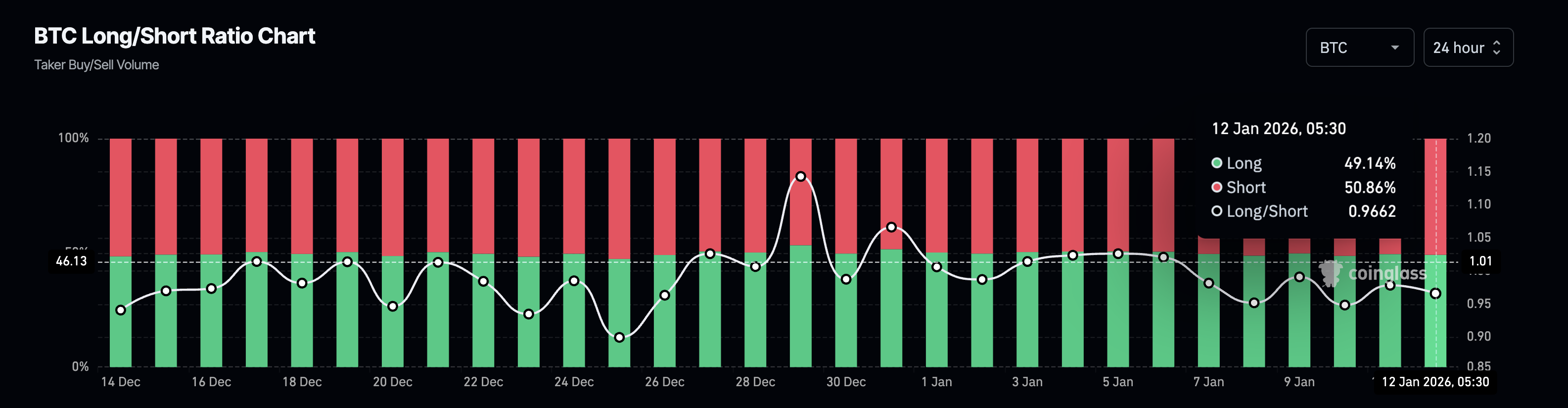

- Derivatives data suggest bearish bias among active long and short BTC futures positions.

Bitcoin (BTC) is trading below $91,000 at press time on Monday, struggling to hold above the 50-day Exponential Moving Average (EMA) at $91,548. A steady outflow from US spot Bitcoin Exchange Traded Funds (ETFs) reflects weakened institutional demand, risking a decline in market sentiment. Meanwhile, the derivatives market witnesses a selling bias with a greater number of active short positions.

Bitcoin remains under bearish pressure ahead of the December US CPI data

Bitcoin remains under pressure amid geopolitical tensions between the US and other countries, including Venezuela and Greenland, the US Supreme Court’s next ruling on tariffs coming on Wednesday, and US President Donald Trump’s call for a 10% cap on credit card interest rates.

A steady outflow from BTC-focused ETFs reflects weakened institutional support. Sosovalue shows that the Bitcoin spot ETFs recorded an outflow of $681.01 million last week, with four consecutive days of offloading.

On the derivatives side, the long-to-short ratio chart shows 50.86% of active bearish positions were opened in the last 24 hours, keeping the ratio at 0.9662.

However, the US Consumer Price Index (CPI) for December, scheduled for release on Tuesday, could ease pressure on Bitcoin. Wells Fargo's research team anticipates the core CPI to be around 2.8%, after the surprisingly soft November CPI report due to the longest-ever US government shutdown, as previously shared by FXStreet.

As inflation inches closer to the US Fed's 2% target, the chances of an interest rate cut in early 2026 could increase. Typically, a rate cut diverts increased liquidity toward high-risk assets, such as Bitcoin.

Technical outlook: Will Bitcoin sustain above $90,000?

Bitcoin retraces below $91,000 at press time on Monday, after reaching a high of $92,519 earlier in the day. The pullback reflects strong overhead pressure and highlights the 50-day EMA at $91,548 as a crucial and immediate level of resistance.

For a sustained recovery, Bitcoin should secure a daily close above this moving average, which could extend the rally to $94,588 and align with the December 9 high.

However, the momentum indicators on the daily chart remain weak. The Relative Strength Index (RSI) at 51 stretches flat near the halfway line, indicating a lack of momentum.

At the same time, the Moving Average Convergence Divergence (MACD) converges with the signal line, flashing the risk of a crossover, which would confirm a fresh bearish cycle.

If BTC slips below $90,000, it could test the December 24 low at $86,420.