Top Crypto Losers: NIGHT, PUMP, TAO – Altcoins plunge just before the holidays

- Midnight trades near $0.07500 on Wednesday after a 24% decline on Tuesday.

- Pump.fun extends its decline by over 2% following the 9% drop the previous day, marking its third straight day in the red.

- Bittensor extends the breakdown of a consolidation range by over 1% after Tuesday's over 3% loss.

Midnight (NIGHT), Pump.fun (PUMP) and Bittensor (TAO) are leading losses over the last 24 hours as the broader cryptocurrency market declines. The altcoins under pressure risk further losses as the selling pressure rises just before the holidays.

Midnight in a free fall could fracture the local support trendline

Midnight is down over 3% at press time on Wednesday, extending the 24% decline from the previous day. The three consecutive days of losses for NIGHT since the $0.1200 peak on Sunday have resulted in a 33% loss so far this week.

On the 4-hour chart, Cardano’s privacy-focused sidechain risks breaking a local support trendline, connecting the December 16 and 18 lows, near $0.07500. A decisive close below this level could extend the decline toward the S1 Pivot Point at $0.07000, followed by the $0.05000 psychological support.

The technical indicators on the 4-hour timeframe signal a bearish bias, as the Relative Strength Index (RSI) at 39 inches is approaching the oversold zone. At the same time, the Moving Average Convergence Divergence (MACD) points downward after crossing below the signal line, accompanied by successively rising red histogram bars.

Looking up, a potential rebound from $0.07000 should surpass the 50-period Exponential Moving Average (EMA) at $0.07808.

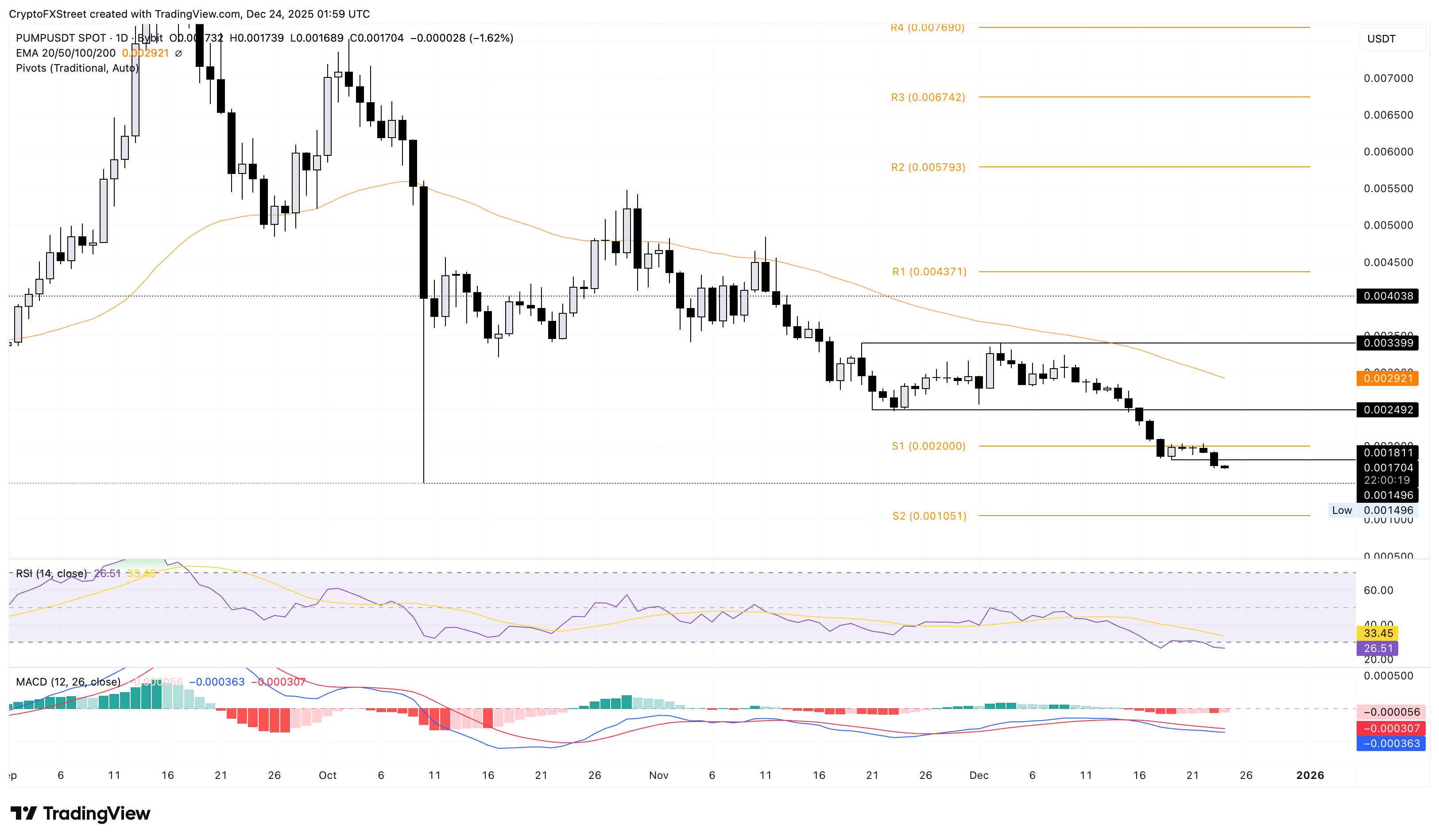

Pump.fun’s decline targets the $0.001000 level

Pump.fun extends its declining trend below the $0.002000 psychological level after a 3% drop on Monday. At the time of writing, PUMP is down 2% on Wednesday, marking its third straight day of losses.

The immediate support for the launch token lies at the October 10 low of $0.001496, followed by the S2 Pivot Point at $0.001051.

The RSI at 26 remains in the oversold zone, steadily moving sideways, indicating intense selling pressure. Meanwhile, the declining trend in the MACD and the signal line suggests bearish momentum.

To reinforce an upward trend, PUMP should reclaim the $0.002000 level.

Bittensor’s under pressure risks losing $200

Bittensor approaches the $200 psychological level after breaking below its short-term support at $215, aligning with Friday’s low. TAO risks losing the $200 level to test the S1 Pivot Point at $194.

If TAO slips below $194, it could extend the decline to the S2 Pivot Point at $167.

The RSI at 27 enters the oversold zone, reversing from near the halfway line last week, suggesting renewed selling pressure. Additionally, the MACD converges with the signal line, risking a crossover that could trigger a renewed bearish momentum.

If TAO bounces off the $200 mark, it could retest the declining 50-period EMA at $234.