BOJ Raises Interest Rates to 0.75%, But Bitcoin Stands Unshaken—Is the Crypto Calm a Warning or Opportunity?

The Bank of Japan (BOJ) raised its policy interest rate by 25 basis points to 0.75% on December 19. It marks its highest level in nearly 30 years, reinforcing the country’s gradual exit from ultra-easy monetary policy.

Yet despite the historic shift and warnings of a global liquidity squeeze, Bitcoin showed little reaction, rising just under 1% and holding in the $87,000 range.

BOJ Just Raised Interest Rates Another 25 Basis Points – Why Did Bitcoin Hold Steady?

The muted response stands in contrast to history. Previous BOJ tightening cycles have often coincided with sharp sell-offs in crypto markets, particularly as yen carry trades unwind and global liquidity tightens.

This time, however, traders appeared unfazed, suggesting the move had been fully priced in well ahead of the announcement. Market participants had largely anticipated the decision.

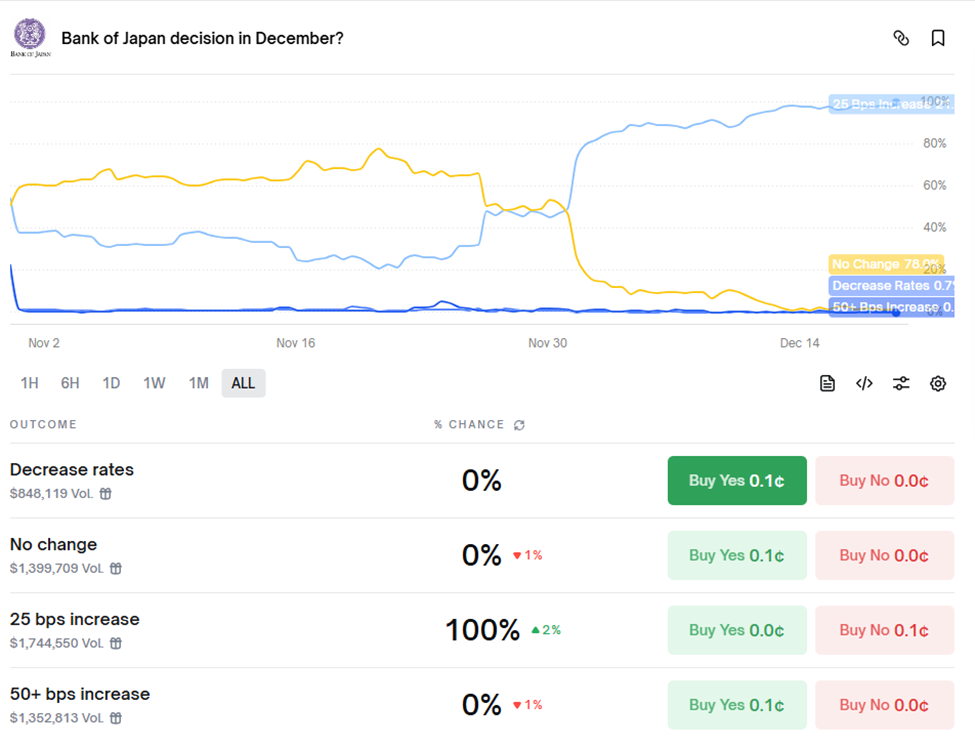

BOJ Interest Rate Probabilities. Source: Polymarket

BOJ Interest Rate Probabilities. Source: Polymarket

Japan’s rate increase represents a symbolic break from decades of near-zero interest rates that made the yen a cornerstone of global funding markets. Cheap yen borrowing fueled leverage across equities, bonds, and cryptocurrencies.

As Japanese yieds rise and narrow the gap with global rates, those trades become less attractive, potentially forcing investors to unwind risk positions. Still, Bitcoin’s calm reaction suggests markets were prepared.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

According to analysts, however, the focus was never the hike itself, but what comes next.

“Markets are pricing in a near-certain 25 basis point hike, marking the highest Japanese policy rate in about 30 years. While the hike itself is largely anticipated, the real focus is on Governor Ueda’s forward guidance during the press conference—signals of future hikes could amplify effects,” wrote analyst Marty Party.

That forward guidance may prove crucial. The BOJ has signaled it remains prepared to raise rates further, potentially to 1% or higher by late 2026, depending on wage growth and sustained inflation.

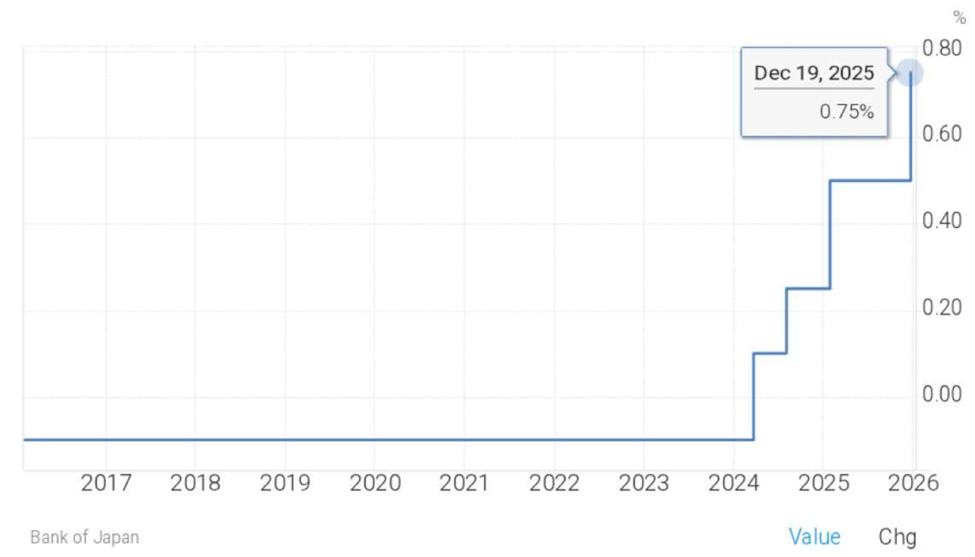

BOJ policy rate climbing from near 0% to 0.75% in December 2025, ending decades of ultra-easy policy. Source: Wise Advice via X

BOJ policy rate climbing from near 0% to 0.75% in December 2025, ending decades of ultra-easy policy. Source: Wise Advice via X

That outlook keeps pressure on risk assets, even if the initial move failed to trigger volatility.

Bitcoin Holds Firm as Altcoins Face a Prolonged Liquidity Squeeze

Analysts argue that Bitcoin’s resilience could be a bullish sign. Blueblock pointed to historical patterns, noting the divergence from past reactions.

“The BOJ just hiked rates to 0.75%, ending decades of ultra-loose policy and narrowing the gap with global yields. History shows that every prior tightening has triggered 20–30% Bitcoin drops as yen carry trades unwind and liquidity tightens. Yet with the hike fully priced in and BTC holding around $85k–$87k, this could be the dip buyers have been waiting for,” the analyst wrote.

However, not all corners of the crypto market are expected to fare as well. Altcoins, which are typically more sensitive to shifts in liquidity, remain vulnerable if Japanese tightening accelerates.

The prospect of higher rates through 2026 suggests a prolonged headwind rather than a one-off shock.

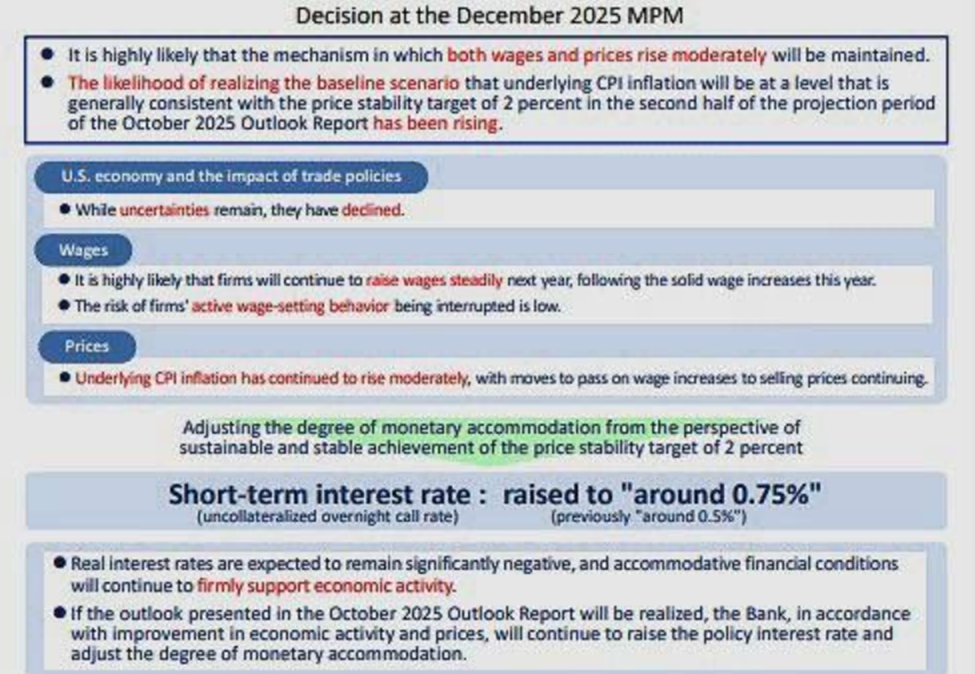

BOJ’s December 2025 policy decision raised rates to 0.75% with guidance for further tightening. Source: Money Ape on X

BOJ’s December 2025 policy decision raised rates to 0.75% with guidance for further tightening. Source: Money Ape on X

“BOJ signals it is ready to hike further, potentially 1% or higher by late 2026, depending on wage growth and sustained inflation. NO MERCY FOR ALTCOINS,” commented Money Ape.

Bitcoin’s stability reflects a market that had ample time to prepare for the BOJ’s decision. Whether that resilience holds will depend less on the December hike itself and more on how aggressively Japan continues its path of tightening. It will also hinge on how global liquidity adapts to the end of one of its longest-running monetary backstops.