Pi Network Price Forecast: PI falls as December token unlock overshadows gaming partnership

- Pi Network ticks lower by 4% on Friday after three consecutive days of trading in the green.

- The recent partnership between Pi Network and CiDi Games expands the PI token's utility in the real world.

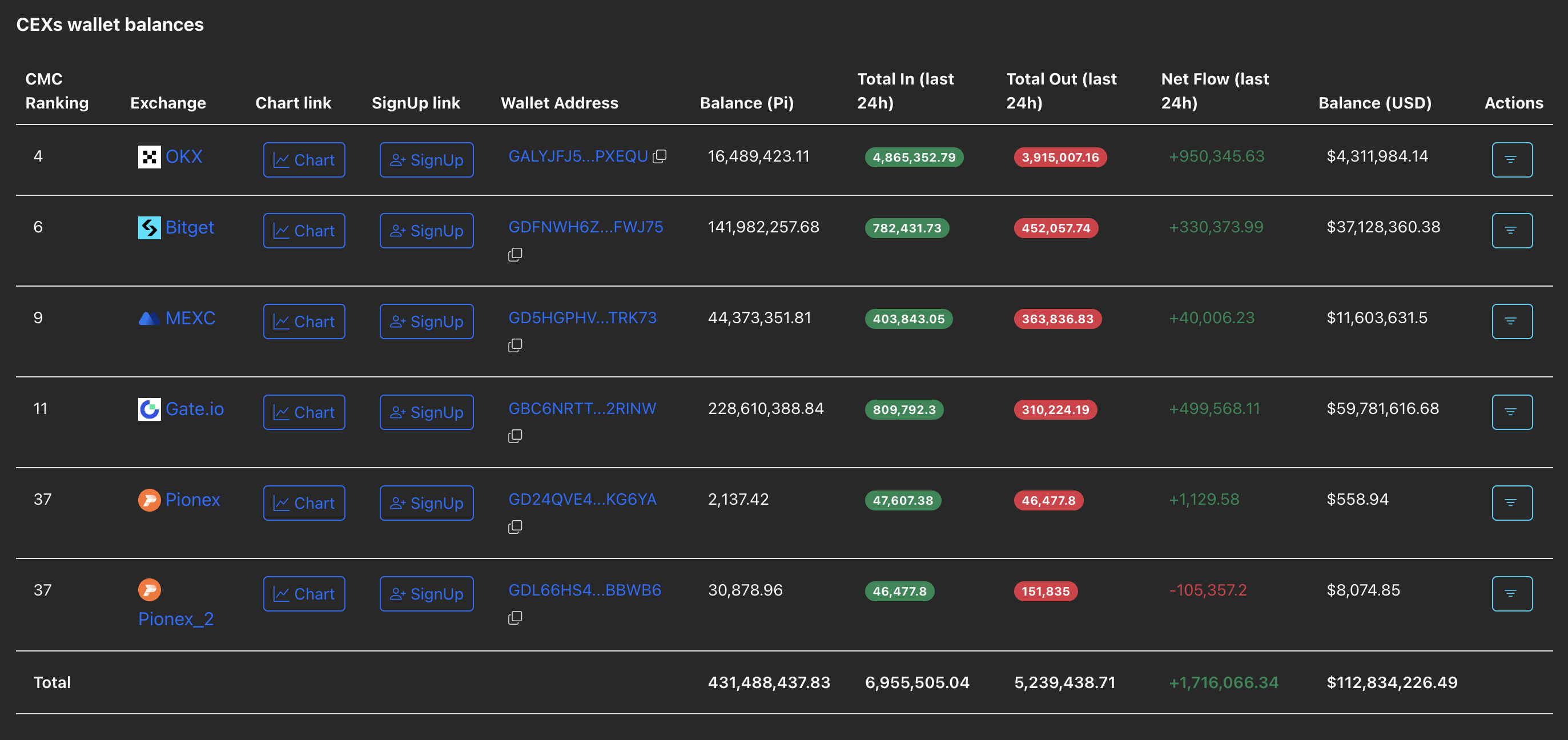

- A surge in CEXs' inflows signals increased selling pressure ahead of the 186 million PI token unlock in December.

Pi Network (PI) is down 4% by press time on Friday, after three days of an uptrend fueled by the CiDi Games partnership announcement on Wednesday. The intraday pullback risks erasing this week's gains as Centralized Exchanges (CEXs) witness large deposits ahead of the scheduled unlock of 186 million PI tokens in December.

CiDi Games' announcement loses its charm ahead of the December token unlock

Pi Network’s partnership with CiDi Games expands the real-world utility of the PI token in the gaming industry. Building on the mobile mining cryptocurrency, the PI token will now serve as the primary currency for payments, transactions, and incentives across CiDi Games’ titles.

Beyond this, an open framework is in the works by CiDi Games to extend Pi Network, which is scheduled for initial testing in early 2026.

However, the intraday pullback in PI aligns with a surge in CEXs' wallet balances, reaching 1.71 million tokens over the last 24 hours, indicating large deposits from traders losing confidence.

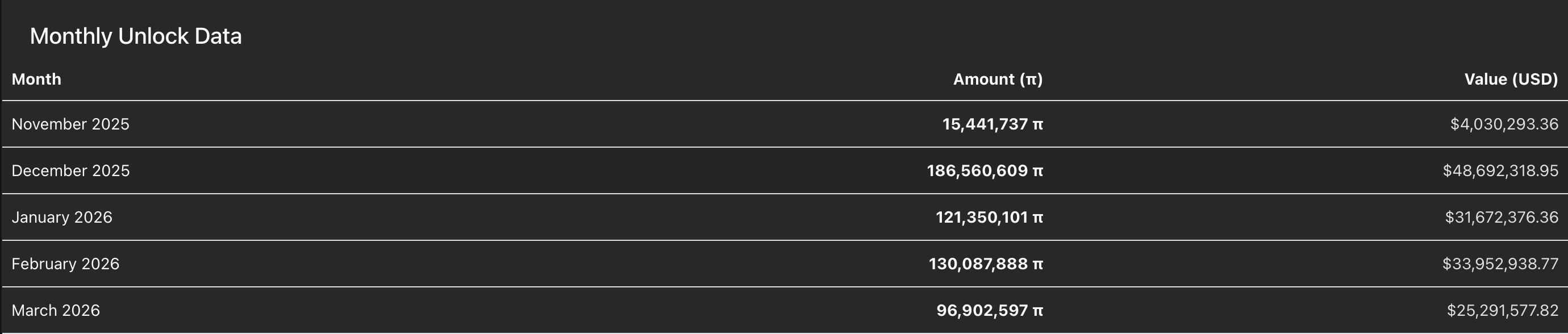

The sudden supply shock after the gaming expansion boost aligns with the upcoming 186 million PI tokens to be unlocked in December, which accounts for 43% of the total supply of 431.48 million PI available on CEXs. Typically, token unlocks can boost selling pressure when investors' confidence is low.

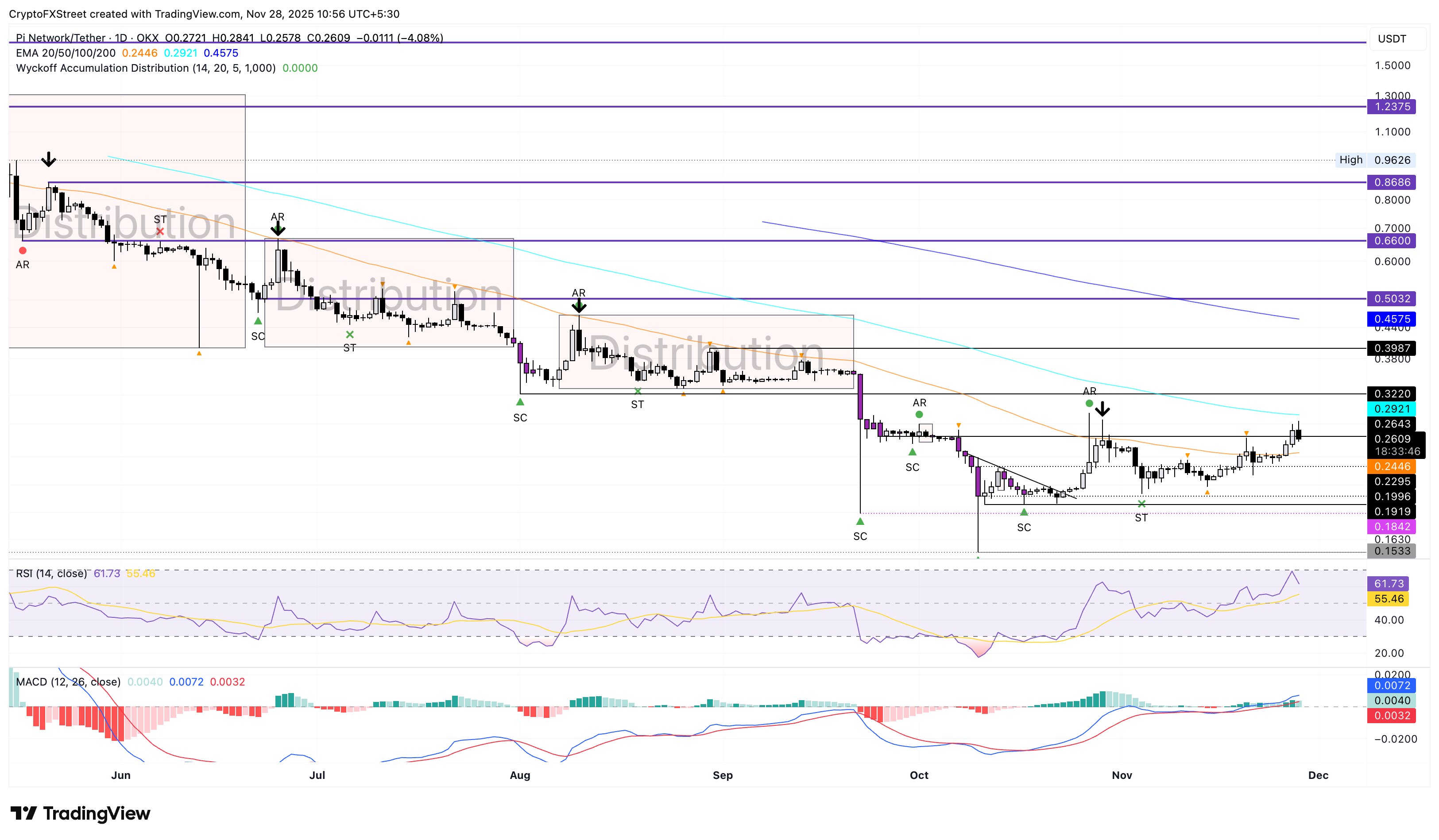

Pi Network loses strength near the 100-day EMA

Pi Network trades near the $0.2600 mark after a 4% drop by press time on Friday, nearly erasing the 6.88% gains from Thursday. A bearish close to the day would mark the end of the short-term recovery run, threatening the reclaimed 50-day Exponential Moving Average (EMA) at $0.2446.

If PI drops below $0.2446, it could further extend the pullback to the $0.2000 psychological level.

The technical indicators on the daily chart suggest that buying pressure has cooled, as the Relative Strength Index (RSI) has dropped to 61, signaling a retracement from the overbought territory.

However, the Moving Average Convergence Divergence (MACD) and signal line are holding steady above the zero line. If the pullback extends, the red line could cross below the blue one, triggering a sell signal.

Looking up, a potential rebound in PI could test the 100-day EMA at $0.2921, followed by the August 1 low at $0.3220.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.