Crypto Gainers: Internet Computer, Filecoin rebound in a bear market

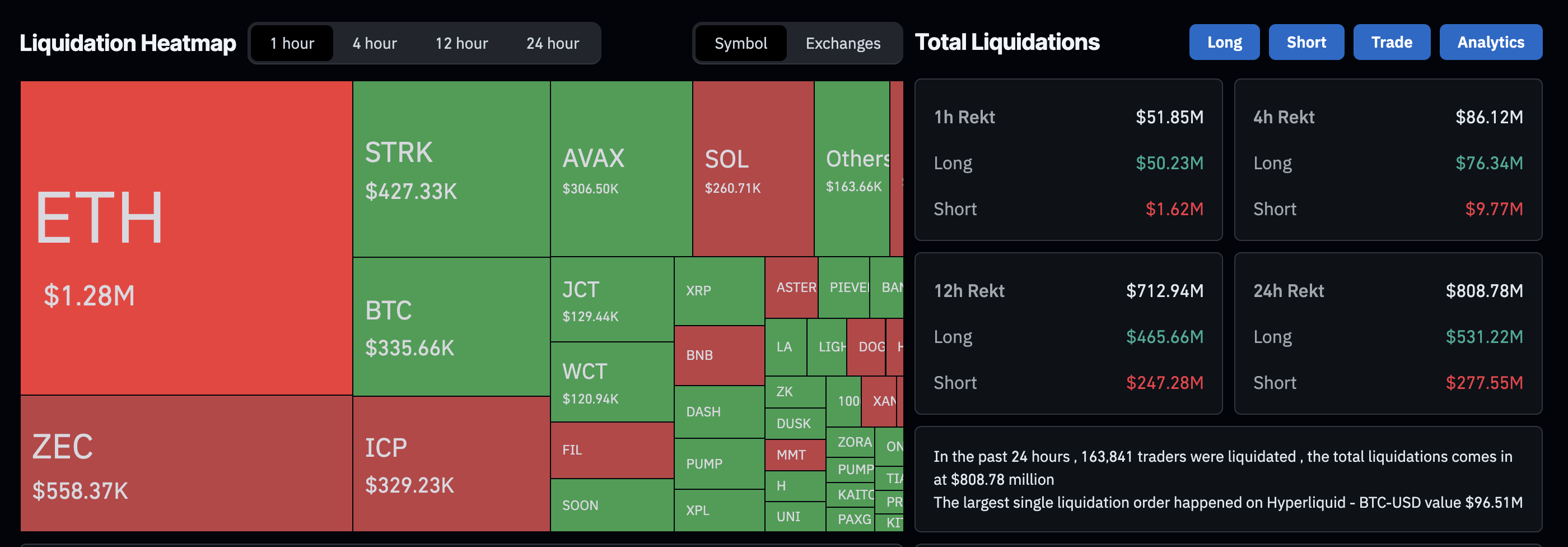

- Crypto market suffers over $800 million in liquidations as Bitcoin slips below $92,000.

- Internet Computer rises by over 6% on Tuesday, extending the recovery this week.

- Filecoin gains 7% on Tuesday, holding above the $2.00 mark and the 50-day EMA.

Internet Computer (ICP) and Filecoin (FIL) are the only Top 100 altcoins trading in the green, by press time on Tuesday, as the broader cryptocurrency market shifts bearish. Bitcoin (BTC) crosses below $92,000, resulting in a broader market liquidation of over $800 million in the last 24 hours.

Still, the technical outlook for ICP and FIL remains relatively optimistic as overhead supply pressure wanes.

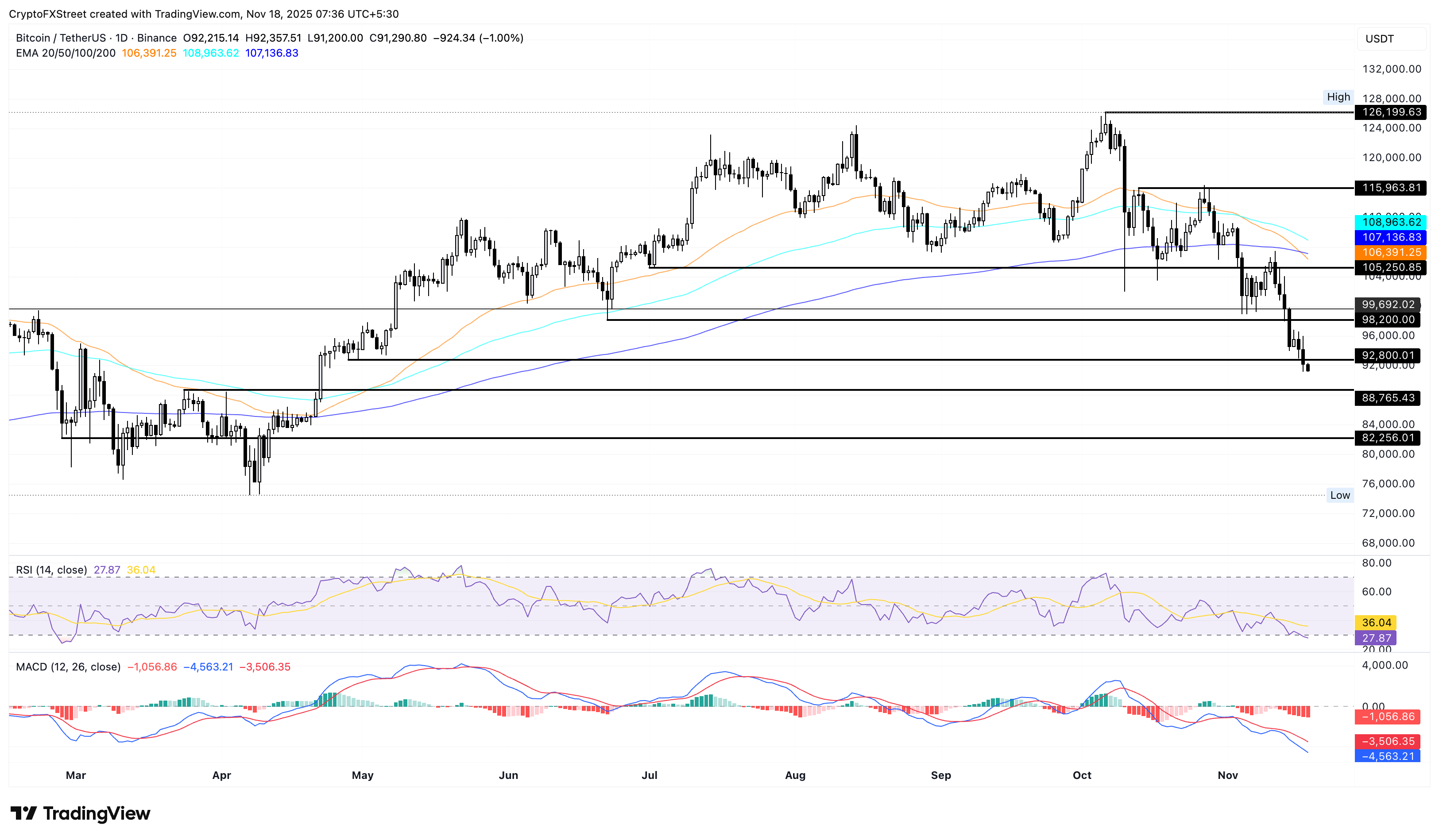

Crypto market bleeds as Bitcoin drops below $92,000

The broader cryptocurrency market experienced a massive liquidation of $808 million over the last 24 hours, comprising $531 million in long liquidations and $277 million in short liquidations. Bitcoin’s pullback triggers the sudden wipeout of largely bullish-aligned positions, including the largest liquidation trade of $96.51 million on Hyperliquid in the BTC/USD pair.

Bitcoin extends its fourth consecutive bearish week, erasing gains made since late April. At the time of writing, BTC is down 3% so far in the week, targeting the $88,765 support level marked by the March 24 high.

The 50-day Exponential Moving Average (EMA) crossed below the 200-day EMA on Sunday, marking a Death Cross pattern, which confirms the bearish dominance in the short and medium term.

In line with the Death Cross, the momentum indicators, including the Relative Strength Index (RSI) at 27, signal an oversold condition. At the same time, the Moving Average Convergence Divergence (MACD) extends the declining trend with the signal line, indicating an increase in bearish momentum.

On the upside, if BTC resurfaces above $92,800 level, aligning with the April 28 low, it could extend the recovery to the June 22 low of $98,200.

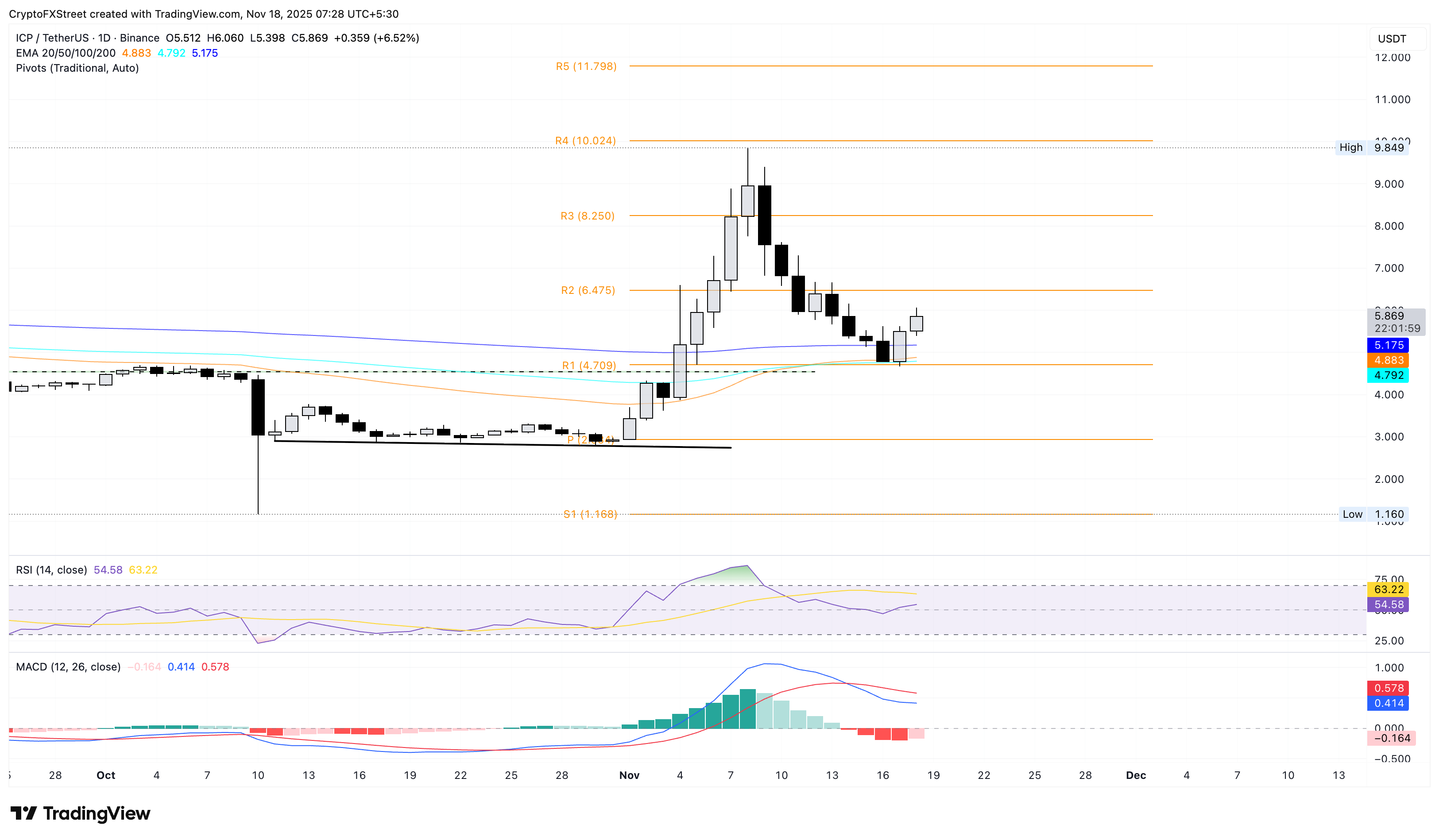

Internet Computer’s rebound gains momentum

Internet Computer edges higher by over 6% at press time on Tuesday, extending the 15% rebound from Monday. The recovery cements a strong support at the R1 Pivot Point at $4.70, with bulls aiming to reclaim the $6.00 level.

If the recovery clears the R2 Pivot Point at $6.47, ICP could target the R3 Pivot Point at $8.25 level.

The momentum indicators on the daily chart corroborate the short-term bullish shift as the RSI at 54 bounces off the midline, suggesting an increase in buying pressure. Furthermore, the MACD and the signal line shift sideways from a negative trend, increasing the possibility of a bullish crossover.

On the downside, if ICP slips below $4.70, it would erase the gains made so far this week, increasing the risk of a pullback to the centre Pivot level at $2.93.

Filecoin aims to extend recovery

Filecoin trades above the 100-day EMA at $2.12, recording 7% at press time on Tuesday. The rebound from the 50-day EMA could target the 200-day EMA at $2.42 if it holds a daily close above $2.12.

Similar to the Internet Computer, the FIL recovery aligns with reduced selling pressure as RSI at 53 shifts upwards from the halfway line. Meanwhile, the MACD and signal line are moving closer to a potential crossover, which would flash a buying opportunity.

However, if FIL drops below the $2.00 round figure, it would nullify the recovery chances and potentially target the November 4 low at $1.27.