Bitcoin Price Forecast: BTC reclaims $106,000 as US government shutdown resolution lifts sentiment

- Bitcoin price trades above $106,000 on Monday, holding firm after rebounding from a key support zone in the previous week.

- The US Senate passes a deal to end the longest government shutdown, boosting market sentiment and risk appetite.

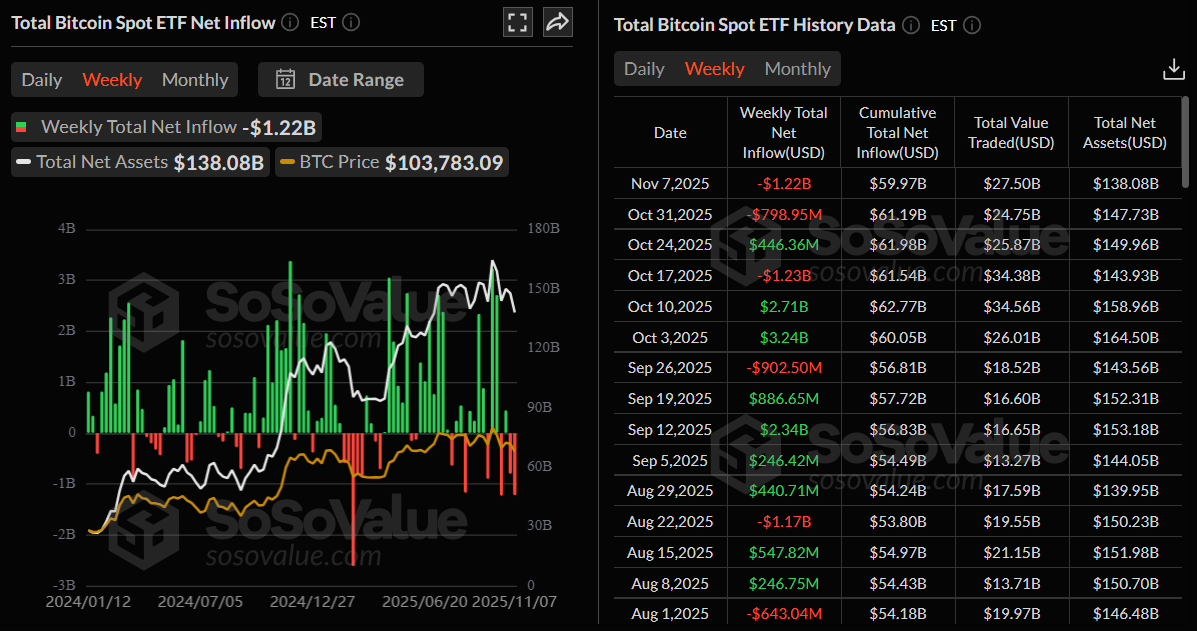

- US-listed spot Bitcoin ETFs recorded $1.22 billion outflows last week, signaling fading institutional confidence.

Bitcoin (BTC) price reclaims $106,000 at the time of writing on Monday, after rebounding from a key support zone last week. Market sentiment improved slightly following the US Senate’s move to end the longest government shutdown in history, boosting risk appetite across financial markets. However, institutional confidence remains under pressure as US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded $1.22 billion in weekly outflows, signaling cautious investor sentiment despite the broader recovery.

Bitcoin recovers as US Senate passes bill to end government shutdown

Bitcoin price begins the week on a positive note, trading above $106,000 on Monday. The recovery comes after the US Senate took the first step to end the longest government shutdown in history on Sunday night in Washington.

According to the Financial Times, eight Democratic lawmakers crossed party lines to endorse a compromise plan to reopen the US federal government and keep it funded until the end of January. The plan would also reverse the lay-offs initiated by the White House during the shutdown, which began on October 1, and guarantee that furloughed workers receive back pay, while including a concession by Democrats on healthcare tax credits that have been a key sticking point in the funding stand-off.

Global markets rallied on Monday due to this positive development, with US government bonds slipping as investors moved back into riskier assets. Yields on 10-year US Treasuries, which move inversely to the price, rose 0.05 percentage points to 4.14 per cent.

Added to this, US Treasury Secretary Scott Bessent said, also on Sunday, that US President Donald Trump’s suggestion that Americans may receive a tariff “dividend” of at least $2,000 could come via the tax cuts passed in his signature economic policy bill earlier this year. This move signals a positive sentiment aimed at boosting consumer spending amid economic uncertainty. The stimulus could inject fresh liquidity, fueling market optimism and increased crypto adoption.

Institutional demand shows signs of weakness

Bitcoin institutional demand shows signs of weakness. SoSoValue data shows that spot Bitcoin ETFs recorded a total outflow of $1.22 billion by November 7, marking the second consecutive week of outflows. If these outflows continue and intensify, BTC could extend its ongoing price correction, suggesting declining institutional confidence.

Bitcoin Price Forecast: BTC rebounds after retesting key support

Bitcoin’s price found support around the 50% Fibonacci retracement at $100,353 on November 4 and retested it over the next four days. On Sunday, BTC rebounded 2.36%. At the time of writing on Monday, BTC is extending its recovery and trades around $106,000.

If BTC closes above the 61.8% Fibonacci retracement at $106,453 on a daily basis, it could extend the recovery toward the 50-day Exponential Moving Average (EMA) at $110,241.

The Relative Strength Index (RSI) reads 45 on the daily chart, pointing upward toward the neutral level of 50, indicating fading bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level. Additionally, the Moving Average Convergence Divergence (MACD) lines are converging, with decreasing red histogram bars below the neutral level, indicating early signs of fading bearish momentum.

On the other hand, if BTC faces a correction, it could extend the decline toward the key support at $100,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.