Hyperliquid Price Forecast: HYPE drops for the seventh day as demand falters

- Hyperliquid drops near 7% so far on Tuesday, marking its seventh consecutive day of losses.

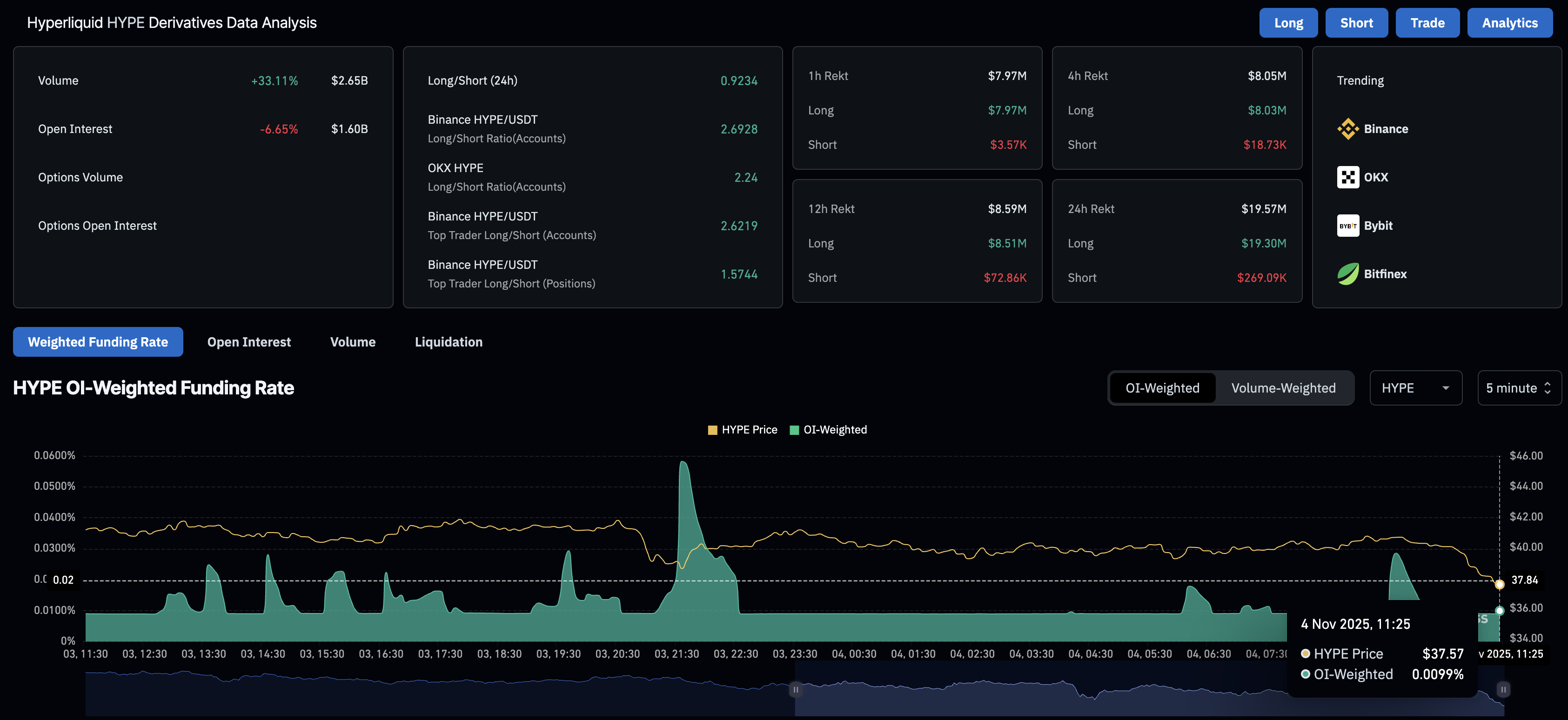

- The HYPE futures Open Interest and funding rate decline on centralized exchanges, suggesting low demand.

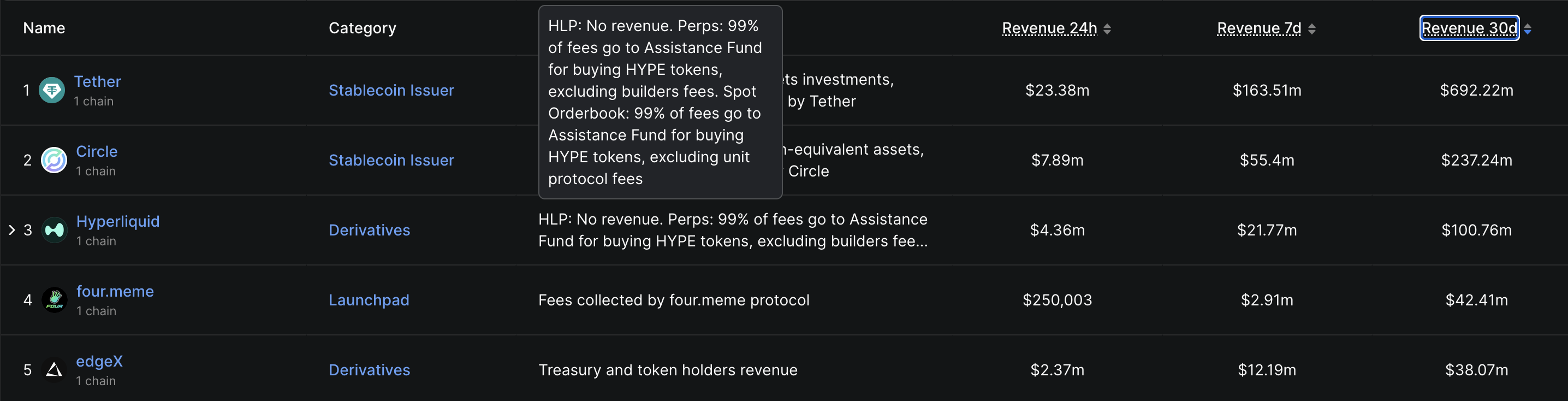

- Hyperliquid's 30-day revenue reaches $100 million, redirecting 99% of the funds to the Assistance Fund.

Hyperliquid (HYPE) retains the declining trend for the seventh straight day, crossing below $38 and the 200-day Exponential Moving Average (EMA). The Decentralized Exchange (DEX) token is facing sharp selling pressure as retail demand declines amid a broader crypto market correction.

Still, a stream of revenue amounts to $100 million over the last 30 days, redirecting 99% of the funds to expand the Hyperliquid Assistance Fund.

Risk-off sentiment neglects steady revenues and buybacks

Hyperliquid is experiencing a decline in demand among traders as the crypto market incurred $1 billion in total liquidations over the last 24 hours. CoinGlass data shows that the HYPE futures Open Interest (OI) has decreased by 6.65% over the last 24 hours to $1.60 billion, indicating that traders are closing positions or reducing their leverage.

Defending the risk-off sentiment, the long liquidations of $19.30 million in the last 24 hours, compared to $269,090 in short liquidations, magnify the wipeout of bullish-aligned positions.

Still, the positive OI-weighted funding rate of 0.0099% in the last 24 hours suggests that buyers are paying a premium to hold long positions, making short positions more lucrative as short-sellers will receive the premium in addition to their profits if HYPE continues its downtrend.

Despite the bearish trend in the derivatives market, Hyperliquid, as a platform, outperforms the majority of Decentralized Finance (DeFi) projects, except for the stablecoin issuers, Tether and Circle. DeFiLlama data shows the 30-day revenue of Hyperliquid amounts to $100.76 million, exceeding four.meme token launchpad revenue increased by more than 50% to $42.41 million. The steady revenue flow indicates consistent demand from users.

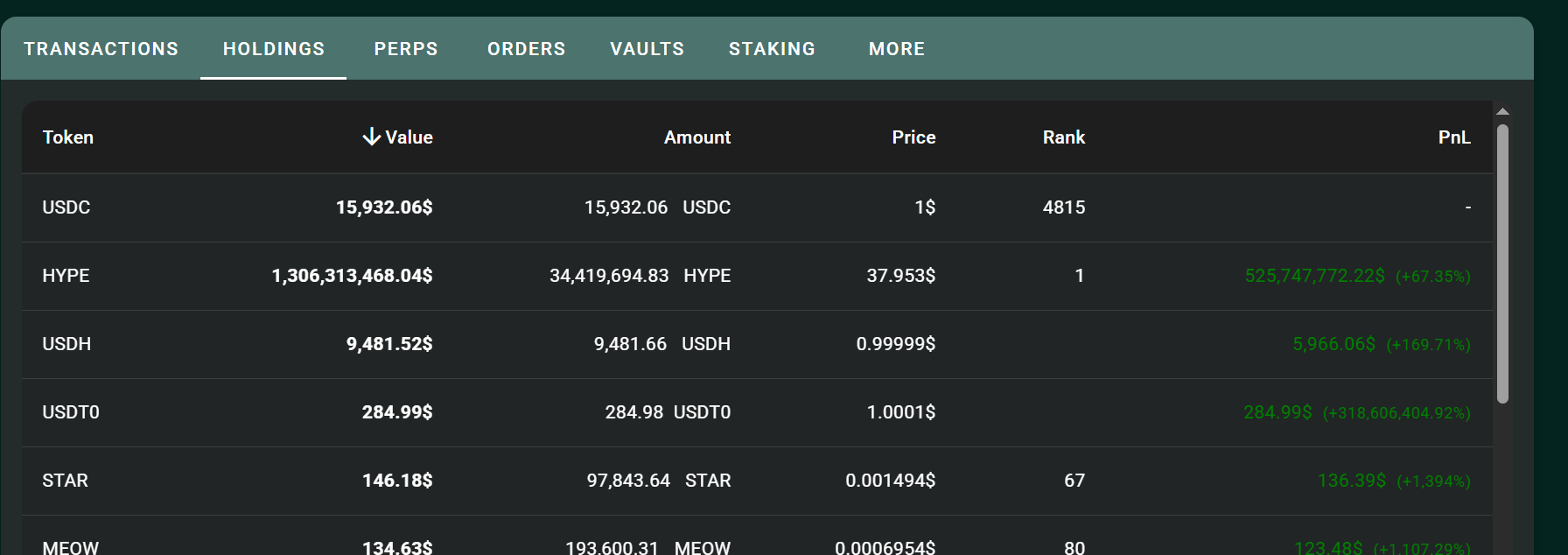

Furthermore, 99% of the funds collected in revenue fuel its revenue-based token buyback program, named the Hyperliquid Assistance Fund. As of Tuesday, the fund holds 34.41 million HYPE tokens, representing 3.44% of the total 999.53 million supply.

Still, the steady increase in revenue, which fuels token buybacks, struggles to provide a buffer against the ongoing decline.

Hyperliquid risks further loss despite risk aversion

Hyperliquid edges lower by 7% at press time on Tuesday, trading under strong supply pressure from last week. An overnight close below the 200-day EMA at $38.80 could extend the decline to the August monthly swing low at $35.51.

If HYPE fails to hold above this level, the May 30 low at $30.59 would become the next line of defense.

Moreover, the Moving Average Convergence Divergence (MACD) crosses below the signal line on the daily chart, indicating a renewed bullish momentum. At the same time, the Relative Strength Index (RSI) reads 39, pointing downwards, signaling a steady supply pressure with room for further correction before hitting the oversold boundary at 30.

If HYPE resurfaces above the 200-day EMA at $38.80, it could extend the recovery to the 100-day EMA at $43.11.