Privacy Coins Dash and ZCash surge despite the broader crypto market facing a correction

- Privacy-focused cryptocurrencies Dash and Zcash extend their gains on Tuesday, continuing last week’s strong rally.

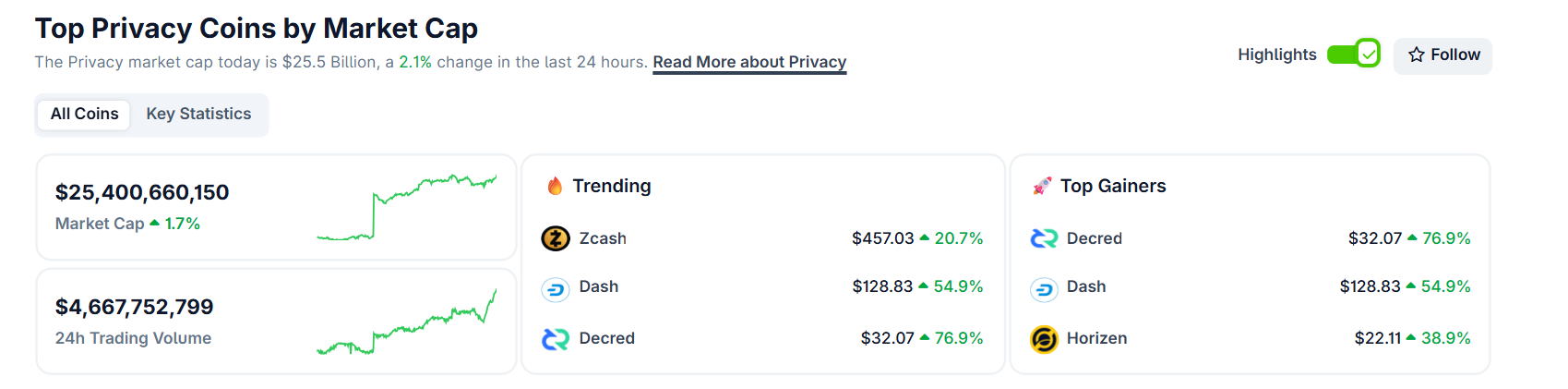

- The total market capitalization of privacy coins briefly surpassed $25 billion even as the broader crypto market declined.

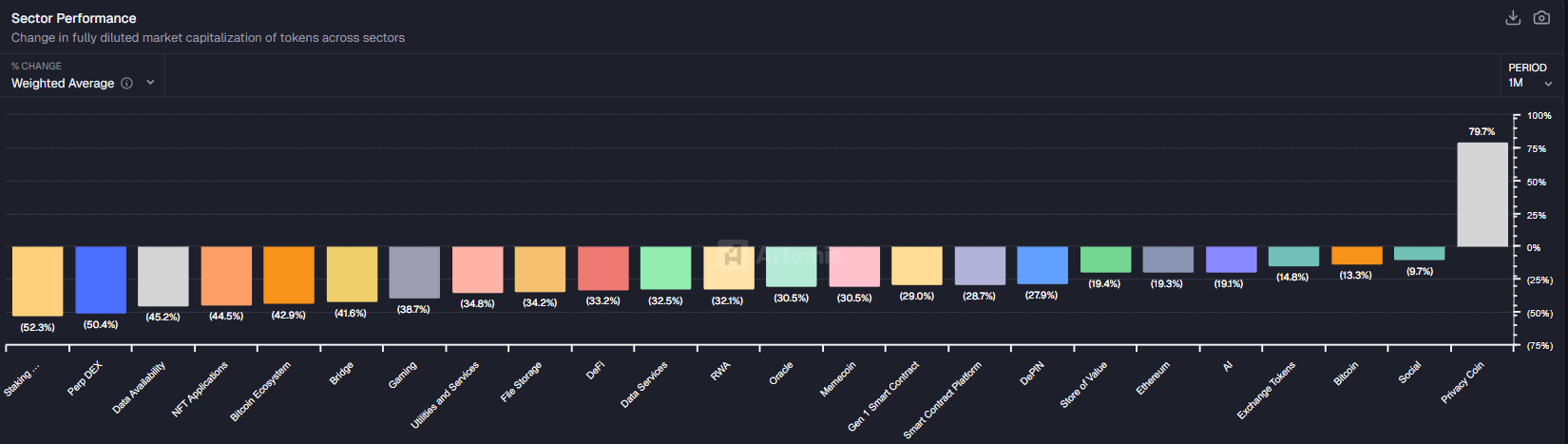

- Artemis data shows that privacy coins have outperformed the wider market, delivering 79.7% returns over the past month.

Privacy-focused cryptocurrencies Dash (DASH) and Zcash (ZEC) continue to defy the broader market trend, extending their gains on Tuesday amid a wider crypto market correction. The privacy coin market capitalization briefly crossed $25 billion, underscoring strong investor interest as the segment outperforms with nearly 80% monthly returns, according to Artemis data.

Dash and Zcash surge sharply amid growing interest in privacy-focused cryptocurrencies

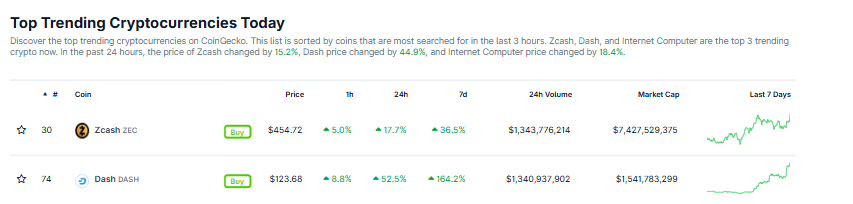

Dash and Zcash top today’s list of trending cryptocurrencies, surging 68% and 21%, respectively, in the past 24 hours, and posting impressive weekly gains of 201.5% and 43%, according to CoinGecko data.

The market capitalization of these privacy-focused cryptocurrencies has surpassed $1.78 billion for Dash and $7.78 billion for Zcash, as shown in the graph below.

On-chain metrics further indicate a bullish outlook for these privacy coins. Dash’s on-chain trading volume surged to $1.44 billion on Tuesday, its highest level since May 2021. Similarly, Zcash’s trading volume climbed to $1.35 billion, marking a steady rise since late September. This sharp surge in trading activity highlights growing trader interest and improving liquidity in both assets, strengthening their bullish momentum.

[10-1762233552771-1762233552772.27.59, 04 Nov, 2025].png)

Dash trading volume chart. Source: Santiment

[10-1762233572962-1762233572964.29.49, 04 Nov, 2025].png)

Zcash trading volume chart. Source: Santiment

Privacy coin market cap hits $25 billion, leading the crypto sector with top monthly returns

The total market capitalization of privacy coins surpassed $25 billion on Tuesday, according to CoinGecko data, defying the broader market downturn as Bitcoin slipped below $107,000.

The Artemis data sector performance chart shows that privacy coins have outperformed the wider market, delivering 79.7% returns over the past month.