Bitcoin warning, plus: Metals, miners, and USD ready to move

Last week’s session, along with the early trading of today’s session supports my previous analysis.

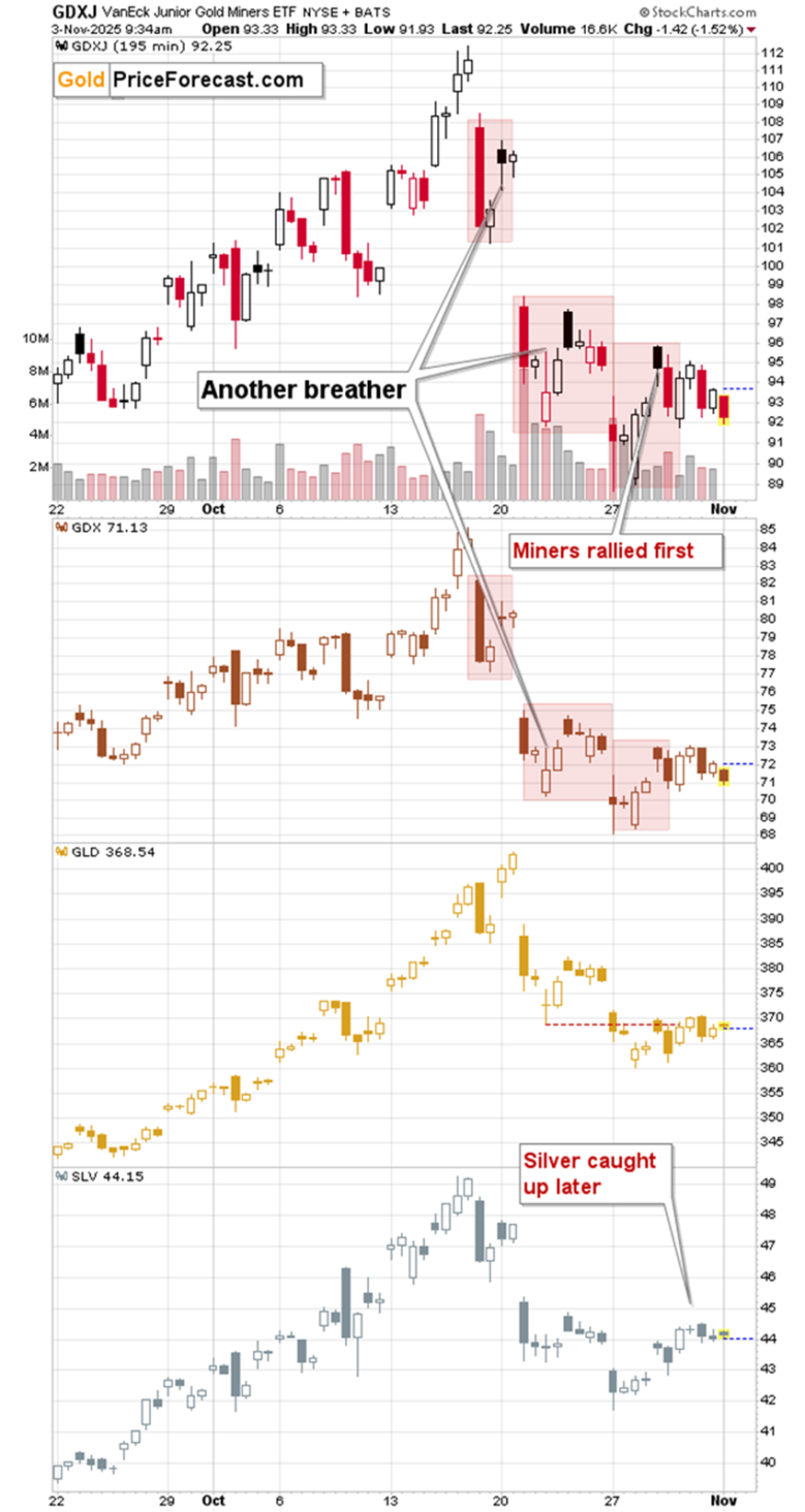

The mining stocks moved lower and they are most likely leading the rest of the precious metals sector lower.

Miners lead the sector lower

The GDXJ is testing its late-October lows while neither gold nor silver are doing the same thing. The stock market is not sliding today, so that’s not the reason for it. And even if this was the case, then it would likely be impacting both: miners and silver.

So, what we have here is true underperformance of mining stocks. This doesn’t bode well for the following weeks, as watching the miners for gold’s direction is one of the more reliable gold trading tips.

Yes, the GDXJ fell from above $110 to below $90 (temporarily), but this is just the beginning of the bid decline.

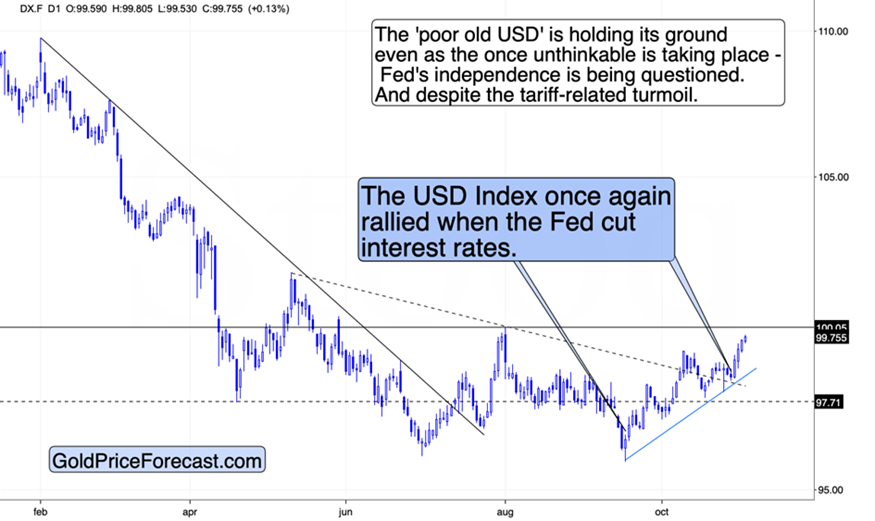

Let me remind you that the stock market hasn’t declined in any meaningful way so far - yet. In fact, it’s still trading very close to its all-time highs. This – along with the explosive potential for the USD Index – amplify the bearish indications that come just from the technical picture for the miners and metals.

We saw a clear monthly rally in the USD Index in October, but most investors still remain oblivious to what’s going on here. People are still in the “USD = bad’ sentiment, not realizing that it is exactly this kind of sentiment that creates great buying opportunities.

Remember how nobody wanted to touch stocks after their Covid-and-lockdown-based declines? Exactly.

Tariffs are fundamentally bullish for the USD, and yet the latter declined after they were announced in April. Not only should the USD rally back to its April levels, but then rally well above them.

Gold price appears to be forming a broader short-term top in its resistance zone in a way that’s similar to what we saw in the second half of October. Back then, we saw triple top, and this time, we see three/four tops, depending on how one will count them.

Still, once the USD Index’s rally becomes obvious, gold price is likely to tumble. I already wrote why gold price prediction for November 2025 was bearish previously, and what we see today simply confirms it.

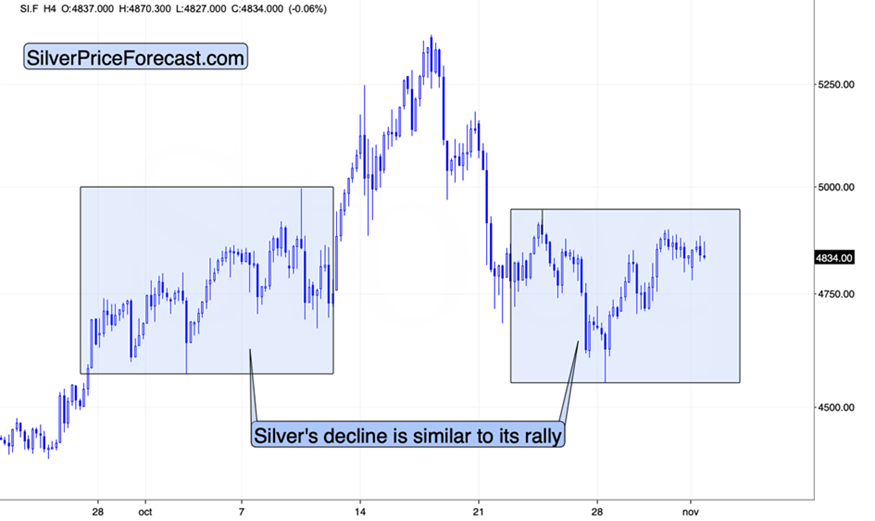

Silver is also correcting its recent decline, and it’s doing so in a way that’s creating a symmetrical pattern relative to how its price moved in the early part of October.

Some would say that this is a head-and-shoulders pattern that’s being formed, where a smaller H&S pattern is the head of the new pattern. This makes sense and it shows just how far silver can decline in the short- and medium-term. Long-term-wise, I’m extremely bullish on silver, but it seems to me that its current run-up is over.

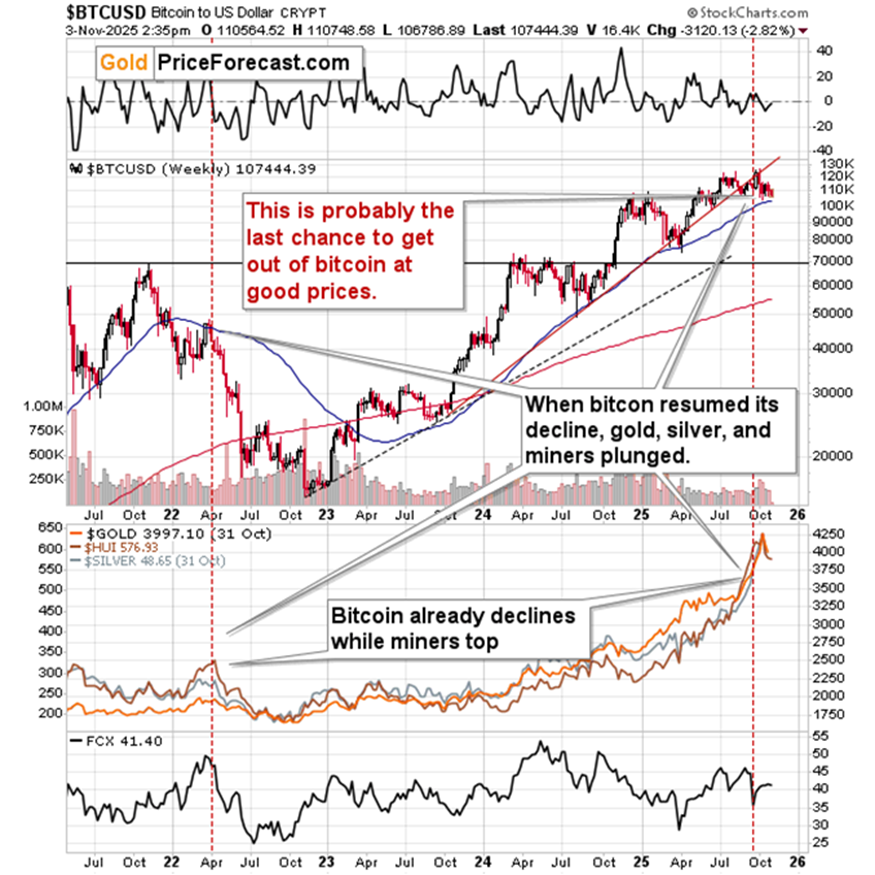

It’s not the only market where I think the big run-up is over.

Bitcoin breakdown flashes a major warning signal

I think the same is the case with regard to bitcoin.

Yes. The ‘new gold’ broke below its rising support line, and it verified this breakdown by moving back to this line and then moving lower once again. At the same time, bitcoin invalidated its move to new highs.

Those are powerful sell signals, and since we see them while the USD Index is poised to move higher, it seems that these are the final days when one could get out of bitcoin and most (if not all) cryptocurrencies at very good prices. If you own bitcoin or cryptos, please treat this as a major red flag and a WARNING.

The prices might decline really fast when people realize what’s really going on in the USD (by reading this, you’re already well ahead of them).

Overall, it seems that taking profits from the long-term investments and from half of the insurance capital (in gold and silver) when gold was at about $4,150 and silver was above $50 was a great idea.

When the USD Index finally confirms its breakout above 100, things will get really interesting, and many USD bears will be extremely surprised by the outcome.

Speaking of monthly performance, October just ended, and we can see that we have indeed seen a powerful monthly (!) reversal in gold in the target area that I had featured on Oct. 16. This fully supports all the points that I had made above.

Summing up, gold had a magnificent run-up and so did silver, however, it seems that this rally is over. Fortunately, this creates unique opportunities.