Ethereum Price Forecast: Developers lock in December 3 for Fusaka upgrade

Ethereum price today: $3,820

- Ethereum developers have marked December 3 as the official mainnet launch date for the Fusaka upgrade.

- Developers will also increase the network's blob's limit on December 9 and January 7.

- ETH could find support near $3,600 if it loses the $3,815 level.

Ethereum (ETH) faces downside pressure around $3,800 despite developers finalizing December 3 as the mainnet launch date for Fusaka.

Fusaka mainnet launch scheduled for December

In its All Core Developers Consensus (ACDC) call #168 on Thursday, Ethereum developers locked in December 3 as the mainnet launch date for the Fusaka upgrade.

While developers earlier set the date as tentative, they made it final after Fusaka's success on the Hoodi testnet on Tuesday. The upgrade had gone live on the Holesky and Sepolia testnets earlier in October.

Fusaka includes 12 Ethereum Improvement Proposals (EIPs) focused majorly on improving scalability and security on the main chain and Layer 2 networks. The most anticipated is EIP-7594, or PeerDAS, which enables developers to validate Layer 2 transactions by sampling a small subset of blobs data.

After Fusaka goes live, developers will increase the network's blob capacity limit in two phases on December 9 and January 7.

Fusaka will launch in just six months after Pectra — which went live in May — making it one of Ethereum's fastest major upgrades in recent times.

Ethereum Price Forecast: ETH tests key $3,815 support

Ethereum saw $220.8 million in liquidations over the past 24 hours, led by $190.3 million in long liquidations, per Coinglass data.

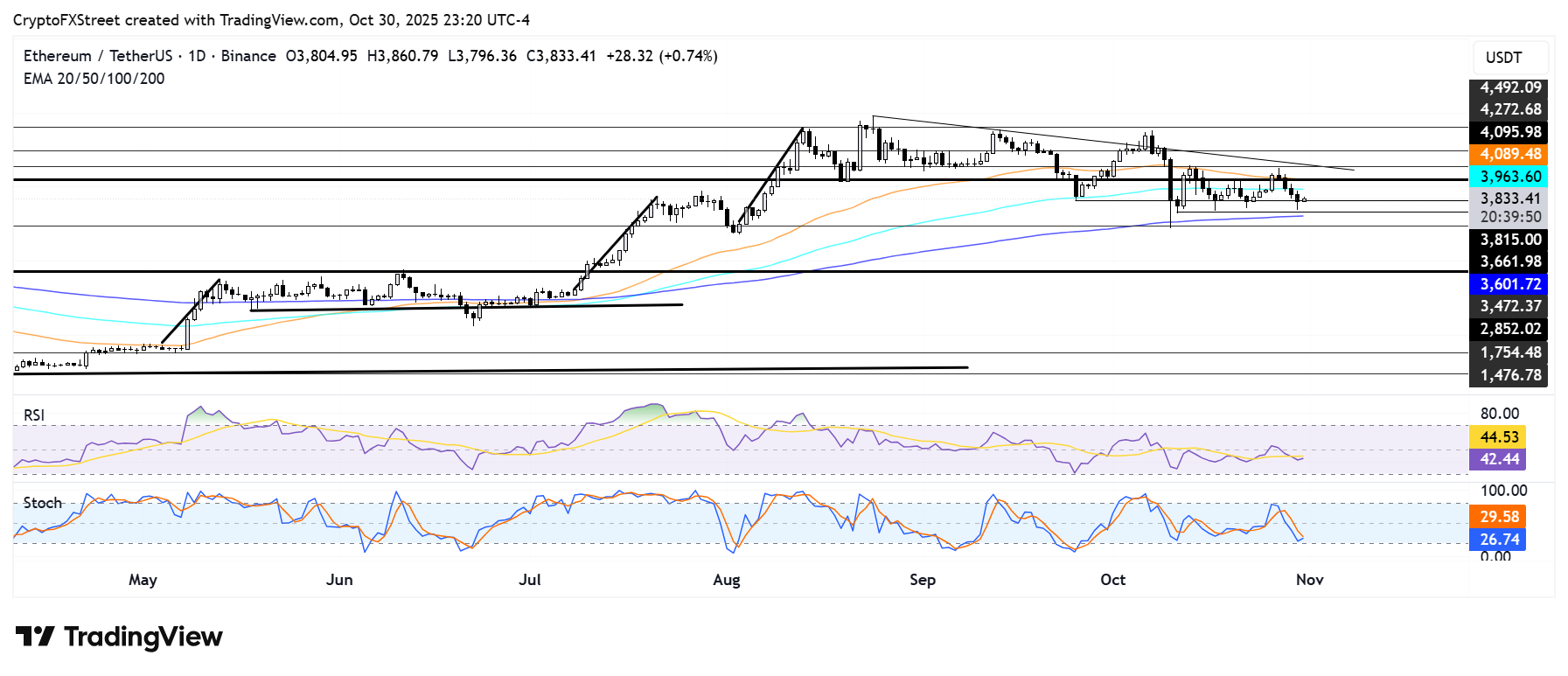

ETH briefly declined below $3,700 on Thursday after seeing a rejection at the 100-day Exponential Moving Average (EMA). However, bulls quickly recovered the support near $3,800.

ETH/USDT daily chart

On the downside, ETH could find support near $3,600, strengthened by the 200-day EMA. Meanwhile, the top altcoin has to rise above the $4,270 level and a descending resistance to initiate a potential move toward $4,500.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downwards below their neutral levels, indicating a rising bearish momentum.