Is D-Wave Quantum a Millionaire-Maker Stock?

Key Points

D-Wave Quantum is taking a different approach to quantum computing than its peers.

A sizable quantum computing market could emerge by 2030 for D-Wave to capture.

- 10 stocks we like better than D-Wave Quantum ›

Quantum computing stocks have taken investors on a wild roller coaster ride over the past few weeks. This cohort has lost a ton of value during this time frame, although there were a few positive spikes along the way. This may have investors wondering if this is a smart buying opportunity, as these stocks have a ton of potential to skyrocket if their quantum computing solutions become widely adopted.

One stock that was hit particularly hard is D-Wave Quantum (NYSE: QBTS). D-Wave's stock sold off to start 2025 and hit a low of $3.83. However, it touched a new, all-time high of nearly $45 just a few weeks ago before falling to today's level of about $30 (although this price could change drastically within a few days). With D-Wave off about 25% from its all-time high, is now the time to scoop up shares in hopes of having the stock transform a meager investment into $1 million? Let's find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

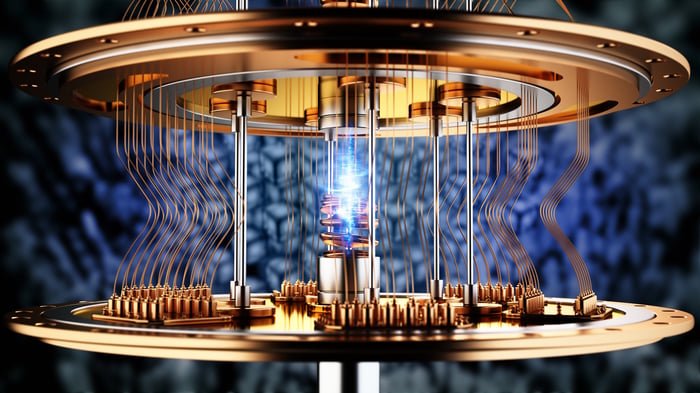

Image source: Getty Images.

D-Wave Quantum is taking a unique approach to the quantum computing industry

Most of D-Wave's competitors are working on developing a quantum processing unit that can be used for a wide variety of computing tasks, similar to how graphics processing units (GPUs) are used today. D-Wave isn't taking that approach. Instead, it's focusing on developing a computer that utilizes quantum annealing.

Quantum annealing is different from more generally used quantum computing practices because it utilizes quantum mechanics to pinpoint the lowest energy level in a system, to pinpoint the ideal answer. This makes quantum annealing ideal for optimization problems, such as logistics networks, AI inference, and statistics. Consequently, these are some of the primary areas where quantum computing can provide utility, so with D-Wave focusing on an alternative method of quantum computing, it makes itself stand out as a potential quantum computing winner.

We're in the early stages of the quantum computing arms race, and this technology is still trying to prove its worth. D-Wave's solution may end up being the ultimate winner in the end, but it's also possible that its peers dramatically outperform it and the technology is worthless, causing the stock to plummet to zero. This high-risk, high-reward nature of D-Wave's stock is a reality that investors must juggle, but if it works out, the results could be incredible.

D-Wave has the potential to be an incredible investment

To determine if D-Wave could be a million-maker stock, I'll set the threshold for returns at 100 times. This would transform $10,000 into $1 million, making it a wildly successful stock pick. One of D-Wave's competitors, Rigetti Computing (NASDAQ: RGTI), projects that the annual quantum computing market will be worth around $15 billion to $30 billion between 2030 and 2040.

If D-Wave can capture 50% of the higher end of that market, it would generate $15 billion in annual revenue. Should it establish a 30% profit margin, that would generate $4.5 billion in profits each year. If we assign a 30 times earnings multiple to its stock, that would value the company at $135 billion.

At today's $11 billion valuation, that would only provide about 12 times returns. While that falls short of our million-dollar threshold, it's still an impressive return. However, none of it is guaranteed.

The projections laid out above assume that D-Wave captures a large portion of the potential quantum computing market with technology that hasn't been proven out yet. There are a ton of "ifs" in those projections, and if they don't work out, D-Wave may not provide the returns investors are looking for with the risk they're taking on.

That's where I am in the quantum computing industry, and I think investors can afford to be patient and wait to see if a leader emerges. Additionally, there's bound to be a more aggressive market sell between now and when most companies believe quantum computing will become commercially viable in 2030. Investors will need to stay patient with the quantum computing stocks, and if they do, an even more attractive opportunity could surface.

Should you invest $1,000 in D-Wave Quantum right now?

Before you buy stock in D-Wave Quantum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D-Wave Quantum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.