Old Bitcoin Supply Remains Calm: ASOL Shows No Panic Selling

Bitcoin (BTC) is struggling to hold the $110,000 support level as price pressure intensifies heading into the final days of the month. Market structure remains fragile following recent volatility, and several analysts warn that BTC could still retest lower demand zones before establishing a stronger base. With liquidity pockets sitting below current price and sellers showing persistence near resistance, short-term downside cannot be ruled out as traders reassess positioning after the Federal Reserve’s policy shift.

However, not all signals point to weakness. Many investors remain optimistic as macroeconomic conditions begin favoring risk assets once again. The Fed’s recent 25bps rate cut and confirmation that quantitative tightening will end by December 1st have laid the groundwork for what some view as the early phase of a new liquidity cycle — historically constructive for Bitcoin’s long-term trajectory.

On-chain data also supports a calmer market environment. Over the past month, the activity of old coins has remained moderate, with long-term holders showing no signs of panic selling. This behavior suggests conviction among seasoned market participants, even as BTC navigates short-term turbulence. Collectively, these dynamics frame a market in transition: tactically cautious, yet strategically positioned for potential upside.

Low ASOL Activity Signals Strong Holder Conviction

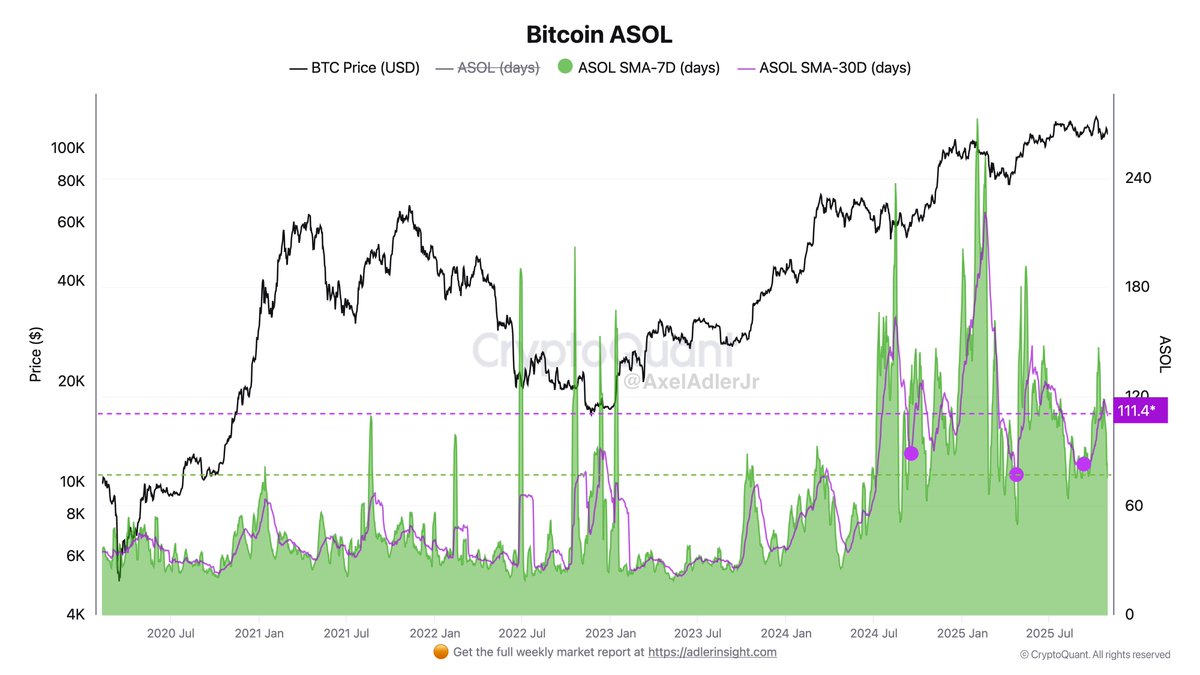

According to on-chain insights highlighted by top analyst Axel Adler, Bitcoin’s recent spending behavior among long-term holders remains remarkably stable, underscoring strong market conviction even as price struggles to hold above key support. Adler points to the Average Spent Output Lifespan (ASOL) — a metric that measures the average age of coins being moved on-chain — noting that while there were short-lived upticks to 245 days on October 8 and 209 days on October 21, these signals were far weaker than the heavy long-term holder activity seen in spring and June.

This distinction is important: during those earlier periods, older coins moving signaled meaningful distribution events, often preceding corrective phases. In contrast, the recent mild increases indicate no widespread desire among long-term holders to exit positions. The 30-day ASOL moving average currently sits near 111 days, which Adler characterizes as a structural baseline — a zone consistent with healthy consolidation rather than distribution.

In practical terms, this means seasoned holders remain patient, showing no urgency to take profits, despite macro uncertainty and short-term volatility. At the same time, incoming liquidity continues to absorb supply, as referenced in this week’s Substack commentary. This absorption dynamic is crucial: it reflects a market where available Bitcoin is gradually tightening, enabling price stability even as speculative flows remain constrained.

Collectively, these on-chain conditions suggest a foundational phase rather than exhaustion. As liquidity improves and macro headwinds ease, this quiet conviction among long-term holders could form the groundwork for the next significant leg higher — once demand meaningfully re-accelerates. For now, the market remains calm beneath the surface, a posture historically associated with accumulation phases and future expansion rather than broader distribution or capitulation.

Bitcoin Holds Above $110K But Faces Rejections Below Resistance

Bitcoin (BTC) is trading near $110,100, attempting to stabilize after another sharp rejection from the $117,500 resistance area — a level that has consistently capped upside attempts since mid-August. The 12-hour chart shows a repeat pattern: each move toward the upper range fades near the cluster of moving averages, with sellers stepping in aggressively at resistance and forcing BTC back into its mid-range support zone.

BTC is currently holding above a key demand band between $108,500 and $110,000, an area that previously acted as a pivot during late-September and early-October price action. Maintaining this zone is critical for bulls. A breakdown here would expose Bitcoin to the $104,000–$106,000 region, where price wicked during the October 10 liquidation flush.

On the upside, a structural shift requires BTC to reclaim the 50- and 100-period moving averages on the 12h timeframe and establish a foothold above $114,500. Only then would momentum build for another test of $117,500, with a confirmed breakout opening a path toward $120,000–$123,000.

For now, Bitcoin remains range-bound, caught between macro optimism and lingering supply pressure. With volatility compressing again, the next strong move is likely to come once the market digests recent policy shifts and liquidity flows begin redirecting decisively.

Featured image from ChatGPT, chart from TradingView.com