Warren Buffett's Berkshire Hathaway Was Just Downgraded to Sell by a Wall Street Analyst -- but He Somehow Missed the Biggest Risk Factor

Key Points

Warren Buffett has overseen a nearly 5,840,000% cumulative return, spanning six decades, in Berkshire Hathaway's Class A shares (BRK.A).

Berkshire stock was hit with a rare sell rating by an analyst concerned about a laundry list of factors, including the imminent retirement of Warren Buffett in two months.

However, this Wall Street analyst appears to have overlooked the one catalyst that could upend Berkshire Hathaway's near-annual outperformance of the benchmark S&P 500.

- 10 stocks we like better than Berkshire Hathaway ›

Though investing on Wall Street offers no certainties, seeing Berkshire Hathaway's (NYSE: BRK.A)(NYSE: BRK.B) billionaire CEO Warren Buffett run laps around the benchmark S&P 500 (SNPINDEX: ^GSPC) in the return column over long periods has been pretty close to a guarantee.

Since the Oracle of Omaha ascended to the CEO role in 1965, he's overseen a cumulative return in Berkshire's Class A shares (BRK.A) of almost 5,840,000%, as of the closing bell on Oct. 28. In comparison, the broad-based S&P 500 has rallied less than 46,000%, including dividends paid, over the same timeline.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But all things eventually change. Buffett announced his intention to retire from the CEO role at Berkshire Hathaway's annual shareholder meeting in May, which has fueled questions and uncertainty about the company's future.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

It's also spurred an incredibly rare sell rating from Wall Street -- albeit the covering analyst failed to mention the biggest risk factor facing Berkshire Hathaway in the immediate future.

Billionaire Warren Buffett's company just received a rare sell rating

Before the opening bell on Monday, Oct. 27, analyst Meyer Shields of Keefe, Bruyette & Woods (KBW), a subsidiary of Stifel Financial, reduced his rating on Berkshire's Class A shares from market perform to underperform, which is the equivalent of "sell," and lowered his firm's price target to $700,000 per share from $740,000. For context, Shields' price target implied a shade over 5% downside in Berkshire's Class A shares, relative to where they closed out the previous week.

Shields provided a laundry list of potential red flags that have spurred this skepticism in a company known for crushing Wall Street's broad-based stock indexes.

First, as expected, there's the succession risk of Warren Buffett stepping down from the day-to-day CEO role at the end of the year. Even though predetermined successor Greg Abel will, in all likelihood, steer the ship in the same manner that Buffett has for the last six decades, there's arguably been a valuation premium built into Berkshire stock solely because Buffett was leading the charge. When the calendar changes to 2026, this premium likely disappears.

In addition to this obvious headwind, Shields pointed to multiple other factors that can weigh on Berkshire's operating results in the coming quarters, including:

- The prospect of weaker auto insurance margins at GEICO.

- The economic uncertainty created by President Donald Trump's tariffs, and what that might do to the roughly five dozen companies Berkshire owns outright, as well as its $314 billion investment portfolio.

- The Trump administration's dismantling of clean energy tax credits, which may hurt the earning potential of Berkshire Hathaway Energy.

- Declining interest rates, which can reduce the net interest income-earning potential of insurers and banks.

While these are tangible risks (albeit mostly short-term in nature), KBW's Meyer Shields may have overlooked the biggest risk of all for investors of Berkshire Hathaway: valuation.

Image source: Getty Images.

This is the biggest risk to Berkshire Hathaway (and it has nothing to do with Buffett's retirement)

Let me make clear that there isn't a one-size-fits-all blueprint when valuing individual companies or the broader market. Every investor has a unique approach to evaluating businesses, which is one of the primary reasons the stock market is so unpredictable.

Nevertheless, a strong argument can be made that the biggest risk for Berkshire Hathaway stock in the coming quarters is its own valuation, as well as the valuations of some of its core investment holdings.

There may not be an investor on the planet who's more of a stickler for value and getting a good deal than the Oracle of Omaha. He's been a net-seller of stocks for 11 consecutive quarters (Oct. 1, 2022 – June 30, 2025), to the tune of $177.4 billion. Although he'd never bet against America or the stock market, he also won't chase after stocks if he doesn't feel as if he's receiving value for what he's purchasing.

The telltale sign that Berkshire Hathaway stock might be in a bit of short-term trouble is that Buffett stopped buying back shares of his own company in June 2024. Following 24 consecutive quarters of share repurchases (July 1, 2018 – June 30, 2024) totaling almost $78 billion, Buffett hasn't spent a cent to buy back his own company's stock in at least 13 months (June 1, 2024 – June 30, 2025).

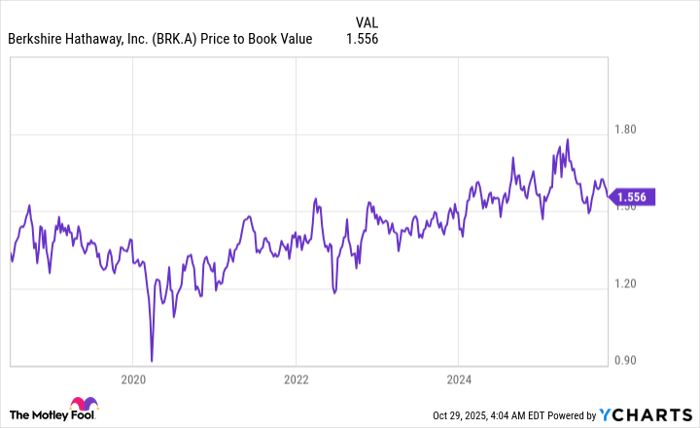

BRK.A Price to Book Value data by YCharts. Price-to-book value history from July 1, 2018-Oct. 28, 2025.

The reason is simple: Berkshire Hathaway stock isn't intrinsically cheap. Buffett was consistently paying a premium of 30% to 50% over book value to repurchase shares from July 2018 to June 2024. But over the last year and change, Berkshire's premium to book value has surged to between 60% and 80%. Even with a near-record amount of cash at his disposal, Buffett isn't interested in buying back his own company's stock at its current premium.

Furthermore, the stock market is historically pricey. The "Buffett Indicator," which measures the cumulative value of all public companies divided by U.S. gross domestic product (GDP), hit an all-time high of more than 225% this week. For the sake of comparison, the market-cap-to-GDP ratio has averaged closer to 85% when back-tested to 1970.

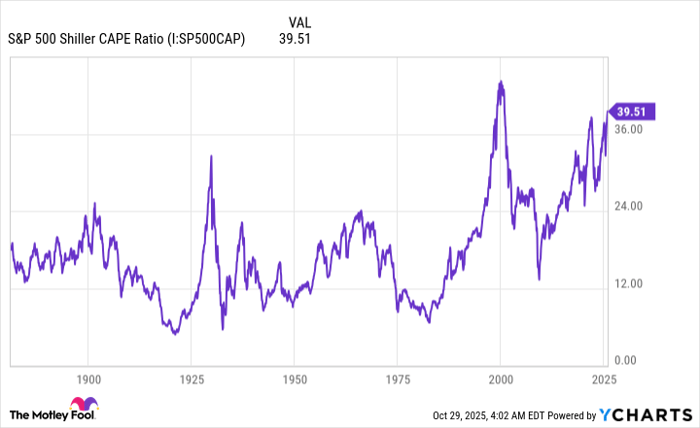

The priciness of stocks is perhaps even more apparent with the S&P 500's Shiller Price-to-Earnings (P/E) Ratio, which is also commonly referred to as the cyclically adjusted P/E Ratio, or CAPE Ratio.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller P/E has averaged a reading of 17.29 when back-tested to January 1871. It ended Oct. 28 at a fresh high for the current bull market of 41.18, which is within striking distance of the highest-ever reading of 44.19, which was set in the months leading up to the bursting of the dot-com bubble.

Berkshire Hathaway's largest investment holding, tech goliath Apple (NASDAQ: AAPL), is currently valued at a trailing-12-month earnings multiple of almost 41! Not only does this represent a 36% premium to its trailing-five-year average P/E ratio, but it's a staggering premium for a company whose growth engine completely stalled over the previous three years.

Although valuation worries tend to be confined to the short-term, they are, by far, the biggest headwind for Berkshire Hathaway stock as we prepare to enter the post-Buffett era.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.