Western Union to launch USDPT on Solana amid high ETF demand, network throughput

- Solana will host Western Union’s Digital Asset Network and USDPT stablecoin issued by Anchorage Digital.

- The Bitwise Solana Staking ETF (BSOL) secured $56 million on the first day of trading.

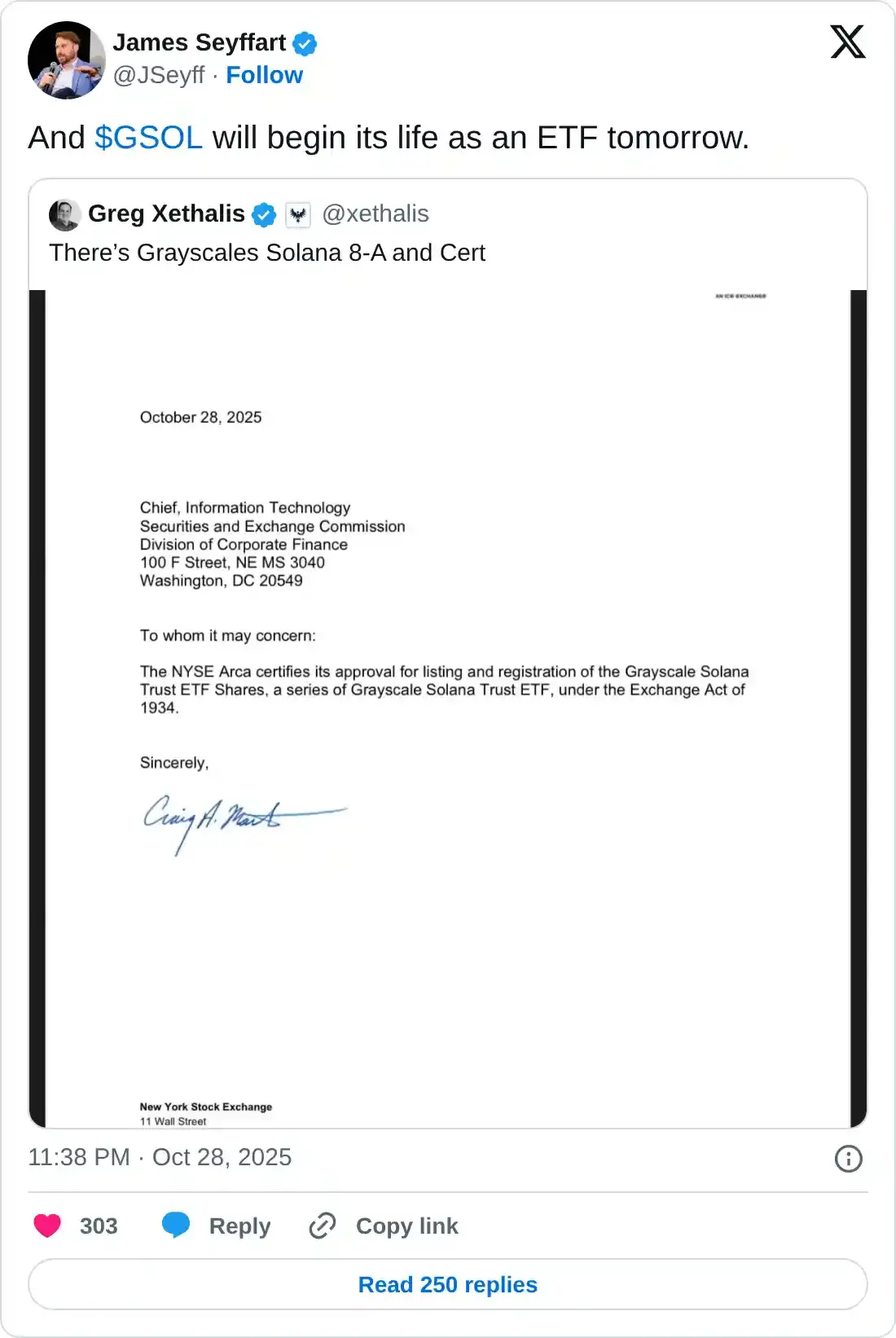

- The US SEC approves the listing and trading of the Grayscale Solana Trust ETF.

Solana (SOL) secures a partnership with Western Union, one of the world’s largest remittance networks, on Tuesday. The institutional backing for Solana is increasing as the Bitwise Solana Staking Exchange Traded Fund (ETF) (BSOL) records $56 million in trading volume on its listing day. At the same time, the US Securities and Exchange Commission greenlights the Grayscale Solana ETF (GSOL).

Western Union selects Solana for its blockchain expansion

Western Union announced the launch of its Digital Asset Network and US Dollar Payments Token (USDPT), a stablecoin issued by Anchorage Digital, on the Solana blockchain on Tuesday. The company plans to launch the network in the first half of 2026 and push USDPT into circulation via partner exchanges.

Devin McGranahan, President and CEO of Western Union, said, “Western Union’s USDPT will allow us to own the economics linked to stablecoins.” Meanwhile, the Digital Asset Network will focus on partnerships with wallet providers for cash off-ramps.

In line with Solana’s blockchain growth, Helius Labs launched a new Remote Procedure Call method, called the getTransactionsForAddress (gTFA). This enables the 493 billion transactions on Solana to be searchable in nearly 8 milliseconds (ms), with a total capacity of over 2.3 trillion transactions.

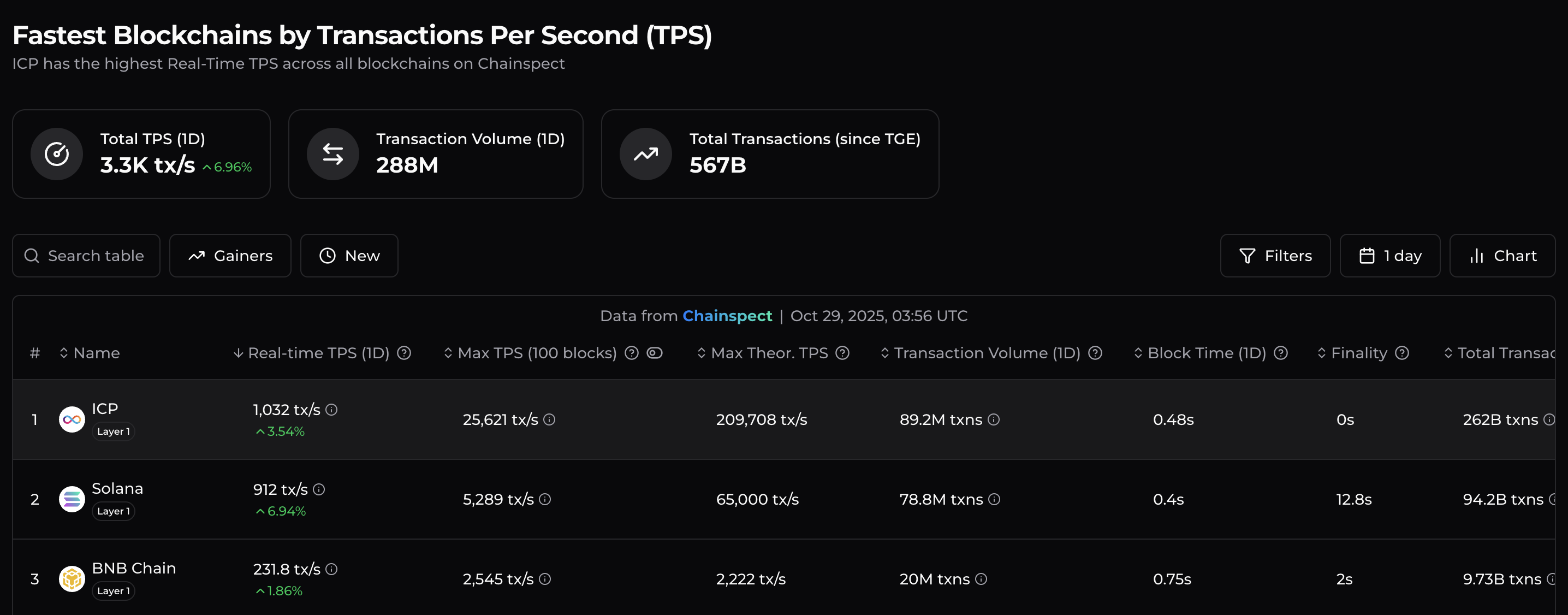

Meanwhile, Chainspect data shows that the Solana blockchain delivers a real-time throughput of 912 transactions per second (TPS), second only to the Internet Computer (ICP) at 1,032 TPS.

Blockchain based on TPS. Source: Chainspect.

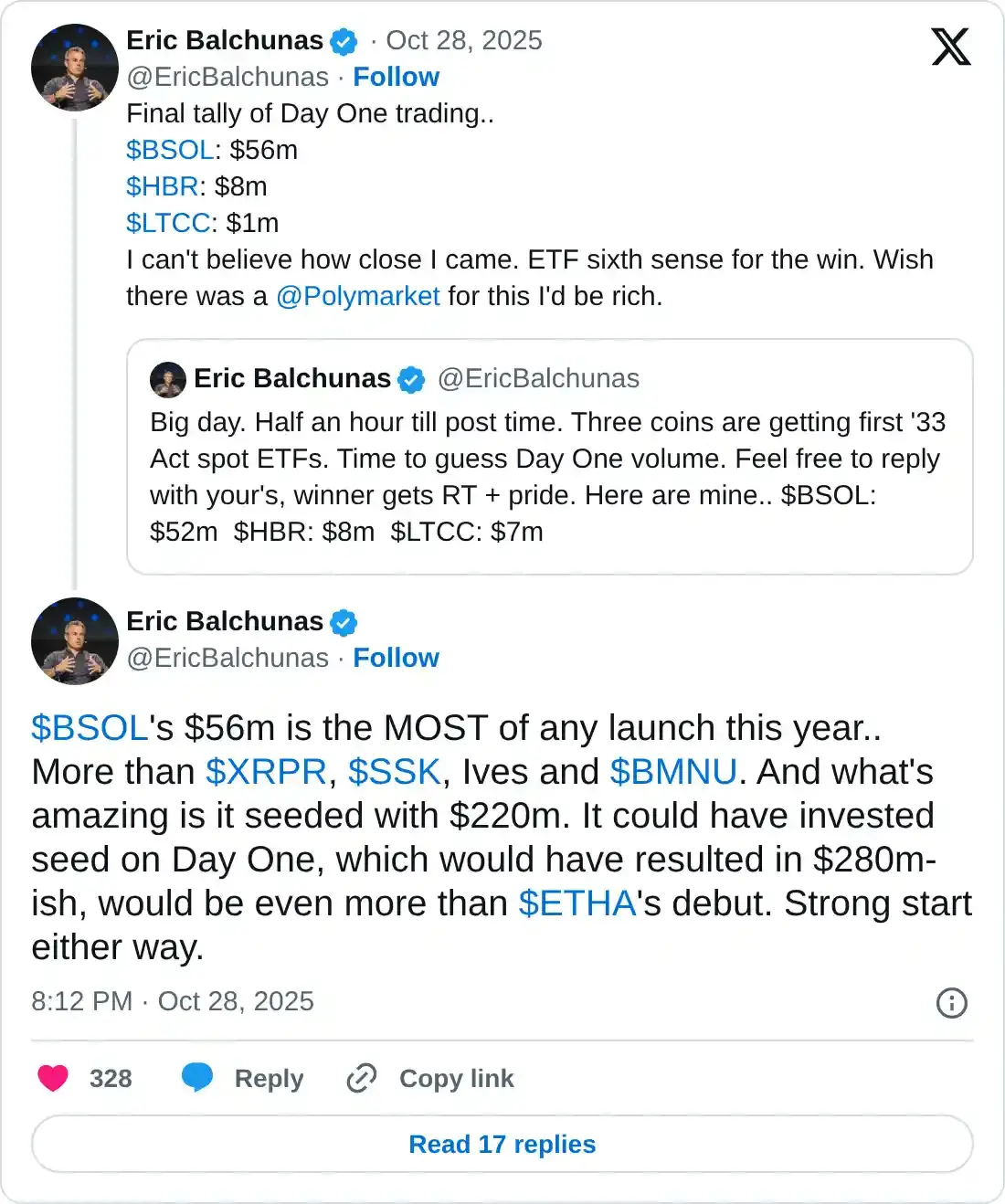

Bitwise Solana ETF outshines Litecoin, HBAR as SEC nods Grayscale SOL ETF

Eric Balchunas, Bloomberg’s ETF analyst, shared in an X post on Tuesday that the Day 1 trading volume of Bitwise Solana Staking ETF (BSOL) recorded $56 million in trading volume, outpacing Canary’s Litecoin (LTCC) and Hedera (HBR) ETFs with $1 million and $8 million trading volume, respectively. The BSOL trading volume outperformed all US-market ETFs launched in 2025 so far.

On the other hand, the US SEC approved the Grayscale Solana Trust ETF (GSOL) for launch on Wednesday during US trading hours. The trust holds 525,387 SOL as of Wednesday (Asian hours), worth nearly $102 million.

Overall, the record performance of BSOL and GSOL heading to market, with $102 million in Solana holdings, reflects growing institutional demand for SOL alongside its blockchain adoption.

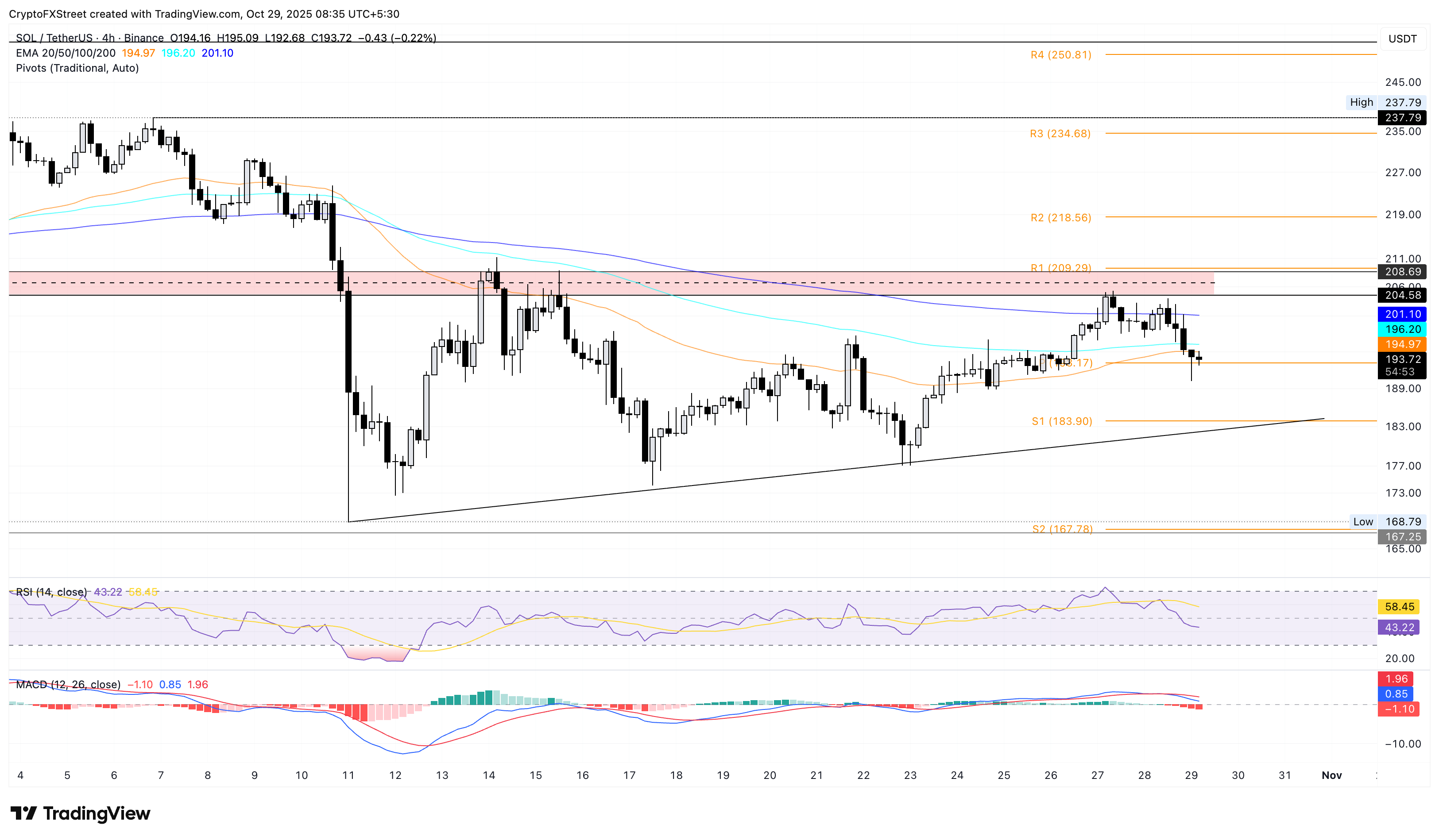

Solana drops below $200, pressing a key support level

Solana holds above $190 at press time on Wednesday, avoiding further losses after the 2% decline on Tuesday. The reversal from the $204-$208 supply zone tests the central Pivot Point at $193 on the 4-hour chart, after breaking below the 50-period Exponential Moving Average (EMA) at almost $195.

If SOL marks a clean push below $193, it could result in a freefall to the S1 Pivot Point at $183, aligning with a support trendline formed by connecting the October 11 and October 23 lows.

The Moving Average Convergence Divergence (MACD) on the 4-hour chart declines into the negative territory after crossing below the signal line on Tuesday, indicating a rise in selling pressure. At the same time, the Relative Strength Index (RSI) falls below the halfway line to 43, indicating a sharp loss in buying pressure.

SOL/USDT 4-hour price chart.

Looking up, a bounce back in Solana from $193 could test the $204-$208 supply zone, with the next key resistance at the R2 Pivot Point at $218.