Prediction: Bitcoin Will Be Worth Less Than $100,000 in 1 Year

Key Points

Bitcoin has thrived alongside gold as an anti-inflationary asset.

But its price moves still follows risk-on assets like tech stocks.

The tech trade could be nearing an end, which could set Bitcoin back in a big way.

- 10 stocks we like better than Bitcoin ›

Bitcoin (CRYPTO: BTC) has been one of the most impressive wealth-creating assets of all time.

The original cryptocurrency helped establish digital assets in the broader investment landscape, and it remains the most prominent cryptocurrency today with a market value of $2.3 trillion. Bitcoin's price has soared by more than 65% during the past year and by a staggering 740% during the past five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Yet, despite Bitcoin surpassing $100,000 nearly a year ago -- a magnificent milestone -- I predict that Bitcoin's price will sit below that level a year from now.

I'll detail why below.

Image source: Getty Images.

Bitcoin isn't behaving like a risk-off asset

Many investors consider Bitcoin an anti-inflationary asset, akin to a digital version of gold. There is some merit to that, which I will reevaluate soon. For now, I want to call attention to Bitcoin's market price behavior.

Investors widely consider gold a risk-off asset, meaning they flock to it for safety. Society has valued gold for virtually forever, and it's a physical asset with a limited supply. When investors shy away from riskier assets such as stocks and cryptocurrencies, safer assets like gold become more popular.

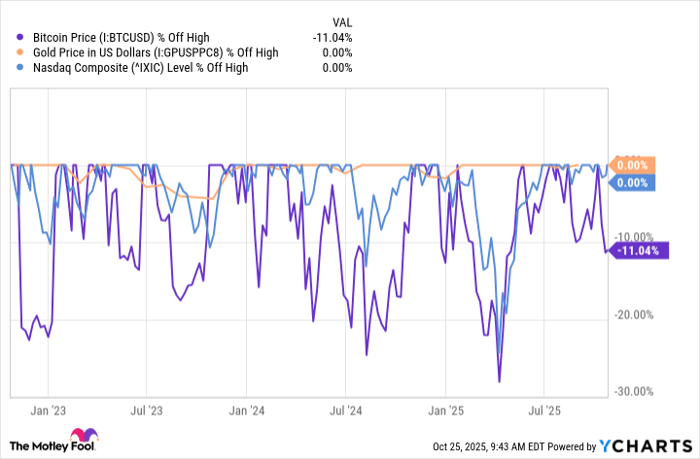

Despite the multiple ways Bitcoin is similar to gold as an anti-inflationary asset, investors still treat it like a risky asset. As shown below, Bitcoin's price action tends to mimic the tech-heavy Nasdaq Composite index. At the same time, gold, the traditional safe asset, has shown far greater price resilience via less price volatility:

Bitcoin Price data by YCharts

What could this mean? Theoretically, both gold and Bitcoin have thrived this year due to their anti-inflationary traits. The continued value erosion of fiat currency (inflation) has driven their fiat currency-denominated prices higher. However, Bitcoin doesn't necessarily offer the same price stability that gold has shown in recent years.

Pressure is building on a hot stock market

Therefore, if stocks fall, Bitcoin will likely follow them lower.

Now, nobody should be in the business of predicting when the stock market might go up or down, myself included. However, it does seem fair to point out that pressures are mounting that could affect a broader stock market that currently trades at pretty expensive valuations.

In these situations, a catalyst -- a metaphorical pinprick -- can let the air out of the balloon.

There is no shortage of those:

- Tariff threats and trade wars loom large over the global economy.

- The U.S. government has shut down with no end in sight.

- Continued inflation is weighing on consumer spending, the engine that drives America's economy.

The technology sector has boomed on artificial intelligence (AI) investments, but that is unlikely to continue forever. How much future growth do those stocks reflect at their current prices? That's not to say that AI is a fluke, but things don't typically play out in a straight line.

The internet ignited stock market euphoria nearly 30 years ago. The web has revolutionized the global economy and society, but not without a severe market decline and multiple recessions.

That doesn't mean Bitcoin's future isn't bright

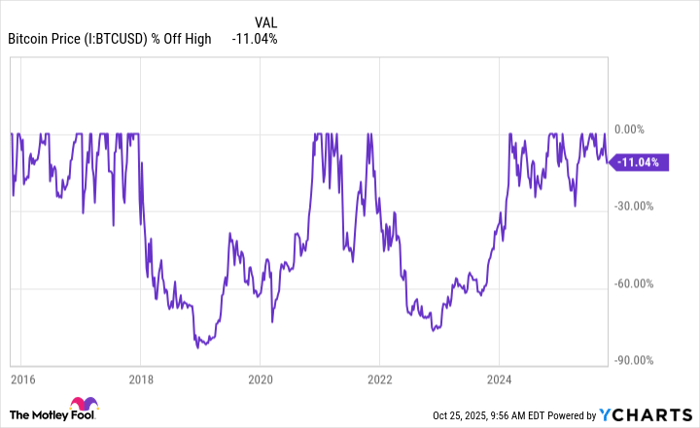

If the market does tumble, Bitcoin's likely plunge wouldn't be the first time. Most people familiar with Bitcoin already know that the cryptocurrency has experienced severe declines throughout its history, sometimes dropping by more than 60% from its highs:

Bitcoin Price data by YCharts

Bitcoin may not be as stable as gold to hold, but its track record as an investment is still stunningly good. Decades of lax monetary policy suggest that inflation will likely persist, which should keep anti-inflationary assets, including Bitcoin, headed higher over the long term.

Bitcoin currently trades about 10% above that $100,000 threshold. If the stock market breaks down over the next year, it seems likely that Bitcoin would tumble enough to drag its price back to a five-figure level.

So, while Bitcoin has a bright future, it wouldn't surprise me at all to see it trading below $100,000 a year from now.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.