Pi Network Price Forecast: PI rallies after mainnet migration, CEXs' balance surge

- Pi Network hits a fresh monthly high on Monday, with bulls eyeing the $0.30 mark.

- CEXs' wallet balances record 2 million PI inflow after the recent mainnet migration of 2.69 million Pioneers.

- Technically, the 50-day EMA breakout could further boost the PI token rally.

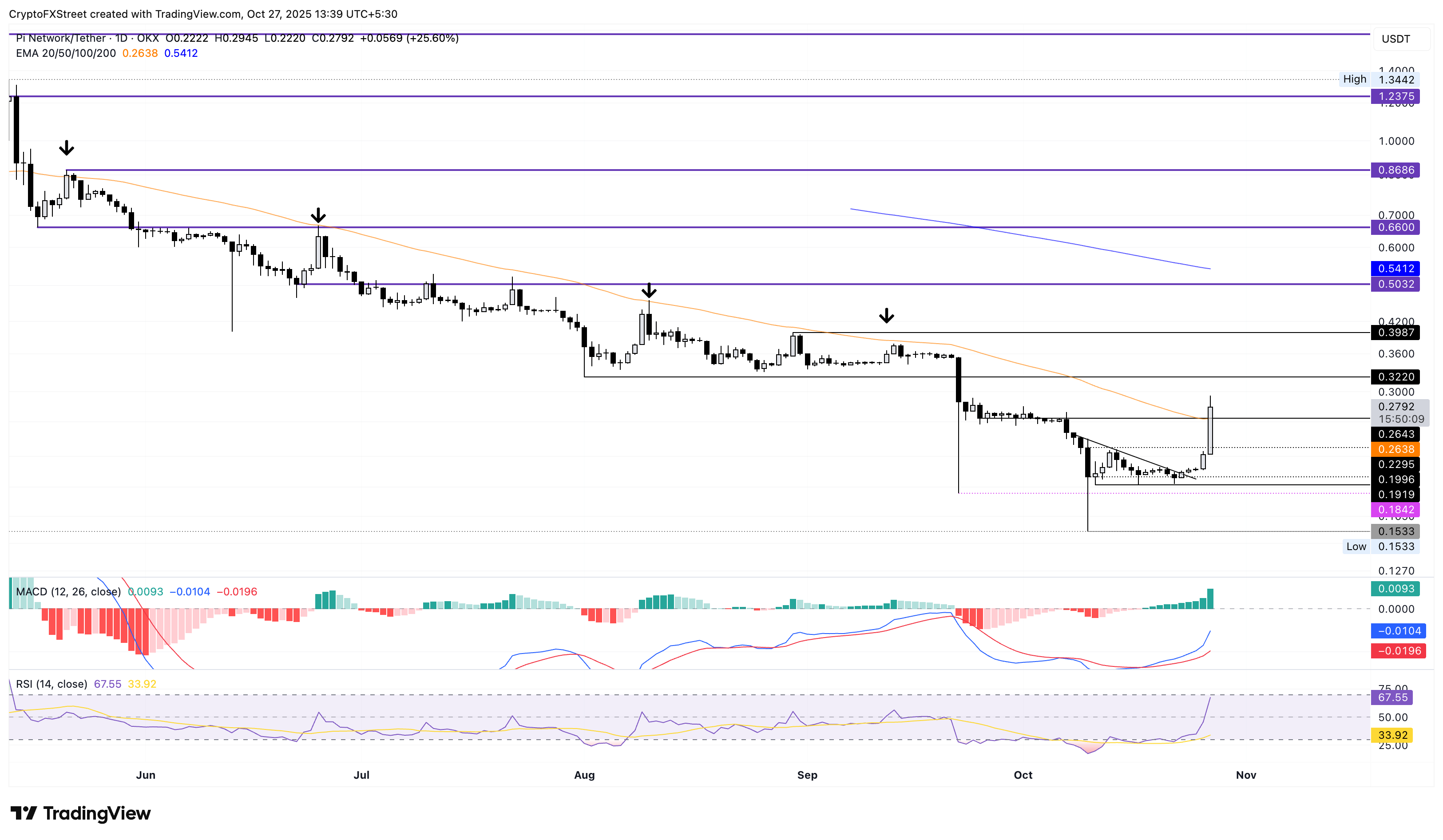

Pi Network (PI) exceeds the 50-day Exponential Moving Average at $0.2638 at press time on Monday. The migration of Pi Network users, also called Pioneers, to the mainnet led to a surge in broader market demand that outpaced supply pressures. The technical outlook indicates a bullish trend, suggesting further gains if the PI token holds above $0.2638.

CEXs' inflows struggle to keep up with demand

Pi Network marks the fifth consecutive day of a renewed uptrend following last week's announcement that 3.36 million Pioneers completed their Know Your Customer (KYC) verification. This allowed 2.69 million Pioneers to migrate to the mainnet, while the rest might have to complete the mainnet checklist. Typically, such migration would add to supply pressure, as Pioneers can transfer their PI token holdings to Know Your Business (KYB) - verified Centralized Exchanges (CEXs).

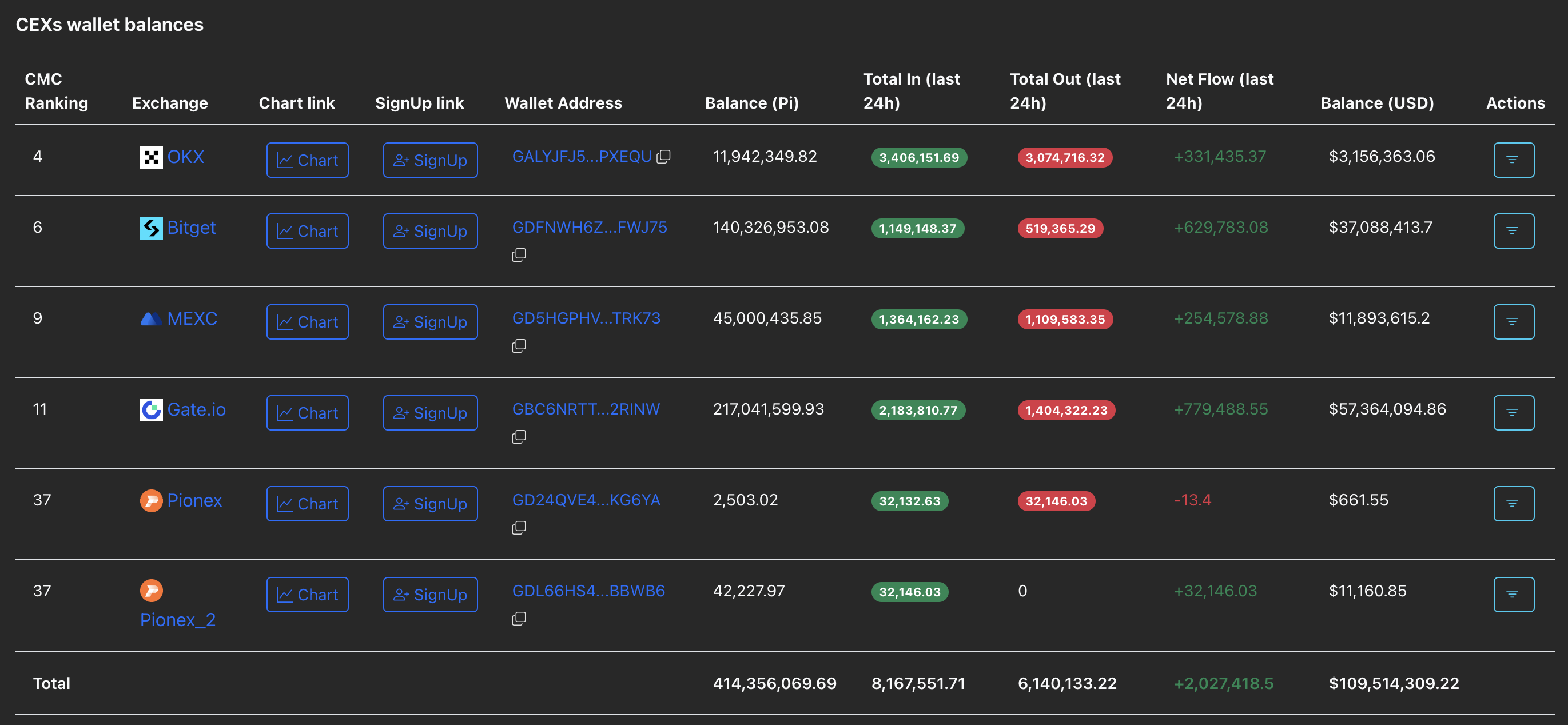

In line with this, PiScan data shows that the CEXs' wallet balances have recorded an inflow of 2.02 million PI tokens in the last 24 hours. However, the broader market demand surge after the recent migration outpaces supply pressures, driving PI token prices higher.

CEXs' wallet balances. Source: PiScan.

Technical outlook: Will the Pi Network sustain its recovery run?

The PI token is up 25% at press time on Monday, trading above the 50-day EMA at $0.2638. The mobile mining cryptocurrency extends its uptrend for the fifth consecutive day, with bulls eyeing $0.3220, which previously served as support in late September.

Furthermore, the PI token trades above the 50-day EMA at $0.2368, which has previously acted as a dynamic resistance providing multiple bearish reversal points. If PI holds above this average line, it could extend the recovery run.

The indicators on the daily chart suggest a surge in buying pressure, as the Relative Strength Index (RSI) at 67 is approaching the overbought boundary.

At the same time, the Moving Average Convergence Divergence (MACD) draws higher towards the zero line, coupled with a consistent rise in green histograms.

PI/USDT daily price chart.

If the PI token fails to hold above $0.2368, it could retest the $0.1919 support floor, marked by the October 11 low.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.