Ethereum Price Forecast: Whales continue accumulation despite weakness in on-chain metrics

Ethereum price today: $3,820

- Ethereum whales have accumulated over 200K ETH since Saturday, sending their collective holdings above 22.31 million ETH.

- While whales accumulate, small-scale holders continue to distribute, aligning with dominant cautious sentiment across the spot and derivatives markets.

- ETH is struggling to hold the $3,815 support after facing resistance at the 100-day EMA.

Ethereum (ETH) is up 2% on Thursday as whales continue to buy the dip despite rising signs of caution across key on-chain metrics.

Whales maintain bullishness amid increased on-chain cautious signs

Despite choppy price action so far in the week, whales or wallets with a balance of 10K-100K ETH continued to accumulate the top altcoin. The cohort has scooped over 200K ETH since Saturday, sending their collective holdings above 22.31 million ETH as of Wednesday, according to CryptoQuant data.

-1761256019495-1761256019497.png)

ETH Balance by Holder Value. Source: CryptoQuant

While large holders buy the dip, small-scale investors, wallets with a balance of 100-1K ETH and 1K-10K ETH, depleted their holdings by about 140K ETH during the same period.

A similar distribution is evident across crypto exchanges, where ETH net inflows have outweighed outflows. The 7-day moving average of Exchange Netflows has climbed from -47,000 ETH to 9,200 ETH, since Saturday, as investors are depositing tokens into exchanges for potential selling more than they are withdrawing into private wallets.

Meanwhile, active addresses and transaction counts have been on a downtrend since October 17, with their weekly average declining below 400,000 and 1.5 million, respectively. The simultaneous drop indicates lesser on-chain activity as prices remain range-bound.

(1)-1761256047012-1761256047013.png)

ETH Transaction Count. Source: CryptoQuant

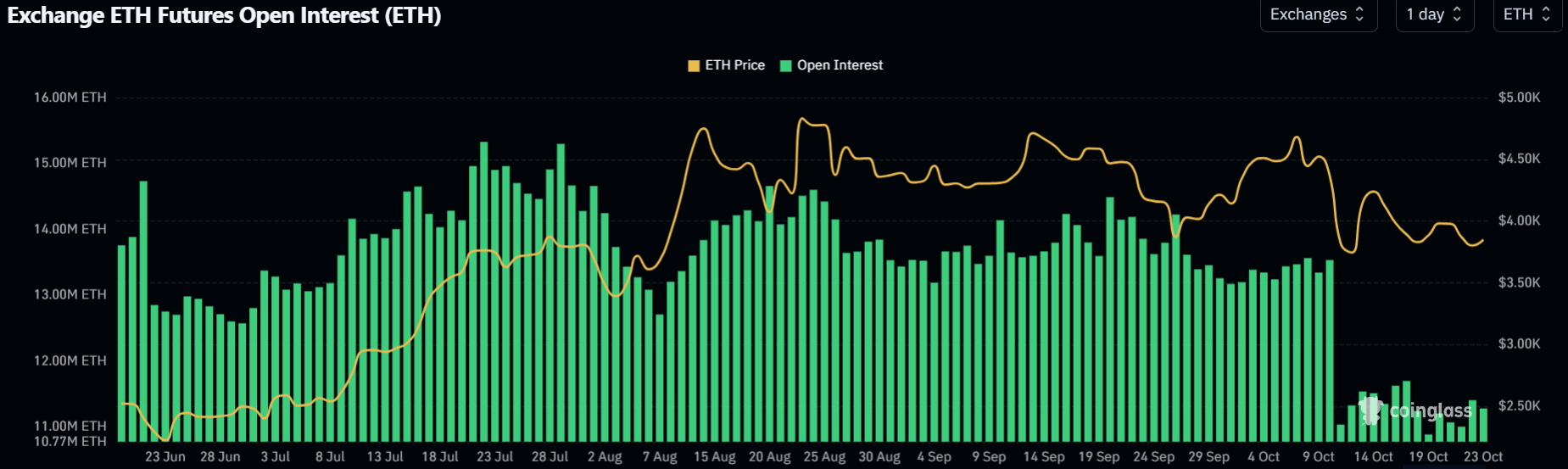

On the derivatives side, Ethereum open interest — the total value of unsettled contracts in a derivatives market — has remained at low levels, failing to rise above 11.5 million ETH since plunging on October 10.

ETH Open Interest. Source: Coinglass

This shows increased cautious sentiment among traders, as many have remained on the sidelines following key leverage unwinds over the past month.

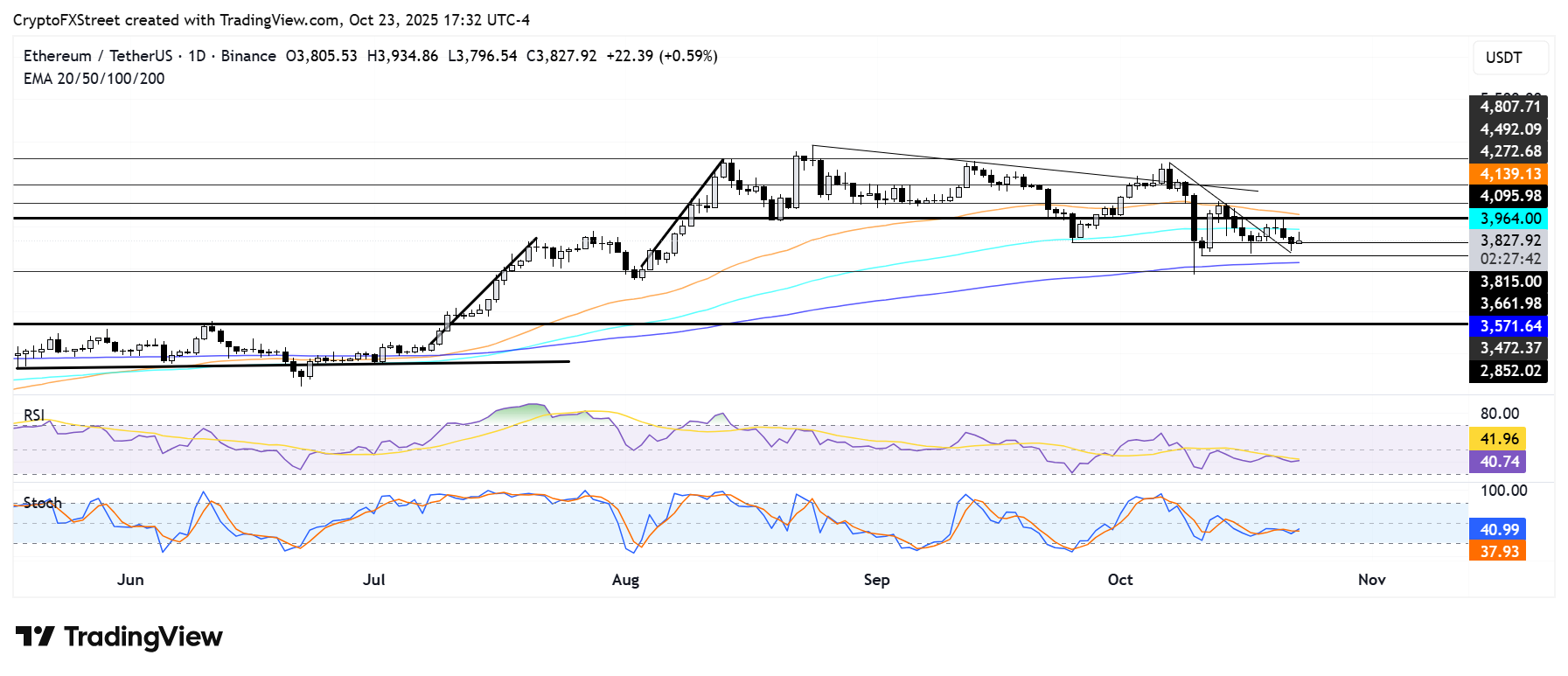

Ethereum Price Forecast: ETH struggles to hold $3,815 support

Ethereum recorded $115.9 million in futures liquidations over the past 24 hours, comprising $62.8 million and $53.1 million in long and short liquidations, per Coinglass data.

ETH is struggling to hold the $3,815 support on Thursday as it faces resistance near the 100-day Exponential Moving Average (EMA).

A failure to hold $3,815 could push ETH toward the short-term support near $3,660. Further down, the $3,470 support level could hold prices if ETH loses the 200-day EMA.

ETH/USDT daily chart

On the upside, ETH needs to flip the $4,100 and 50-day EMA resistance into support levels to resume an uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating a dominant bearish momentum.