Bitcoin Rally Met With Institutional Call Selling In Options Market – Details

The Bitcoin market has experienced a significant price correction in the last few hours, with prices dropping to around $110,000 as the trade war between the US and China may yet recommence. Before this decline, the crypto market leader led a strong rally to set a new all-time high of $126,198.17 on October 6, 2025. Interestingly, recent data on the Bitcoin Options market indicated a wave of cautious positioning among institutional investors amid this price surge ahead of the current market downturn.

Institutions Step Back As Bitcoin’s Rally Turns Euphoric – Glassnode

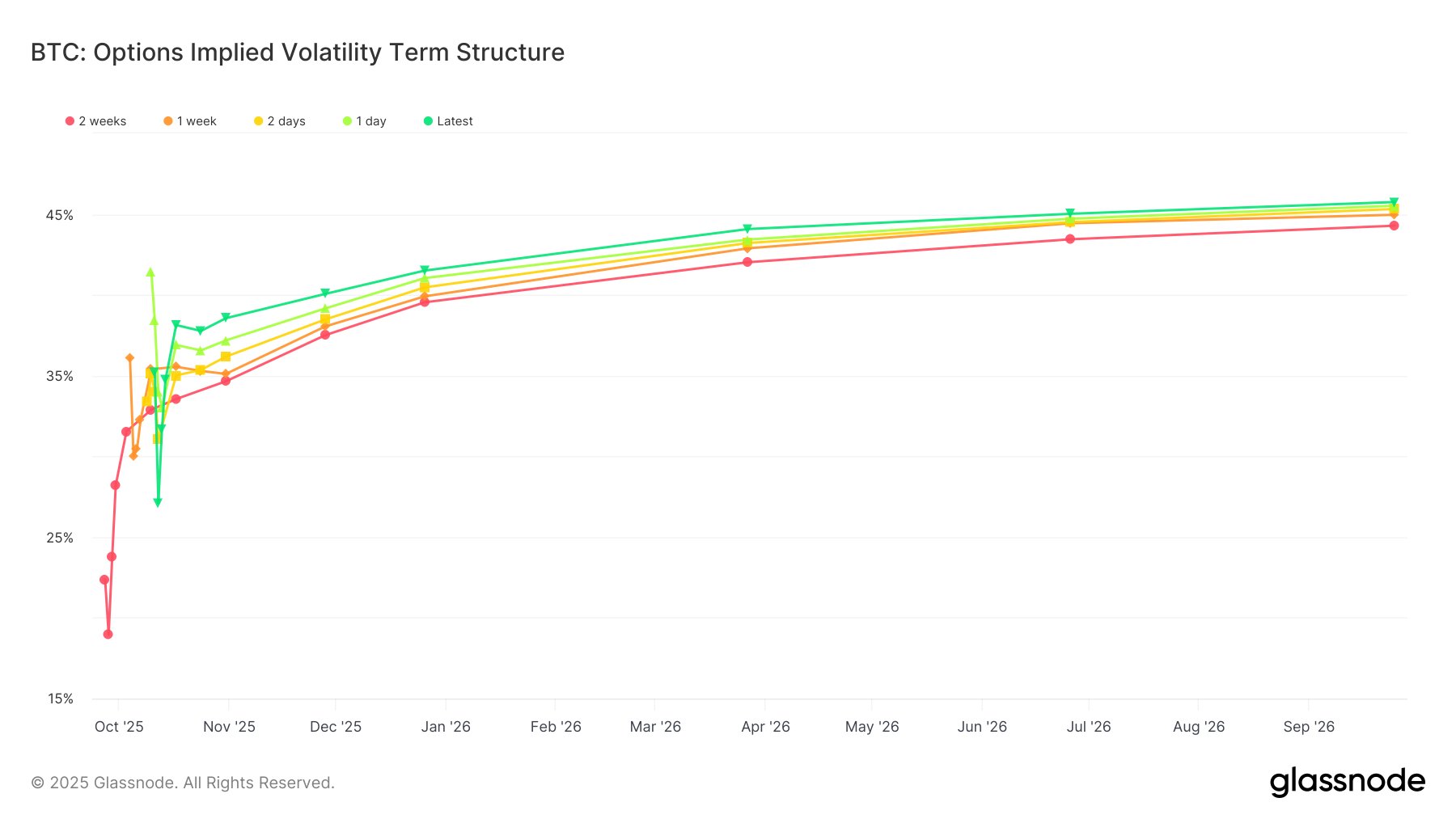

In an X post on October 10, blockchain analytics firm Glassnode lays out some interesting insights in its weekly options market update. Notably, Glassnode analysts report that while Bitcoin prices surged more than 10% in the recent ascent to a new all-time high, institutional traders appear to have maintained a calm market approach, opting to lock in profits and protect downside rather than chase the rally. Despite the steep move higher, implied volatility, i.e., a gauge of expected price swings, barely budged, hovering around 38–40%. Normally, a rally of that size would push volatility higher as traders hurriedly call and amplify their exposure. However, the silent reaction suggests composure from institutional investors who were already positioned for the move or simply unwilling to pay up for additional upside.

Glassnode analysts also draw attention to another subtle but telling sign in option skew. Even at the height of the rally, demand for put options remained strong, keeping the market elevated. This indicates that many large players were selling calls, effectively capping potential upside, through the options market, while maintaining insurance in case the market reversed. In addition, the put-call ratio also reinforces this cautious pattern among institutions. Amidst the option expiry on Friday, October 9, the ratio climbed above 1.0, indicating more puts traded than calls as traders were busy hedging positions ahead of the current downturn rather than chasing momentum and locking in recent gains. Generally, Glassnode describes the Bitcoin market as having adopted a different behavior this cycle, driven by institutional discipline rather than surging volatility and retail exuberance as seen in previous cycles. The dominance of institutional funding driven by spot ETFs and the recent advent of crypto treasury companies may have added a thick layer of maturity to the $2 trillion market.

BTC Market Overview

At the time of writing, Bitcoin is trading at $110,805 after a 7.54% decline in the past 24 hours. Meanwhile, daily trading volume has surged 150.37%, indicating a rise in market activity as traders react to the sharp pullback.