Solana drops 5% as JPMorgan predicts underwhelming SOL ETF performance

- JPMorgan analysts predict that spot Solana ETFs could see modest inflows of $1.5 billion in their first year of trading.

- The bank highlights weak institutional perception of Solana and low on-chain activity as factors for a potential underwhelming performance.

- SOL could find support near a key ascending trendline if it declines below the $219 and 50-day SMA key levels.

Solana (SOL) is down 5% on Thursday following JPMorgan analysts' prediction that spot SOL exchange-traded funds (ETFs) are unlikely to attract major inflows, with projections of about $1.5 billion in their first year of trading.

JPMorgan says Solana ETFs may pull in only $1.5 billion in their first year

Spot Solana ETFs are expected to attract far smaller inflows than their Bitcoin and Ethereum counterparts, according to JPMorgan analysts led by Nikolaos Panigirtzoglou in a report on Wednesday.

The bank projected that Solana funds could attract modest inflows of $1.5 billion in their first year, accounting for roughly one-seventh of spot Ethereum ETF inflows.

JPMorgan's estimate stems from early activity in the REX Osprey Solana Staking ETF (SSK), which garnered nearly $350 million after its launch, compared with about $2.3 billion flowing into spot Ether ETFs during their first three months.

"Applying this 1/7th ratio to Ethereum's first year net inflows of $9.6 billion suggests that Solana ETFs could potentially see around $1.5 billion of net inflows during their first year," the analysts wrote.

The report notes that the lower inflows could be due to declining on-chain activity and memecoin trading on the Solana network. It also highlighted investor fatigue from a series of recent product launches.

Another factor is the rising competition from diversified crypto index funds such as the S&P Dow Jones Indices Digital Markets 50.

The analysts further pointed to Grayscale's Solana Trust (GSOL) premium to net asset value, which has dropped from more than 750% last year to just above zero, as evidence that optimism over ETF approvals may have already been priced in.

JPMorgan stated that spot Solana ETF approvals are highly anticipated, with the Securities and Exchange Commission (SEC) expected to reach a decision on several altcoin products in October.

"The strong likelihood of approval for Solana spot ETFs is reinforced by the fact that there is an already established futures contract at CME," the report added.

The SEC approved generic listing standards for digital asset ETFs in September, allowing for faster issuance of crypto products. The agency also requested issuers who filed 19b-4 applications for spot Solana ETFs to withdraw their submissions last week due to the new listing standard, sparking wider speculation for a near-term approval.

Solana Price Forecast: SOL tests 50-day SMA support

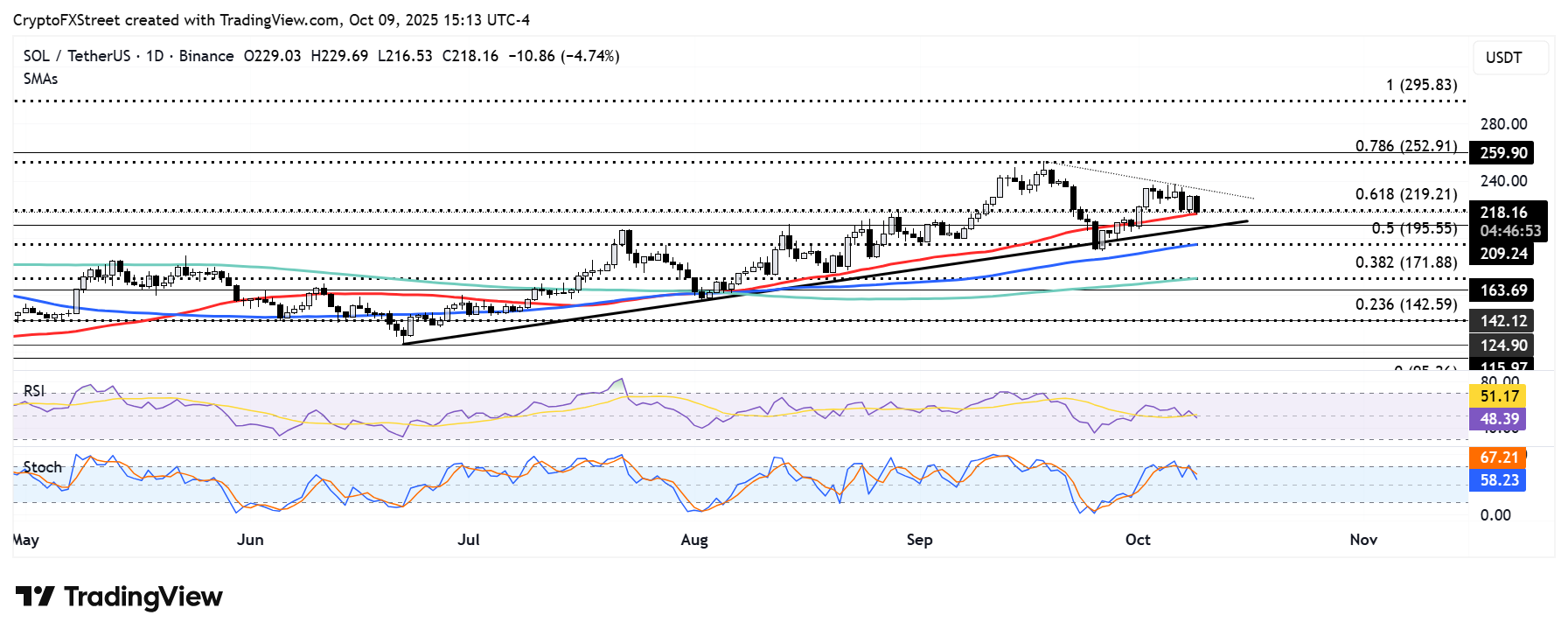

SOL is down 5% on Thursday following a broader crypto market downturn. The altcoin is testing the 61.8% Fibonacci Retracement level around $219 and the 50-day Simple Moving Average (SMA).

SOL/USDT daily chart

If bulls fail to defend $219, SOL could find support around an ascending trendline, which extends from June 22. The 50% Fib Retracement level around $195, which is strengthened by the 100-day SMA, could provide support if prices dip further.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are declining and testing their neutral levels, indicating a weakening bullish momentum.